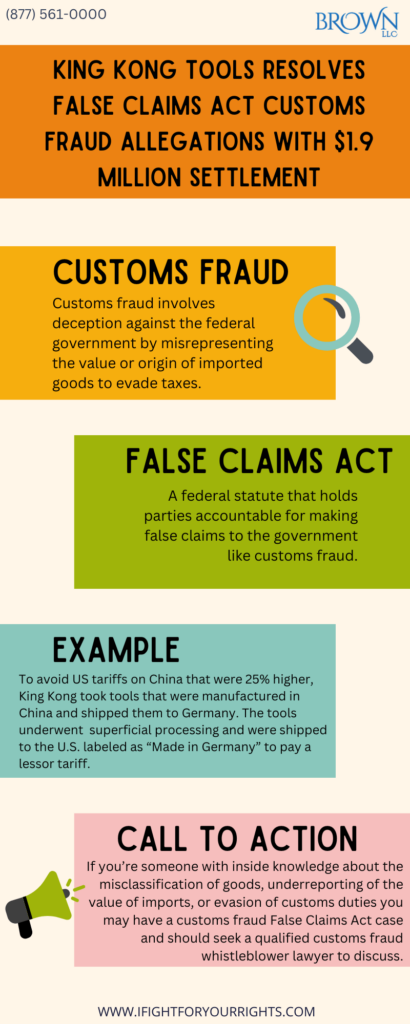

King Kong Tools Settles False Claims Act Customs Fraud Case With $1.9 Million Resolution

With increased tariffs levied on certain countries, companies think they can evade the tariffs with schemes to conceal the true origin of the goods, but in fact by doing so they are committing customs fraud which can be remedied with the False Claims Act with customs fraud whistleblowers receiving awards for their information that leads to a successful prosecution. As an example, a False Claims Act settlement involving King Kong Tools highlights the importance of whistleblowers who report customs fraud and why their inside information is so critical to busting up these evasion schemes.

The False Claims Act is a federal statute to hold parties accountable that present deceptive claims using federal funds. Whistleblowers, also known as “relators”, are those who bring evidence of fraudulent activity to the government and can be entitled to as much as thirty percent (30%) of the awarded amount. In the King Kong Tools claims, the relator received more than a quarter of a million dollars ($286,861) as a customs fraud whistleblower award though his customs fraud law firm who knew how to properly invoke the False Claims Act.

How Mislabeling of Imported Tools Triggered Customs Fraud Claims under The False Claims Act

According to the public press release by the U.S. Attorney’s Office of the Northern District of Georgia, King Kong Tools was alleged to have bypassed paying higher tariffs on tools that they imported into the United States. To get around paying Chinese tariffs that were twenty five percent (25%) higher, King Kong took tools that were manufactured in China and shipped them to Germany. The tools underwent additional superficial processing and were shipped to the U.S. with label as “Made in Germany”. According to these allegations, the false labeling was done to have King Kong evade paying the Chinese tariffs. The whistleblower in this case was a competitor of King Kong illustrating that anyone may be qualified to be relator under the qui tam provisions of the False Claims Act if they have insightful information. In addition to the U.S. Attorney’s Office, these claims were handled by the Homeland Security Investigations and Customs and Border Protection. This claim shows that many divisions under the Department of Justice have a stake in ensuring that customs fraud is reported and handled, which should incentivize whistleblowers to come forward of any known claims since if they are filed with the right customs fraud whistleblower lawyer, the case could be put in a superior position to have the agencies interest engaged and increase the chance of success with the case

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

False Claims Act in Customs Fraud Claims

Customs fraud is a specific type of deception against the federal government that is centered on evading taxes on imported foreign goods by misrepresenting the value or origin of those items. The False Claims Act (U.S.C. 31 §3729-3733) covers many industries, including foreign trade, and incentivizes whistleblowers to come forward to report known perpetrators attempting to evade customs duties.

Manufacturers may attempt to evade international tariffs through differing strategies, but if the conduct lacks any good faith and they just dropship to a second location, make superficial changes to evade the tariff it’s still fraud. Some other examples of notable customs fraud claims that resulted in settlements under the False Claims Act include:

- Noble Brand Holdings Falsified Invoices: The allegations in the Noble Brand Holdings settlement involved customs fraud. In this case, the company was alleged to have generated two sets of invoices for its client, United Silica Productions. One set of invoices showed the amount that United Silica Productions actually paid. The other set of invoices were allegedly falsified invoices that represented undervalued products sold by Noble Brand Holdings. These invoices were sent to a New York-based freight company who provided the false invoices to a customs broker to declare customs on United Silica Productions’ behalf. In the settlements, all parties admitted that they did not provide true and accurate disclosures, as required by international law. Each party agreed to pay a settled amount, with Noble Brand Holdings paying the largest at Five Hundred Thousand Dollars ($500,000).

- International Vitamins Corporation Misclassification: In this alleged claim, International Vitamins Corporation, a company that sells vitamins and nutrition supplements from China, was alleged to misclassify more than thirty (30) products under the “Harmonized Tariff Schedule” to avoid paying customs. The settlement resulted in the amount of almost $23 million that the International Vitamins Corporation was required to pay to the federal government. Similar to the King Kong Tools claim, a customs fraud law firm with a customs fraud whistleblower lawyer was integral in ensuring the whistleblower received the whistleblower percentage of the awarded eligible amount. As a result of properly invoking the False Claims Act the individual was entitled up to $6.9 million as a customs fraud whistleblower reward.

Why a Customs Fraud Whistleblower Lawyer is Necessary in these Claims

A customs fraud whistleblower plays an essential role in exposing illegal practices that circumvent United States tariffs and thus short the taxpayers. Whistleblowers with inside knowledge may have the key evidence in the misclassification of goods, underreporting of the value of imports, or evasion of customs duties. To effectively navigate the complex legal landscape associated with reporting customs fraud, whistleblowers will need to seek a qualified customs fraud whistleblower lawyer. These lawyers are typically associated with a customs fraud law firm and have knowledge in cases under the False Claims Act and other relevant federal laws that may concern customs fraud. They guide whistleblowers through the legal process, ensuring that the report of fraud is handled correctly, and that the whistleblower’s rights and interests are protected. Under the False Claims Act it is required to use a qui tam law firm, you can’t file the matter pro se. Also, only the first to file the customs fraud cases technically has rights under the statute, which is why if you’re aware of customs fraud its critical to consult with one of the best customs fraud whistleblower law firms that you can find that offers free, confidential consultations to learn your rights.