Whistleblower Awarded $280k

Naturally, when goods are shipped from one country to another, there can be taxes or tariffs imposed on them. Customs duties and fees can vary considerably, based on an array of factors, such as what the goods are, the quantity of them, as well as their point of origin. Laws governing imports and exports are in place to conserve the sovereignty of individual countries. Customs fraud occurs when there is an attempt at avoiding taxes owed on the imported goods, not declaring them when they enter another country, or alternatively underpaying or undervaluing what is brought in. This deceitful practice not only undermines the integrity of international trade but also deprives governments of crucial revenue needed for various public services and infrastructure development.

Customs Fraud

To put it simply, customs fraud is the act of submitting false or fraudulent claims for payment to the U.S. government related to the importation of goods. Customs Fraud is covered by the federal law, the False Claims Act. Specifically, customs fraud occurs when individuals or companies knowingly make false statements or misrepresentations to U.S. Customs and Border Protection (CBP) in connection with the importation of goods. This can include undervaluing imported goods, misclassifying products to avoid duties, or providing false information about the country of origin.

A Quick Primer on the False Claims Act

The False Claims Act is a federal law that allocates punitive measures, such as treble damages, and other mechanisms to defend taxpayers from fraudulent claims made by individuals and entities seeking payment from the government. The FCA prohibits any individual or entity from submitting false or fraudulent claims for payment to the government. The FCA also positively reinforces individuals to report fraud against the government by doling out financial incentives to whistleblowers (also known as relators) that extend up to 30% of what the government recovers in its action against the fraudsters.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

A Recent Noteworthy Case of Customs Fraud Comes to a Conclusion

There was a recent settlement of $1.9 million paid by the German company, King Kong-Tools GmbH and Co KG, and its American subsidiary, King Kong Tools, LLC (collectively King Kong) to resolve allegations of customs fraud covered by the False Claims Act.

Allegations state that King Kong deceptively labeled its tools as being made in Germany when they were made in China. King Kong circumvented high tariffs by cloaking the true origin of its tools. The tariffs King Kong should have paid amount to a 25% tariff on Chinese goods.

The case was kicked into high gear by a whistleblower from a King Kong competitor, who filed a complaint alleging King Kong manufactured cutting tools in a factory in China. King Kong’s purported actions include doing some additional processing on some, but not all the tools to seem more German, and less Chinese after they were shipped to Germany, as well as declaring them to be German products. The illicit nature of these activities stems from the seeming actions taken to mislead US Customs, alleged outright lies about the true origin of goods, conning Customs of legitimately imposed levies on foreign goods, and the aftereffect of harming competition for American products by flooding the zone with those who would cheat rather than compete, and effectively raising prices for American consumers in the process. The whistleblower subsequently received $280k for their cooperation.

According to Gregory Alvarez, Customs and Border Protection’s Director of Field Operations in Atlanta, “Customs fraud in international trade of manufacturing goods result in an unfair advantage of legitimate businesses. This enforcement action is another example of how CBPs trade specialists safeguard the economic security of the United States.”

The path to filing a suit concerning customs fraud under the FCA is a lengthy process. It requires exquisite legal knowledge possessed only by the purveyors of wisdom at a renowned customs fraud law firm. To report customs fraud, you need a top-of-the-line customs fraud whistleblower lawyer who can do more than just regurgitate the statute, but actually comprehends the way this laborious process works in practice, whether it be the time it actually takes the government to respond, how to file properly to protect yourself from any inadvertent criminal liability, or properly negotiate a settlement to garner a larger whistleblower reward for you.

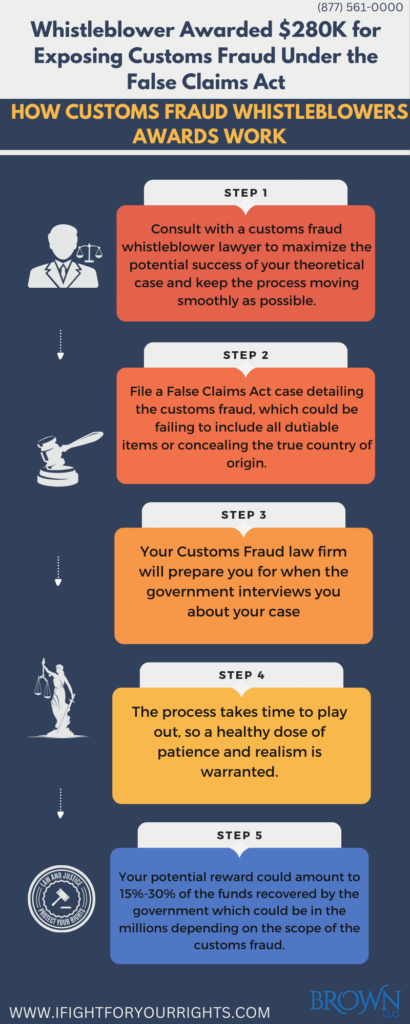

How Rewards for Customs Fraud Whistleblowers Work Is as Follows:

- Consult with a customs fraud whistleblower lawyer to maximize the potential success of your theoretical case and keep the process moving smoothly as deftly as possible.

- File a False Claims Act case detailing the customs fraud, which could be failing to include all dutiable items or concealing the true country of origin.

- Your Customs Fraud law firm will prepare you for when the government interviews you about your case

- The process takes time to play out, so a healthy dose of patience and realism is warranted.

- Your potential reward could amount to 15%-30% of the funds recovered by the government which could be in the millions depending on the scope of the customs fraud.