Three Recent False Claims Act Settlement Involving Kickback Schemes

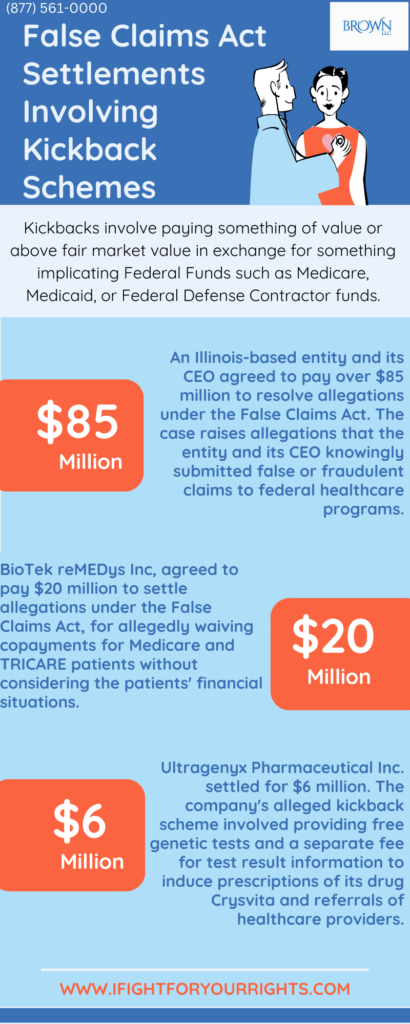

In the ongoing battle against healthcare fraud, one of the most prevalent schemes are kickback schemes which is paying something of value in exchange for something implicating Medicare funds, Medicaid funds, or Federal Defense Contract funds, which is explicitly prohibited by the False Claims Act through the Anti-Kickback Statute (AKS). Some of the largest False Claims Act settlements over the years involve kickbacks and in aggregate hundreds of millions of dollars of whistleblower awards. The government views kickbacks both civilly and criminally and some of the recent False Claims Act settlements double down on the long-standing prohibition against provider kickbacks.

These False Claims Act settlements highlight the importance of the False Claims Act in protecting the integrity of healthcare programs, which is compromised when the perception of a kickback is introduced into the equation. Such as in the case of pharmaceutical fraud where if a provider is receiving items of value to prescribe a product, there’s more than just the best interest of the patient in play, which compromises the objectivity or at minimum the perception of objectivity for the prescriptions. Let’s delve into three recent cases that demonstrate the gravity of kickbacks and the significant role the False Claims Act plays in addressing it.

Our first case talks about a recent False Claims Act settlement involving an Illinois-based entity and its CEO, a Florida resident, who agreed to pay over $85 million to resolve allegations under the False Claims Act. The allegations involve payments to referring healthcare professionals, which were deemed excessive and in violation of relevant healthcare laws.

The settlements consist of a $75 million payment by the entity, with additional amounts tied to future revenues, and a payment of over $10 million by the CEO.

The case raises allegations that the entity and its CEO knowingly submitted false or fraudulent claims to federal healthcare programs. The alleged violations pertain to payments made to referring healthcare professionals that exceeded fair market value, with associated irregularities in the services provided.

This settlement arises from claims initiated under the qui tam or whistleblower provisions of the False Claims Act. In such cases, a private party can file an action on behalf of the United States and is entitled to receive a portion of any recovery which could be up to 30%. In this instance, the whistleblower has received a share of the settlement amount.

In our exploration of kickback schemes within the healthcare industry, we turn our attention to another False Claims Act kickback settlement involving BioTek reMEDys Inc. (BioTek), a company located in New Castle, Delaware. BioTek agreed to pay $20 million to settle allegations under the False Claims Act, which was allegedly a reduced settlement amount which was taking into account its financial capacity, also known as an ability to pay consideration. This settlement addresses claims related to violations of the law, particularly concerning the provision of kickbacks to both patients and physicians regarding BioTek’s practices from at least August 2015 through May 2020. As a specialty pharmacy offering drugs and infusion services, BioTek allegedly waived copayments for Medicare and TRICARE patients without considering the patients’ financial situations. The waiver of copayments is viewed as a kickback since it imbues a benefit to the patient and can thereby unfairly influence the choice of service and further cause additional use of a product and/or service if the patient does not share the cost.

In the latest settlement, pharmaceutical company Ultragenyx Pharmaceutical Inc. has agreed to pay $6 million to resolve allegations of submitting false claims to Medicare and Medicaid. The company allegedly paid for free genetic tests and a separate fee for test result information to induce prescriptions of its drug Crysvita and referrals of healthcare providers (HCPs) to Ultragenyx.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

To meet insurer requirements, Ultragenyx collaborated with a genetic testing laboratory, conducting tests at no cost to HCPs or patients. This “sponsored” XLH testing program aimed to identify potential Crysvita patients. Ultragenyx, additionally, paid the laboratory for test results, using them for marketing purposes. The government contends that Ultragenyx’s actions resulted in false claims submitted to Medicare and Medicaid by offering kickbacks in the form of free genetic tests and payments to the laboratory.

As part of the settlement, Ultragenyx admitted responsibility for certain facts. The settlement, stemming from a whistleblower case, includes a recovery of approximately $5.8 million for Medicare and the federal share of Medicaid, with $200,000 for State Medicaid programs. The whistleblower will receive around $1.07 million from the federal recovery.

In conclusion, the battle against healthcare fraud is an ongoing and crucial endeavor, with kickback schemes being one of the most prevalent and damaging fraudulent practices that threaten the integrity of healthcare programs. These schemes, in which something of value is exchanged for services implicating Medicare, Medicaid, or Federal Defense Contract funds, are explicitly prohibited by the Anti-Kickback Statute under the False Claims Act.

The substantial monetary settlements and whistleblower awards in past cases emphasize the severity of the issue. Recent False Claims Act settlements have reinforced the long-standing prohibition against provider kickbacks, serving as a resounding reminder of the Act’s pivotal role in safeguarding the integrity of healthcare programs. When kickbacks enter the equation, the objectivity of healthcare decisions is compromised, undermining the best interests of patients and the healthcare system as a whole. Therefore, these three recent cases underscore the gravity of kickbacks and the indispensable role the False Claims Act plays in addressing this pervasive problem.