Whistleblower laws include strong protections against retaliation, ranging from overt measures to subtle safeguards like anonymity and initial confidentiality. If you suspect employer retaliation for reporting illegal or unethical practices, such as Medicare fraud, you should consult with an experienced whistleblower lawyer. Better yet, if you’re aware of such conduct, seek legal advice from a whistleblower law firm early to learn your rights under whistleblower programs and strategies to prevent retaliation.

These protections extend to various groups including insiders at health care practices, defense contractor insiders, pharmaceutical insiders, and well-placed individuals who know about securities fraud, corporate fraud, commodities fraud, and IRS tax fraud. Federal whistleblowers, such as SOX whistleblowers, can benefit from whistleblower protections established under laws like the Sarbanes Oxley Act and Dodd Frank Act. An experienced attorney can guide you through potential whistleblower litigation in federal and state courts, ensuring your rights are protected throughout the process.At Brown, LLC, our lawyers handle certain retaliation claims in conjunction with other whistleblower matters nationwide, including whistleblower complaint filings. Contact us for a free, confidential consultation with our experienced whistleblower retaliation attorneys.

What Constitutes Whistleblower Retaliation?

Whistleblower retaliation occurs when an employer takes negative action against a whistleblower (typically an employee, temporary worker, or applicant) that effectively discourages protected whistleblowing. These actions can range from subtle harms to overt retaliatory measures. Subtle forms of retaliation may include excluding an employee from meetings, chilling their speech, or isolating them from the firm. More overt retaliatory actions can include denying benefits, overtime, or promotions, making threats, reducing or changing hours, reassignment, creating poor working conditions, failing to hire or rehire, reducing pay, termination, repeatedly interviewing about the same matter, and other disciplinary activities or harassment.

The law recognizes a concept known as “temporal inference” in whistleblower retaliation cases. This means that when adverse employment actions occur shortly after an employee makes a direct disclosure to the company, or if a whistleblower’s identity is revealed when a False Claims Act whistleblower retaliation lawsuit is unsealed, there may be a strong inference that the action is retaliatory. In such cases, statutory remedies can be triggered to protect the whistleblower, even if the associated qui tam case is unsuccessful.

What Laws Prohibit Retaliation Against Whistleblowers?

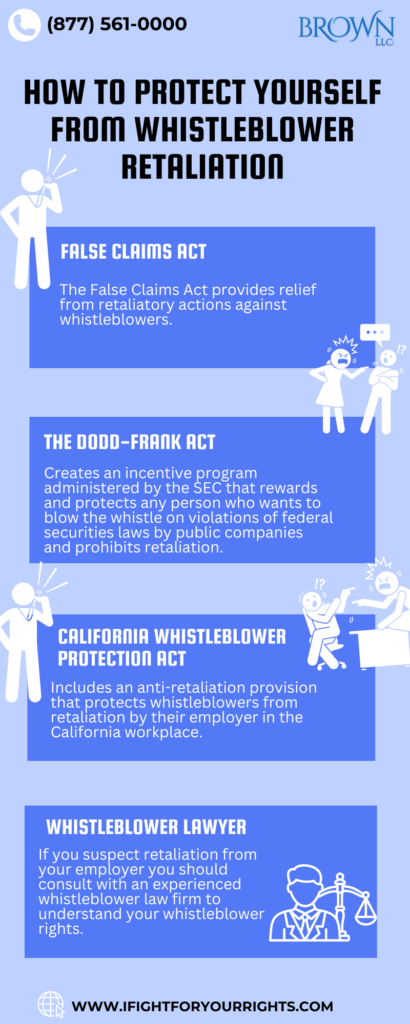

Numerous laws prohibit retaliation against whistleblowers at both state and federal levels. Notable examples include the SEC Whistleblower Program, the False Claims Act, and California’s Whistleblower Protection Act. Almost every whistleblower statute incorporates some form of anti-retaliation provision. A comprehensive list of each state’s respective whistleblower statutes, retaliation prohibitions, and remedies is available for reference.

It is crucial to understand that whistleblowing in isolation is not a protected activity unless it’s grounded in a cognizable statute that offers protection and a mechanism to blow the whistle. Therefore, involving a whistleblower law firm in your matter as early as possible is critical. Without invoking the correct statute, you might inadvertently lead to your own termination at work. At Brown, LLC, our lawyers handle False Claims Act whistleblower retaliation claims and other FCA matters nationwide, generally in conjunction with the underlying action.

If you believe you have a valid whistleblower claim which could stem from information regarding your employer committing:

- Medicare Fraud

- Medicaid Fraud

- Defense Contractor Fraud

- IRS Tax Violations

- SEC Violations such as insider trading

- Failure for a fiduciary to advance the best interests of the client

- Any other way in which people or the government are being cheated

You should consult with a qui tam retaliation lawyer. If you suspect potential repercussions, consulting a whistleblower retaliation attorney is advisable to understand your rights. An experienced federal whistleblower lawyer will have the necessary experience in protecting whistleblowers and collaborating with government agencies. They can guide you in making an informed decision about how to effectively expose wrongdoing in the private sector while safeguarding your own interests.

Brown, LLC handles Qui Tam Retaliation Claims and other False Claims Act matters nationwide, typically in conjunction with the underlying action. The firm is led by former FBI Special Agent Jason T. Brown, whose qui tam team has achieved significant victories. Operating on a contingency basis, the firm is only compensated if it wins your case. For a free, confidential consultation to learn more about your whistleblower rights, contact Brown, LLC at (877) 561-0000.

Should I Report the Misconduct Through the Company’s Internal Compliance Programs

It is strongly advised to consult with a whistleblower law firm before reporting through an internal compliance program. Despite company assurances, internal reporting often leads to employee termination. Following an internal report, employees frequently face persistent retaliation. Companies may attempt to shift blame onto the employee, constrain them with various statements, or create a hostile work environment to force resignation. If the employee refuses to quit, termination often follows. Potential whistleblowers who secure proper legal representation may have some avenues to blow the whistle and remain anonymous, allowing them to report wrongdoing while minimizing their own risk. This approach offers a safer alternative to internal reporting, protecting the whistleblower’s interests while still addressing the misconduct.

SEC Whistleblower Protections – Potential Anonymity

The Dodd-Frank Act established the SEC Whistleblower Program, creating an incentive for insiders to report securities fraud. Administered by the Securities and Exchange Commission (SEC), this program offers potential rewards and protections to individuals who expose violations of federal securities laws by individuals or entities. The program grants whistleblowers a private right of action to file retaliation complaints in federal court, seeking double back pay with interest, reinstatement, reasonable attorneys’ fees, and reimbursement for other litigation costs.

For SEC actions filed with a whistleblower lawyer, disclosures can be made anonymously. This anonymity may extend even to the government itself, although the SEC will likely want to speak with whistleblowers who provide solid, case-building information. There’s a possibility for the cases to remain confidential from start to finish, with the whistleblower’s (relator’s) identity potentially never entering the public record or even being known to the SEC. The program also offers protection from employer retaliation for individuals who attempt to blow the whistle internally.

Under Section 21F(h)(1) of the Exchange Act (15 U.S.C. 78u-6(h)(1)), retaliation is prohibited against an individual who had a reasonable belief the information they provided was related to a possible securities law violation, and they disclosed the violation in a manner that comports with the other provisions of the Exchange Act. An SEC whistleblower attorney can help you properly make disclosures to help you remain protected from retaliation.

Whistleblower Protection Under the False Claims Act

The False Claims Act (FCA) empowers whistleblowers to file suit on behalf of the United States government for fraud against the government. These whistleblowers, known as qui tam relators, can receive a portion of the recovered funds if the case is successful. Such lawsuits are often referred to as qui tam retaliation lawsuits.

The FCA’s anti-retaliation provision extends protection to employees, contractors, agents, and other individuals who assist with qui tam actions. More specifically, the law says that an individual can seek compensation if they are “discharged, demoted, suspended, threatened, harassed, or in any other manner discriminated against in the terms and conditions of employment.”

As an initial protective mechanism, FCA lawsuits are filed confidentially under seal. This means that generally, the company is not alerted to the lawsuit or the whistleblower’s identity for potentially many years.

While False Claims Act retaliation claims are often part of a qui tam action, it’s possible to bring one independently. Qui tam relators who have experienced retaliation have a three-year window from the date of retaliation to file a civil action.

If you have faced workplace retaliation due to your efforts to stop fraud or assist an FCA action, consult with a whistleblower retaliation attorney as soon as possible to learn your rights.

California Whistleblower Protection Act

The California Whistleblower Protection Act prohibits employers from retaliating against whistleblowers who report suspected violations of laws, regulations, or public policy. Importantly, this protection extends even to cases where the whistleblower’s allegations are ultimately proven incorrect, provided they held a reasonable belief in their reports. Mirroring many state whistleblower retaliation provisions, the California False Claims Act’s qui tam retaliation provision closely aligns with its federal counterpart. Under this act, whistleblowers are granted the right to file a civil lawsuit in federal court against their employer, pursue reinstatement with the same seniority status, and claim two times the amount of back pay.

Additionally, the act entitles whistleblowers to seek compensation for lost wages and benefits, litigation costs, attorney fees, emotional distress, and other punitive damages. This comprehensive protection underscores California’s commitment to safeguarding individuals who come forward to report suspected wrongdoing, providing significant legal recourse against retaliatory actions.

New Jersey Conscientious Employee Protection Act

The New Jersey Conscientious Employee Protection Act (CEPA), codified in New Jersey Revised Statutes Section 34:19-1, is the state’s whistleblower law enacted in 1986. It aims to protect employees from retaliation when they report illegal or fraudulent activities and employer misconduct. This protection extends to employees who disclose, oppose, or refuse to participate in unlawful conduct, as well as those who reveal actions they reasonably believe violate the law.

The New Jersey CEPA also protects employees who report any fraudulent or criminal conduct, including activities, policies, or practices that the employee reasonably believes may defraud the employer’s stakeholders, such as shareholders, investors, clients, patients, customers, employees, former employees, retirees, or pensioners, or any government entity.

Under the New Jersey Conscientious Employee Protection Act, employees have the right to file a civil lawsuit against their employer within one year of the retaliatory action. The Act provides employees with the right to a jury trial and entitles them to various forms of damages. These may include reinstatement to the same or a similar job, reinstatement of full fringe benefits and seniority rights, compensation for all lost wages and benefits, compensatory and punitive damages, as well as reasonable costs and attorneys’ fees. This comprehensive set of protections and remedies underscores New Jersey’s commitment to safeguarding whistleblowers and promoting accountability in the workplace.

How to File a Whistleblower Retaliation Claim

If you are considering blowing the whistle, or if you suspect that you may be subject to repercussions for assisting with a qui tam action, you should consult with a qui tam lawyer or whistleblower retaliation lawyer to learn how to best protect your rights. Our experienced attorneys can discuss your options, evaluate the strength of your case, assess your potential compensation, and help you prepare for any conceivable or actual retaliation.

Led by a former FBI Special Agent and consisting of a couple of Department of Justice alumni, our qui tam team has a long track record of amazing victories, and our whistleblower retaliation attorney team can help you prove the link between your complaint and your employer’s retaliatory behavior. Our firm typically operates on a contingency basis, meaning we are only compensated if we win your case.

For a free, confidential consultation to learn more about your whistleblower rights and how we can assist you, please contact us at (877) 561-0000.