Reporting Customs Fraud Under the False Claims Act

Custom fraud poses a serious threat to the United States, undermining global trade and economic stability. As companies cheat the U.S. government out of revenue using complex schemes, uncovering these instances of wrongdoing typically requires courageous individuals known as whistleblowers. The brave individuals who blow the whistle are crucial in exposing customs fraud and are eligible for substantial rewards – up to 30% of what the government recovers. With over $300 billion in annual tariffs, even 1% of false billing represents $3.5 billion in potential fraud, translating to approximately $1 billion available for customs fraud whistleblower rewards.

To effectively safeguard whistleblower rights in customs fraud cases, individuals should consult with a knowledgeable and experienced customs fraud law firm like Brown, LLC. A qualified customs fraud lawyer can file your lawsuit properly under the False Claims Act and guide you through the process.

What is Customs Fraud?

Customs fraud involves the deliberate evasion of customs duties and taxes, typically through the misrepresentation of goods’ value, quantity, or nature or by circumventing trade policies and restrictions.

This illegal activity results in significant revenue losses for the government and poses a threat to national security, public health, and fair market competition while being linked to other forms of organized crime. Governments and international organizations work to combat customs fraud through enforcement actions, audits, and cooperation with trading partners, while businesses often rely on compliance programs and due diligence to mitigate risks associated with customs fraud. However, while governments and businesses employ various methods to combat customs fraud, whistleblowers remain crucial in uncovering these complex schemes.

What are Different Types of Customs Fraud?

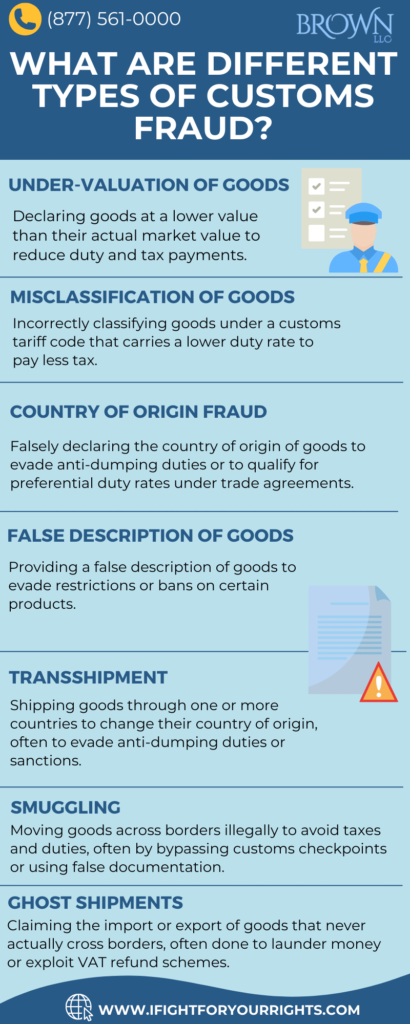

Customs fraud encompasses various schemes designed to evade duties, taxes, or regulations. Common types include:

- Undervaluation of Goods: Declaring goods at a lower value than their actual market value to reduce duty and tax payments.

- Misclassification of Goods: Incorrectly classifying goods under a customs tariff code that carries a lower duty rate to pay less tax.

- Country of Origin Fraud: Falsely declaring the country of origin of goods to evade anti-dumping duties or to qualify for preferential duty rates under trade agreements.

- Overvaluation of Goods: Inflating the value of goods to claim higher refunds on export incentives.

- False Description of Goods: Providing a false description of goods to evade restrictions or bans on certain products.

- Transshipment: Shipping goods through one or more countries to change their country of origin, often to evade anti-dumping duties or sanctions. The more tariffs the more transshipping seems to occur. Oftentimes the company ships the goods from a high tariff location like China to a country like Thailand and does a superficial change or work on the product to claim the second company is the company of origin when in fact the overwhelming bulk of the work was done in the high tariff country.

- Smuggling: Moving goods across borders illegally to avoid taxes and duties, often bypassing customs checkpoints or using false documentation.

- Ghost Shipments: Claiming the import or export of goods that never actually cross borders, often done to launder money or exploit VAT refund schemes.

As global trade continues to grow in complexity, new forms of customs fraud may emerge, requiring constant vigilance and adaptation of detection methods.

Customs Fraud Under the False Claims Act

The False Claims Act is a powerful tool in the fight against customs fraud in the United States. Originally enacted during the Civil War to combat fraud against government suppliers, it has evolved into a comprehensive mechanism for addressing fraud involving federal funds including customs fraud.

The False Claims Act tackles customs fraud by imposing severe penalties on those who knowingly engage in deceptive practices to evade customs duties and taxes. Any false statement or record made to reduce or avoid customs duties violates this law, as it defrauds the federal government of rightful revenue. These violations encompass all types of customs fraud, reinforcing the Act’s role as a powerful deterrent and enforcement tool.

The False Claims Act features a unique “qui tam” provision, allowing private individuals (known as “relators” or “whistleblowers”) to file lawsuits on behalf of the U.S. government against entities committing fraud. If the lawsuit results in the recovery of government funds, the whistleblower can receive a portion of the recovered amount (up to 30%) as a reward. The False Claims Act also allows for “treble damages,” enabling the government to recover triple the amount lost due to fraud. Additionally, it imposes penalties for each false claim, further increasing the potential recovery amounts of whistleblowers. These substantial financial incentives encourage individuals with knowledge of customs fraud to come forward, significantly enhancing the government’s ability to detect and prosecute fraudulent activities.

Customs Fraud Whistleblower Reward

Under the False Claims Act, whistleblowers in customs fraud cases can receive a significant portion of the recovered damages, typically ranging from 15% to 30%. The exact amount depends on several factors:

- The whistleblower’s role and participation in the case

- The government’s decision to intervene

- The quality of evidence provided

- The quality of the customs fraud law firm representing the whistleblower

Government Intervention

- If the government intervenes: The Whistleblower’s potential recovery ranges from 15% to 25% of the recovered damages.

- If the government declines to intervene: Whistleblowers may sometimes proceed independently and may be entitled to a higher share, ranging from 25% to 30%.

Whistleblowers who actively participate and significantly contribute to the case’s success may receive a higher share of the recovery. In all cases, whistleblowers must engage customs fraud lawyers and customs fraud whistleblower law firms to present the strongest possible case on their behalf, as the law does not allow one to file the case without the use of a Whistleblower Law Firm.

Customs Fraud Case

King Kong Tool Customs Fraud Settlement under the False Claims Act – Transshipping

The company allegedly evaded higher Chinese tariffs by shipping tools from China to Germany for superficial processing, then relabeling them as “Made in Germany” before U.S. import – is a scheme known as transshipping. By appropriately invoking the False Claims Act, the whistleblower became eligible for a customs fraud whistleblower reward of up to $6.9 million.

How to Report Customs Fraud

To report customs fraud effectively, an individual should first consult with a whistleblower law firm. These experienced attorneys can guide whistleblowers in lawfully gathering evidence related to fraudulent activities, such as documents, emails, and other relevant information to substantiate the claim. Since qui tam cases represent the interests of the United States, not the relator, whistleblowers cannot file qui tam cases “pro se” (without a lawyer). Therefore, working with a customs fraud lawyer who can evaluate the strength of the evidence and advise customs fraud whistleblowers on the best course of action.

Navigating the complexities of customs law and whistleblower lawsuits requires an experienced whistleblower attorney. They determine federal court viability and guide government investigations. A customs fraud lawyer manages procedural requirements, strategically files lawsuits, and negotiates with relevant parties. Their experience from similar cases increases the chances of success. They’ll assess the accused company committing customs fraud, examine evidence like false invoices on imported goods from foreign countries, and advise on self-protection against potential backlash from unscrupulous importers.

What Protections Exist for Whistleblowers Under the Customs False Claims Act to Prevent Retaliation?

While whistleblowers risk retaliation, the False Claims Act provides protections, including reinstatement and compensation. The initial confidential filing allows time for exit strategy planning. For information on your rights regarding customs fraud, seek a free, confidential consultation with a customs fraud whistleblower attorney.