Dodd-Frank Act: SEC & CFTC

Table of Contents

What is The Dodd-Frank Act

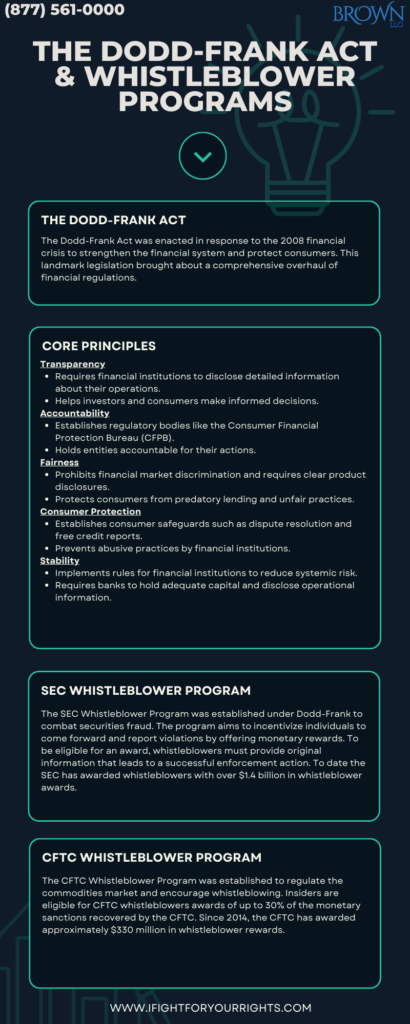

The Dodd-Frank Act Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) is landmark legislation enacted on July 21, 2010, in response to the 2008 financial crisis to try avoid other economic collapses by incentivizing whistleblowers to come forward with information and imposing more stringent industry regulations. In the aftermath of the Great Recession, the law overhauled financial regulations, affecting all federal financial regulatory agencies and nearly every aspect of the nation’s financial services industry.

The 2008 financial crisis, which was caused by a variety of factors, including excessive risk-taking by banks and other financial institutions, left millions of Americans unemployed and put the country in trillions of dollars’ worth of debt. The Dodd-Frank Act whistleblower program was enacted to avert another financial crisis by strengthening the financial system, protecting consumers from unfair financial practices and providing whistleblower awards of up to 30% for individuals who come forward with inside information about unlawful practices.

If you believe you have information about financial fraud, contact a Dodd-Frank whistleblower attorney to learn more about your options.

What Does the Dodd-Frank Act Do?

The Dodd-Frank Act contains several provisions, including:

- It establishes the Consumer Financial Protection Bureau (CFPB), an independent agency charged with protecting consumers from deceptive financial practices. As of this writing, the United States Supreme Court may imminently render an opinion about certain constitutionality of the CFPB’s powers.

- It governs derivatives, which are complicated financial instruments used to speculate on certain financial products including the housing market which overleveraged certain positions and contributed to the financial crisis.

- It strengthens bank capital requirements, which are the amounts of money that banks must keep in reserve which is critical with the recent implosion of certain banks and certain other banks issues with the stress test.

- It created the Financial Stability Oversight Council (FSOC), an interagency body charged with identifying and responding to systemic risk in the financial system.

- It forbids banks from engaging in certain risky activities such as proprietary trading and hedge fund investing.

- It mandates that banks hold adequate capital reserves, not be overly leveraged and disclose more information about their operations with transparency.

- It has led to the Federal Government proactively stepping in and addressing stressed financial institutions.

What Are the Core Principles of the Dodd-Frank Whistleblower Program?

The Dodd-Frank Act’s core principles are intended to strengthen the financial system and protect consumers from abusive financial practices. The core principles include:

- Transparency: Under the law, financial institutions must disclose detailed information about their operations, such as trading positions and risk exposures. This data assists investors and consumers in making educated decisions about where to invest their money and how to protect themselves from financial risks.

- Accountability: The law establishes new regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB), to hold entities accountable for their actions. The CFPB arguably has the authority to investigate and punish financial institutions that engage in abusive practices.

- Fairness: The law prohibits financial market discrimination, such as redlining, the practice of denying loans or other financial services to people in specific neighborhoods. The law also requires financial institutions to provide product and service disclosures in plain language that consumers can understand.

- Consumer protection: The law establishes new consumer safeguards, such as the right to dispute credit card charges and the right to a free credit report from each of the three major credit bureaus once a year. Financial institutions are also prohibited from engaging in certain abusive practices, such as predatory lending, under the law.

- Stability: The law establishes new rules for financial institutions in order to reduce systemic risk. These regulations require banks to hold more capital and disclose more information about their operations. The law also establishes the Financial Stability Oversight Council (FSOC), which oversees detecting and responding to systemic risk in the financial system.

Our Dodd-Frank act whistleblower attorneys know exactly how to navigate the complex process of filing for rewards.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.