False Claims Act: Whistleblower

What potential whistleblowers need to know about bringing a qui tam lawsuit under the federal False Claims Act.

History of the False Claims Act

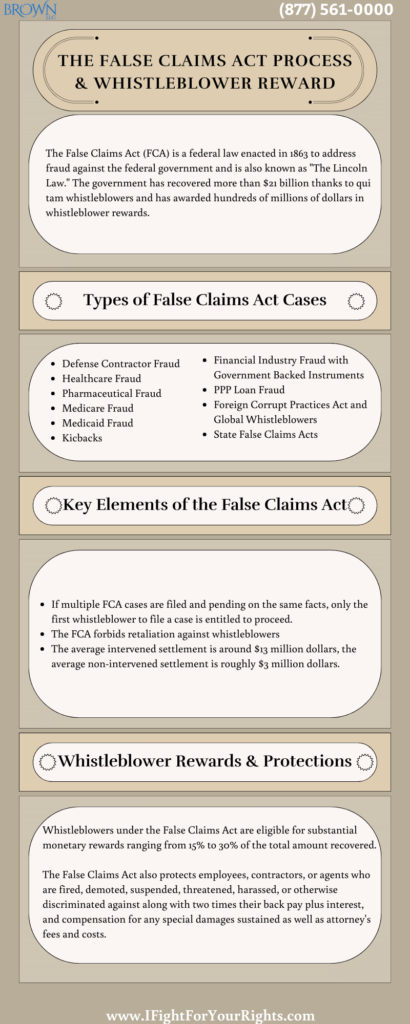

The False Claims Act (FCA), 31 U.S.C. 3729 – 3733 is a federal statute enacted in 1863 in response to defense contractor fraud during the American Civil War. Passed during the administration of “Honest Abe,” President Abraham Lincoln, the False Claims Act has also been dubbed “The Lincoln Law.”

The False Claims Act is one of the most powerful tools available for combating fraud against the federal government and its contracts and programs like Medicare, Medicaid, Defense Contracts, PPP Loans and Customs Fraud to name a few. The False Claims Act’s qui tam provision, allows individuals – whistleblowers – with inside knowledge of fraud to sue on behalf of the government. As a potential reward for their efforts, the citizen-whistleblowers or qui tam “relators”– are entitled to 15-30% of the amount recovered by the government. In the last 22 years, the federal government has recovered more than $21 billion thanks to the efforts of qui tam whistleblowers and, in turn, has given hundreds of millions of dollars out as whistleblower rewards, which is a healthy sum for people who want to do the right thing.

In the fiscal year ending September 30, 2022, the Department of Justice obtained more than $2.2 billion in settlements and judgments from civil cases involving fraud and false claims against the government and over a hundred million dollars went to whistleblower awards.

The whistleblower False Claims Act is a crucial legal mechanism designed to combat fraud against the government that empowers individuals who possess knowledge of fraudulent activities to step forward and initiate a qui tam lawsuit, making the whistleblower False Claims Act an essential tool for exposing wrongdoing and protecting taxpayer dollars if invoked in the right manner. If you file incorrectly, you may not receive anything for your efforts, which underscores the reasons you should consult with one of the best whistleblower law firms before filing a case

Types of False Claims Act Cases

False Claims Act violations can arise in a variety of contexts and can involve a wide range of industries and types of fraud – but one constant is that the fraud must be against the federal government to be actionable under the FCA:

- Defense Contractor Fraud – Companies who overcharge or fail to deliver military and defense services or products with government contracts.

- Healthcare Fraud – Providers or healthcare entities who submit false claims or make misrepresentations involving federal health insurance programs, like Medicare, Medicaid or Tricare.

- Pharmaceutical Fraud – Drug companies and pharmaceutical manufacturers/distributors involved in kickbacks, NDA falsification, blatant drug adulteration, inflated pricing, illegal marketing, etc. who in turn bill the federal government insurance program(s).

- Medicare Fraud – Healthcare providers who specifically engage in practices that defraud the Medicare system, which is the largest federal healthcare program in the United States.

- Medicaid Fraud – Similarly, healthcare providers who engage in fraud involving Medicaid, which is designed to provide healthcare to those with low income and generally administered by the states with the use of federal funds.

- Kickbacks – Kickbacks are a specific kind of fraud that refers to payments or benefits over fair market value in exchange for referrals.

- Paycheck Protection Program (PPP) Loan Fraud – The Paycheck Protection Program (PPP) was a program designed to aid small business owners during the financial repercussions of the COVID-19 pandemic. This type of fraud refers to entities who specifically defrauded this program, often by false applications when not eligible for the loans provided by the government or concealment if interrelated companies.

- Foreign Corrupt Practices Act and Global Whistleblowers – This type of fraud is international in scope. This law targets individuals who bribe foreign officials and engage in other corrupt behavior with regards to international business practice.

- State False Claims Acts – Similar to the False Claims Act, many individual states have their own version of false claims act that supplement the federal False Claims Act by providing a mechanism to address fraud against the state when no federal funds are implicated or in addition to it.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

These are just a few examples of the types of False Claims Act cases that can arise. Violating the False Claims Act can result in significant penalties and damages. If you suspect that a company or individual is defrauding the federal government, it is important to speak with a qui tam whistleblower attorney who can evaluate your case and help you determine the best course of action as time is of the essence. Technically, only the first person to file a False Claims act is eligible for an award under the first to file rule.

The False Claims Act Process

A False Claims Act case is initially filed in federal district court “under seal.” The complaint and evidence in support of the whistleblower’s claims are only confidentially provided to the US Department of Justice, including the district United States Attorney, and the assigned district court judge. While the complaint is under seal – a period that is frequently extended – the Department of Justice will investigate the allegations. The DOJ will typically interview the whistleblower also known as the relator and may subpoena documents, interview other witnesses, and consult with agency personnel, sometimes in collaboration with other law enforcement agencies and with the assistance of whistleblower counsel.

The government must decide whether or not to intervene in the case. If the government intervenes in a whistleblower case, the government takes over the litigation. If the government does not intervene, the relator may continue the case on the government’s behalf, if the government doesn’t object and if it does object there also very limited discretionary grounds to proceed.

False Claims Act Violations

Violating the False Claims Act can result in significant penalties and damages. If you suspect a False Claims Act violation has occurred, it is advisable to consult with an attorney who is experienced in this area of law. They can guide you through the process of reporting the violation and potentially filing a qui tam lawsuit on behalf of yourself and the government.

False Claims Act Whistleblower Rewards

A False Claims Act whistleblower is eligible for substantial monetary rewards ranging from 15% to 30% of the total amount recovered. To be eligible for a False Claims Act whistleblower reward, you must have firsthand knowledge of the fraud and be the first to report it to a whistleblower law firm, preferably one that can work seamlessly with the Department of Justice.

Notable Whistleblower Cases

Whistleblower cases under the False Claims Act can range in variety, with some cases making headlines for settlements worth hundreds of millions, if not billions of dollars. Some notable examples include:

- GlaxoSmithKline (2012): GlaxoSmithKline is a global pharmaceutical company who was alleged to be engaging in illegal marketing and pricing practices. GlaxoSmithKline resolved the claims made against them for Three Billion ($3 Billion) Dollars. This was the largest healthcare fraud settlement at the time. The whistleblowers who brought the claim to light included current former employees of the company.

- DaVita Healthcare (2015): DaVita Healthcare is a leading provider of dialysis services. DaVita faced allegations of creating waste by intentionally using medicine vials that were larger than medically necessary and billing Medicare and Medicaid for the unused portions. DaVita agreed to settle the claims for Four Hundred Fifty Million ($450 million) Dollars. The case was made visible by a former employee, who argued that DaVita’s practices were systematically designed to overbill the government.

Whistleblower Reporting Protections

Several laws provide legal protection to whistleblowers in order to encourage them to come forward and report wrongdoing. Employers are prohibited from retaliating against employees who report misconduct under the False Claims Act whistleblower laws.

If you report systemic Medicare fraud, Medicaid fraud, defense contractor fraud, or pharmaceutical fraud, the case is initially filed confidentially under seal, which protects your identity from the defendants. Other statutes, such as the AML whistleblower statute (Anti-Money Laundering), the SEC whistleblower, the NHTSA whistleblower, and the CFTC whistleblower statutes, may provide anonymity from beginning to end if a whistleblower attorney is used.

Provisions to Prevent Retaliation under the False Claims Act

The False Claims Act protects employees, contractors, or agents who are fired, demoted, suspended, threatened, harassed, or otherwise discriminated against because of lawful actions taken to stop FCA violations. Retaliation liability extends beyond one’s employer and may extend to others. Whistleblowers who have been wronged may be reinstated with the same seniority status they would have had if not for the discrimination, two times their back pay plus interest, and compensation for any special damages sustained, such as emotional distress, as well as attorney’s fees and costs. A retaliation case may be filed concurrently or separately with an FCA qui tam complaint.

Specific Protections Against Retaliation under 31 U.S.C. § 3730(h):

Protections afforded specifically to whistleblowers under the False Claims Act can be found in 31 U.S.C. § 3730(h):

“(h)Relief From Retaliatory Actions.— (1)In general.— Any employee, contractor, or agent shall be entitled to all relief necessary to make that employee, contractor, or agent whole, if that employee, contractor, or agent is discharged, demoted, suspended, threatened, harassed, or in any other manner discriminated against in the terms and conditions of employment because of lawful acts done by the employee, contractor, agent or associated others in furtherance of an action under this section or other efforts to stop 1 or more violations of this subchapter. (2)Relief.— Relief under paragraph (1) shall include reinstatement with the same seniority status that employee, contractor, or agent would have had but for the discrimination, 2 times the amount of back pay, interest on the back pay, and compensation for any special damages sustained as a result of the discrimination, including litigation costs and reasonable attorneys’ fees. An action under this subsection may be brought in the appropriate district court of the United States for the relief provided in this subsection. (3)Limitation on bringing civil action.— A civil action under this subsection may not be brought more than 3 years after the date when the retaliation occurred.”

This provision covers varying types of retaliation, including discharge demotion, suspension, threats, harassment, or discrimination in employment conditions. Whistleblowers who face any of these forms of retaliation for bringing a claim are entitled to apply for the following forms of relief:

- Reinstatement: Employee is given the position back at the same level of seniority prior to any retaliation from the employer.

- Back Pay: Any amount that the employee is owed in back pay is provided at twice (2x) the amount plus any interest incurred.

- Special Damages: Employee may be entitled to compensation for any emotional distress, litigation costs, and reasonable attorney’s fees.

It is important to note that any claims of retaliation must be brought within three (3) years of the incident under the statute. Consulting with a whistleblower attorney is essential to preserving the necessary rights and protections you are entitled to.

Speak to a Qui Tam Whistleblower Attorney About Your Case

If you suspect that a company or individual is defrauding the federal government, you may want to speak to a qui tam whistleblower law firm like Brown, LLC. They can evaluate your case, help you navigate the legal process, and protect your rights as a False Claims Act whistleblower and provide free, confidential consultations.