Medicare Fraud Whistleblower Rights

Medicare fraud is a widespread problem that costs taxpayers billions of dollars every year, but fortunately, the qui tam provisions of the False Claims Act allows whistleblowers to report fraud and in turn receive generous whistleblower rewards if the case is successful. If you have information about Medicare fraud, you may be eligible for a reward by blowing the whistle the right way with a whistleblower law firm.

Filing a False Claims Act lawsuit is one of the few areas of law that you must use an attorney for, so it’s essential that you select a firm that has a track record of success in whistleblower litigation. Hundreds of millions of dollars in whistleblower awards have gone to courageous individuals who blew the whistle the right way with the right firm and hundreds of heartaches have felled those who did not.

Choosing the right whistleblower law firm can be the difference between success and disappointment in whistleblower litigation. The intricate nature of False Claims Act lawsuits necessitates the knowledge and experience of a pharmaceutical fraud lawyer to navigate effectively. Whistleblowers who partner with seasoned attorneys increase their chances of a favorable outcome and maximize their potential whistleblower rewards. Conversely, those who fail to select a competent firm may encounter significant obstacles and missed opportunities. With millions of dollars at stake, the importance of selecting the right legal representation cannot be overstated. It’s essential to entrust your case to a firm with a proven track record of success in whistleblower litigation to ensure the best possible outcome.

What is Medicare Fraud?

Medicare fraud is any intentional deception or misrepresentation that results in a payment from the Medicare program. Examples of Medicare fraud include billing for services that were not provided, upcoding (billing for a more expensive service than was provided), kickbacks (payment for referring Medicare patients to another provider), and/or improper self-dealing in which a physician refers patients to other entities it owns without disclosing the interest in the derivative companies (self-referrals inherently question the integrity of the referral).

Medicare fraud can be committed by healthcare providers, patients, or others who work in the healthcare industry, but the False Claims Act statute looks to address systemic problems from entities that either routinely defraud Medicare, or have received significant overpayments and refuse to surrender their ill-gotten gains. Medicare Fraud can also morph into other dimensions when pharmaceutical fraud is occurring, which includes off label promotion of products, failure to adhere to commonly accepted good manufacturing practices (GMP or CGMP) or furnishing physicians with lavish trips, food, sports tickets, etc, to induce referrals.

Medicare Fraud Whistleblower Reward

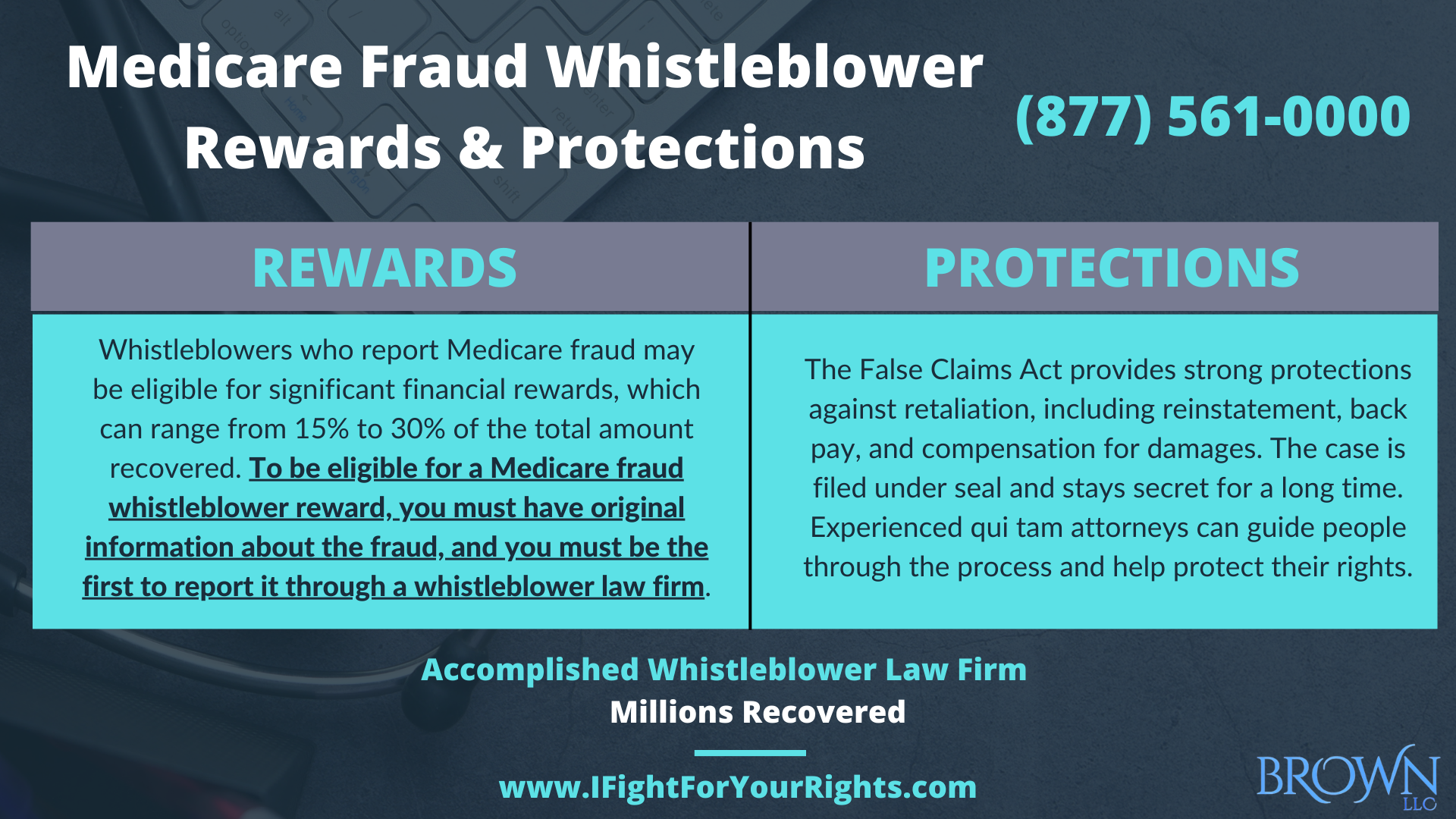

Whistleblowers who report Medicare fraud may be eligible for a significant Medicare whistleblower reward, which can range from 15% to 30% of the total amount recovered. To be eligible for a Medicare whistleblower reward, you must have original information about the fraud, and you must be the first to report it through a whistleblower law firm, preferably a firm that can seamlessly interface with the Department of Justice. The secret handshake of lawyers is their language.

With the False Claims Act, there are Latin terms like qui tam and relator, sophisticated concepts such as materiality and procedural landmines involving seals and service, so you are strongly advised to retain counsel that has successfully navigated through these hurdles before and routinely engages with the government who may be the ultimate arbiter in deciding whether to bequeath a whistleblower award. Firms that have a former Department of Justice individual, such as an Attorney General, Assistant United States Attorney, FBI Special Agent or FBI Legal Advisor may have deeper insight into the innerworkings of the government and add value with their representation.

Navigating the intricacies of the False Claims Act requires a deep understanding of legal nuances and procedural complexities. From Latin terms like qui tam and relator to intricate concepts such as materiality, the terrain can be treacherous without the guidance of seasoned counsel. It’s crucial to engage a whistleblower law firm that not only comprehends these intricacies but also maintains a strong rapport with government agencies like the Department of Justice. Firms staffed with former Department of Justice personnel possess invaluable insights into governmental processes, enhancing their ability to advocate effectively on behalf of whistleblowers. By aligning with experienced counsel, whistleblowers can maximize their chances of success and potentially secure the whistleblower rewards they deserve.

Whistleblower Protections

Reporting Medicare fraud can be a complicated process, and whistleblowers are sometimes at risk of retaliation from their employers, and even if they are not, will certainly hold concerns about retaliation. However, the False Claims Act and other laws provide strong protections against retaliation, including reinstatement, back pay, and compensation for damages. Whistleblowers can also work with experienced qui tam attorneys who can guide them through the process and help protect their rights. Some initial protections that whistleblowers have under the False Claims Act is time and secrecy.

A False Claims Act lawsuit is initially filed under seal confidentially, so the defendant is not served with the complaint and does not know about it, and the period under seal can last many, many years. With the benefit of timing and planning, the insider can prepare for when the wrongdoer finally finds out. Further, if the defendant is brazen enough to try something upon disclosure of the action, not only will your own qui tam counsel be ready to step in, but it is on the government’s radar as well, and the government is strongly incentivized to ensure that whistleblowers are not stymied as they are integral to the conduit of information that is essential in prosecuting Medicare fraud. Over 100 million in judgments and settlements trials in state and federal courts.

We fight for maximum damage and results.

Speak with the Lawyers at Brown, LLC Today!

Medicare Fraud Lawyers and Medicare Fraud Attorneys

Whistleblower attorneys can assist individuals who wish to report systemic Medicare fraud and in fact under the False Claims Act you must use a whistleblower law firm to report the fraud to obtain an award. Medicare fraud lawyers can help whistleblowers understand their rights and protections under the False Claims Act, which provides protection against retaliation for whistleblowers. Whistleblower attorneys can also help whistleblowers navigate the complex legal process of reporting Medicare fraud and filing a claim for a Medicare fraud whistleblower reward for reporting Medicare fraud.

Recent Examples of Successful Medicare Fraud Whistleblower Cases

Recent years have seen a significant increase in successful Medicare fraud whistleblower cases. In 2022, the U.S. Department of Justice announced a $45 million settlement in a case brought by a whistleblower alleging that a healthcare provider violated the False Claims Act rules by accepting and paying kickbacks to dermatologists. The whistleblower who came forward and blew the whistle received a whistleblower award of approximately $9 million under the False Claims Act. In 2021, a whistleblower was awarded approx $35 million for exposing violations of the Stark Law and the Anti-Kickback Statute (AKS) provisions of the False Claims Act.

How to Report Medicare Fraud and File a Qui Tam Lawsuit

To report Medicare fraud and file a qui tam lawsuit, a whistleblower must consult with an experienced qui tam attorney. The attorney will help the whistleblower prepare a complaint, which will be filed with the appropriate court and served on the defendant. The government will then have an opportunity to investigate the fraud and decide whether to join the lawsuit. If the lawsuit is successful, the whistleblower may be eligible for a whistleblower reward of up to 30% of the recovered funds which may be considerable, considering the average recovery for a government intervened case is roughly $13 million. Even assuming a 20% relator share, that’s a couple million dollars as a potential whistleblower award for doing the right thing.

The Importance of Holding Medicare Fraudsters Accountable

The importance of holding Medicare fraudsters accountable cannot be overstated. Medicare fraud is a serious problem that costs taxpayers billions of dollars every year, and it also has significant consequences for patients who depend on the program for their health care needs. By holding these fraudsters accountable through legal action and imposing penalties, it sends a clear message that Medicare fraud will not be tolerated, and it also helps to deter others from engaging in fraudulent activities. Additionally, the recovery of funds from Medicare fraud can be reinvested back into the program, helping to ensure that Medicare continues to provide vital services to those who need it most and keeping healthcare costs and taxes under control. To state it inversely, rampant Medicare fraud will lead to worse services, out of control costs, and higher taxes.

What You Can Do to Help Fight Medicare Fraud

If you have information about Medicare fraud, you can help fight it by reporting it to an experienced whistleblower law firm who offers free confidential whistleblower consultations to evaluate the merits of a case and determine the best course of action. By coming forward and blowing the whistle on Medicare fraud, you can help protect taxpayer dollars and ensure that patients receive the care they need.

Medicare fraud is a serious issue that costs taxpayers billions of dollars each year. Fortunately, whistleblowers who report Medicare fraud can receive a significant Medicare whistleblower reward and legal protections under the False Claims Act. If you have information about Medicare fraud, it is important to work with experienced whistleblower attorneys who can help guide you through the legal process and protect your rights. Together, we can fight Medicare fraud and protect both taxpayers and patients.