Home Healthcare Settles $10M False Claims Case in Energy Program

The Booming Home Healthcare-and Healthcare Fraud-Industry

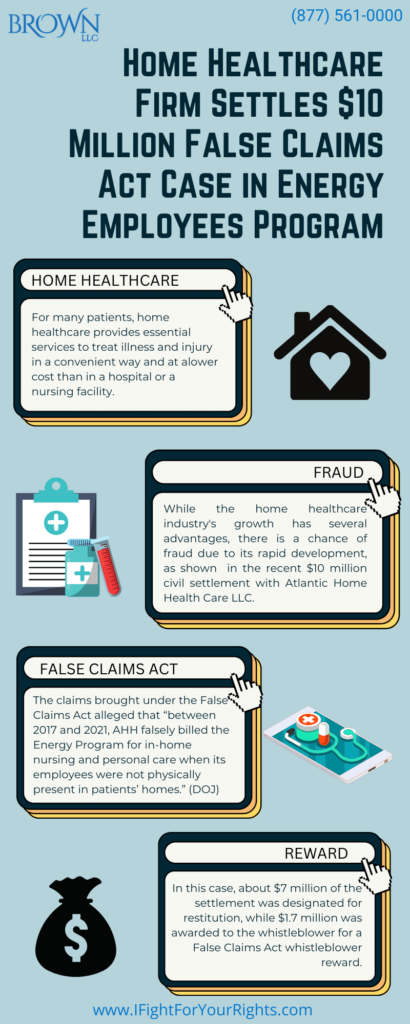

For many patients, home healthcare provides essential services to treat illness and injury in a convenient way and at a lower cost than in a hospital or a nursing facility. However, with any sprawling industry with billions in play it is replete with fraud as well. The home healthcare industry is one of the fastest growing job markets in the United States, and in 2020, there were over 11,000 home healthcare agencies treating over 3 million patients. The industry generates an estimated $56B in annual revenue, which is only expected to increase as the baby boomer generation ages, and the aging population requires more health services. While the home healthcare industry’s growth has several advantages, there is an acute prospect of fraud married to its rapid development, as shown in the recent $10 million civil settlement with Atlantic Home Health Care LLC.

Home Healthcare fraud can come in many forms—from excessive billing for things like services not rendered, upcoding, fake prescriptions and a couple other areas that are big are kickbacks for home healthcare patients and self-dealing violations (Stark law) where providers refer patients to home healthcare companies they own without properly disclosing the relationship. Such fraud impacts both individuals and businesses by raising health insurance premiums and increasing taxes—resulting in tens of billions of dollars in losses per year. However, there are many laws that can help protect against such fraud, such as the False Claims Act, and the Anti-Kickback Statute.

The Allegations Against Atlantic Home Healthcare

On January 5th, The Department of Justice announced a $10 million civil settlement under the False Claims Act (FCA) with the Wisconsin-based home healthcare company Atlantic Home Health Care LLC (AHH). While operating in Arizona, the company allegedly misused public funds pulled from the Energy Employees Occupational Illness Compensation Program (EEOICP or Energy Program), a healthcare program for Department of Energy employees and contractors with occupational illnesses.

The claims brought under the qui tam or whistleblower provisions of the False Claims Act alleged that “between 2017 and 2021, AHH falsely billed the Energy Program for in-home nursing and personal care when its employees were not physically present in patients’ homes.” (DOJ)

Further, the government alleges that AHH paid kickbacks “in the form of cash payments up to $5,000 for patient referrals via its ‘friends and family program’ and in-kind payments for food, internet, travel and other expenses made to patients and their families.” Such activities are prohibited under The Anti-Kickback Statute, as no parties participating in federal healthcare programs may exchange remuneration for items and services furnished by such programs. As these kickbacks were voluntarily disclosed to the Department of Health and Human Services’ Office of Inspector General prior to the disclosure of the AHH’s investigation, AHH’s cooperation was acknowledged in the settlement agreement.

“Quality care is critical to beneficiaries participating in the Energy Employees Occupational Illness Compensation Program,” said U.S. Attorney Gary M. Restaino for the District of Arizona. “The payment of cash kickbacks to induce referrals has no place in our healthcare system. False Claims Act enforcement protects the integrity of federal healthcare programs.”

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

How Were These Claims Brought Up Under the False Claims Act?

AHH’s former Corporate Administrator and Director of Human Resource Administration and Management initially reported the fraud, acting as the relator in this case. The qui tam provisions of the False Claims Act allow for a whistleblower to report fraud against the federal government, which in turn files a case against the company making the alleged violations. In turn, the whistleblower is eligible to receive 15-30% of the amount recovered by the government as a whistleblower reward. In this case, about $7 million of the settlement was designated for restitution, while $1.7 million was awarded to the whistleblower for a False Claims Act whistleblower reward.

Since its amendment in 1986, qui tam whistleblowers have received rewards totaling over $8 billion, and the False Claims Amendments Act of 2023 seeks to further strengthen the False Claims Act and its anti-fraud efforts. The bill prevents companies from being absolved for their illicit involvement in government business, protects against post-employment retaliation, and reinforces the authority of the False Claims Act. The bipartisan bill has wide support among whistleblower advocates.

Working With a False Claims Act Attorney

To file claims under the False Claims Act, it is required to use a whistleblower law firm as an individual cannot file the matter pro se (without an attorney) since the lawsuit seeks to represent the United States’ interests as well as the relator’s (a qui tam term for whistleblower). One should consult a False Claims Act attorney regarding the circumstances of the case to determine whether to file it, and make sure it’s presented in the best possible manner. A False Claims Act lawyer can aid in structuring a case, lawfully compiling documents, and most importantly, the whistleblower could have the benefit of the firm’s experience to navigate them through any issues that may arise. Experienced False Claims Act attorneys also ensure that the facts of a whistleblower’s case are succinctly and persuasively presented, giving such reports a competitive edge over those submitted by a general practitioner. Since cases under the FCA are filed and presented to the Department of Justice it is helpful to look for a firm who has a track record of success in this space and further, that has former DOJ individuals, like FBI agents or FBI Legal Advisors.

Qui tam cases are filed under seal, meaning the complaint does not initially appear on the public docket and the investigation proceeds without notifying the defendant. This is done in the interest of the government’s investigation so it can proceed without complications. This also ensures that the whistleblower’s identity remains confidential until the seal is lifted or partially lifted at the conclusion of a case. The False Claims Act also prohibits retaliation against employees acting in the capacity of a whistleblower.

While there may be fraud that accompanies all economic growth, there are sophisticated legal mechanisms in place to combat fraud and recover illegally obtained funds. Whistleblowers continue to be the pivotal components to fraud recovery efforts, since it is through their intervention that the proper authorities can respond to and deter fraud.

https://www.cdc.gov/nchs/fastats/home-health-care.htm

https://www.ankota.com/home-care-industry-overview-and-statistics

https://www.cdc.gov/nchs/fastats/home-health-care.htm

https://www.cms.gov/files/document/overviewfwalawsagainstfactsheet072616pdf