What Is Healthcare Fraud in the Context of Medicare and Medicaid Fraud?

Medicare fraud whistleblowers help uncover healthcare fraud that costs taxpayers billions each year, and hundreds of millions of dollars in Medicare whistleblower awards are paid to individuals courageous enough to step forward. Healthcare fraud occurs when individuals or companies deliberately deceive government healthcare programs like Medicare and Medicaid to knowingly receive payments they are not entitled to, to retain overpayments they know don’t belong to them, or when they engage in kickbacks.

While healthcare fraud can happen with any insurance payor, Medicare and Medicaid fraud specifically involve false claims submitted against federally funded programs, costing taxpayers billions of dollars each year.

When healthcare providers, corporations, or suppliers engage in schemes such as upcoding, kickbacks, or billing for services not rendered, they violate federal laws and undermine patient care. As a Medicare fraud whistleblower, you can play a critical role in uncovering healthcare fraud and helping the government recover taxpayer funds.

Whistleblowers who properly report Medicare or Medicaid fraud through a qui tam action may be eligible for significant financial rewards under the False Claims Act. Systemic healthcare fraud against private insurance companies is typically only remedied in California and Illinois, in contrast to the fraud against the federal government.

Medicaid Fraud Whistleblower Reward

The antidote to fraud against the government with the False Claims Act (FCA), a statute that incentivizes whistleblowers to come forth and receive up to 30% of what the government recovers. Add to that certain states like California and Illinois have a mechanism to recover for private insurance fraud, and the whistleblower can receive up to 50% of what is recovered. It’s no wonder individuals have received hundreds of millions of dollars in whistleblower rewards each year for properly reporting healthcare fraud with the use of a healthcare fraud attorney, especially if the violation is tied to a Medicare fraud case with extensive billing

Let’s talk about the two common types of healthcare fraud: Medicare fraud and Medicaid fraud.

Medicare & Medicaid Fraud

The False Claims Act allows whistleblowers who blow the whistle properly to claim up to 30% of what the government recovers as a Medicare Whistleblower Award. It is estimated that there are hundreds of billions of dollars a year lost due to fraud, which means whistleblowers could stand to receive aggregate awards in the billions if they file a qui tam lawsuit with the right whistleblower law firm. Medicare whistleblower protection under the False Claims Act safeguards against retaliation, ensuring whistleblowers can report fraud without fear of retribution. For example, according to government estimates, improper payments to healthcare professionals through Medicare and Medicaid exceeded $130 billion in 2020. Significant sums of taxpayer dollars, up to 10 percent of all healthcare expenditures nationally, by some estimates, go to healthcare providers who defraud the federal and state health insurance programs.

Call now for a free confidential consultation with an experienced Medicare fraud lawyer at (877) 561-0000 or Request a Free Consultation online.

Those who work in the healthcare industry know that it’s not just the taxpayers who are being cheated; it’s the patients, too. Fraudulent conduct can and does lead to real patient harm. The Medicare and Medicaid programs depend on whistleblowers with integrity to step forward to blow the whistle to combat systemic fraud. It’s essential to learn your rights under the False Claims Act. Many people mistakenly assume that Medicare fraud whistleblowers are protected under the Whistleblower Protection Act (WPA) or the Whistleblower Protection Enhancement Act (WPEA). They are not. Medicare and Medicaid whistleblowers are protected under the False Claims Act through its anti-retaliation provisions. If you’re thinking about blowing the whistle on Medicare or Medicaid fraud, speak with an experienced litigation team with real experience and results fighting Medicare and Medicaid fraud.

What Happens When You Report Medicare Fraud Online?

What is Medicare Fraud?

Medicare and Medicaid are government health insurance programs (GHIPs). Medicare is a federal health insurance program for people over 65, or certain younger people who have disabilities, or people with end-stage renal disease, otherwise known as ESRD. Medicaid is a joint federal/state program that covers medical expenses for low-income individuals. Medicaid provides health coverage to millions of Americans, including low-income adults, children, pregnant women, elderly adults, and people with disabilities. States administer Medicaid in accordance with federal laws and it is funded jointly by states and the federal government.

Because Medicare and Medicaid cannot review every single claim submitted before making payment, the Government places enormous trust in doctors and other healthcare providers to submit accurate and truthful claims. As directed by the U.S. Department of Health and Human Services, “The Government’s payment of claims is generally based solely on the provider’s representations in the claims documents.” The sobering reality is that many providers are willing to bend or break the rules to increase their profits.

Common types of Medicare & Medicaid fraud include Upcoding & Unbundling, Billing for Non-Existent or Unnecessary Services, Kickbacks, Pharmaceutical Fraud, and Telehealth Fraud, but there’s no end to the ways that healthcare providers systemically cheat the government.

So, if you witness something that appears to be billing fraud, know you are entitled to have a free consultation with a Medicare or Medicaid fraud law firm, depending on the situation to understand your rights as a potential whistleblower. Medicare fraud and Medicaid fraud law firms can also help you evaluate the downsides of continuing to work in an environment with rampant fraud versus the opportunity to obtain a Medicare whistleblower award if you blow the whistle the right way. A qualified whistleblower law firm can guide you in protecting yourself while maximizing the potential to recover an award for reporting fraud the right way.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts.

We fight for maximum damage and results.

Upcoding & Unbundling

“Upcoding” refers to the submission of false or improper billing codes to obtain higher reimbursement from Medicare & Medicaid. Healthcare providers can upcode by making a false diagnosis for a more serious condition, exaggerating the amount of time they spent with patients, or billing for more expensive procedures than they provided.

A tell-tale sign of upcoding is if a provider automatically selects the highest level of service that can be billed, regardless of the individual needs of each patient. This practice is sometimes referred to as “reflexive billing,” where providers automatically code for the highest reimbursement without individualized clinical justification. Another indicator of upcoding is missing or inadequate clinical documentation. As the saying goes, “If it wasn’t documented, it didn’t happen.”

Another common form of Medicare fraud is called “unbundling.” Many medical services are supposed to be “bundled” together so that the healthcare provider receives only one lump sum payment for related procedures under one billing code. By splitting up these services into different codes, healthcare providers can illegally generate multiple payments from the government that should have been paid in one lump sum payment. Some providers even falsely bill services as occurring over several days when, in reality, they were performed on the same day solely to inflate the amount reimbursed. While some providers may be frustrated with the bureaucracy and wrongly dismiss billing rules as mere red tape, intentionally manipulating billing codes to increase payments constitutes Medicare fraud and Medicaid fraud.

Billing for Services Not Rendered or Not Medically Necessary

To be covered by Medicare & Medicaid, medical services and procedures require a doctor’s order attesting to the medical necessity of such services, and a significant amount of Medicare/Medicaid fraud involves the billing of medically unnecessary services, such as pointless diagnostic tests like ultrasounds or x-rays, or unneeded durable medical equipment (DME) like back and knee braces.

In more egregious cases, providers have actually performed unnecessary procedures and even unnecessary surgery! Conduct in which patients’ insurance plans are treated as open checkbooks, sacrificing patient well-being for profits, is of particular interest to government investigators. Taxpayer harm is bad enough, but actual patient harm can (and often does) trigger criminal as well as civil liability.

Another common form of Medicare fraud is telehealth fraud, where remote doctors sign orders and prescriptions for expensive medications, services, or equipment, even though they never see or examine the patients. In July 2022, the Office of Inspector General for the Department of Health and Human Services announced that the government was investigating dozens of companies that paid physicians to “generate orders or prescriptions for medically unnecessary durable medical equipment, genetic testing, wound care items, or prescription medications,” often without any direct patient interaction.

Incident-to Billing Fraud

Medicare reimburses non-physician providers (NPPs), such as nurse practitioners and physician assistants, at a rate lower than what a physician would receive for the same type of care. But if the NPP’s care is “incident to” the care provided by a physician, the NPP can bill their services as though performed by the physician to obtain the higher reimbursement rate. This is known as “incident-to billing.”

One key requirement of “incident-to billing” is that the physician “directly supervises ” the NPP. This requires the supervising physician to physically “present in the office suite and (be) immediately available to provide assistance and direction throughout the time the aide is performing services.”

Many clinics and medical practices, including urgent care and family medicine practices, are staffed solely by nurse practitioners or physician assistants without a physician present on the premises. Even in offices staffed by both physicians and nurses, the physicians may not always be present to supervise. If those nurses then bill their services as “incident to” a physician’s services, while the physician was not present, they would be violating incident-to rules and thereby committing Medicare fraud. As an example, in 2018, a dermatology practice in New York agreed to pay more than $811,000 to resolve incident-to-billing fraud claims

Kickbacks & Physician Self-Referrals

A kickback occurs when money or other benefits are offered, paid, solicited, or received in exchange for referring patients for services or products covered by Medicare or Medicaid, which essentially functions as an illegal bribe in the healthcare system. Kickbacks corrupt medical decision-making by encouraging providers to refer patients based on financial incentives rather than medical necessity, undermining patient trust and inflating healthcare costs. Even when done with the best of intentions, kickbacks create the appearance of a conflict of interest that erodes the integrity of the healthcare payor system.

Kickbacks can take many forms, including cash payments, lavish meals, speaking fees, sham consulting agreements, free travel, or excessive gifts to providers who refer patients or prescribe particular drugs or medical devices. Offering, making, or receiving any kickback is prohibited by the Anti-Kickback Statute, 42 U.S.C. § 1320a-7b, and submitting claims for services tainted by a kickback constitutes Medicare and Medicaid fraud.

The offering, making, and receiving of any such kickbacks are prohibited by the Anti-Kickback Statute, 42 U.S.C. § 1320a-7b, and submitting any claims for services tainted by a kickback constitutes Medicare and Medicaid fraud.

Physician self-referrals present a related but distinct form of fraud. A self-referral occurs when a physician refers a patient to a provider or entity with which the physician has a financial relationship without fully disclosing the interest, creating a conflict of interest that may incentivize unnecessary services. Physician self-referrals are prohibited by the Stark Law, 42 U.S.C. §§ 1395nn and 1396b(s).

Both kickbacks and self-referrals distort clinical judgment, put patient welfare at risk, and expose providers to significant civil and criminal liability.

You can read more on our Kickbacks page.

Pharmaceutical Fraud

Pharmaceutical companies do some wonderful things, but they sometimes cross lines in pursuit of profit. Pharmaceutical companies pay physicians kickbacks, including lavish meals and compensation for “speaker programs,” to endorse and prescribe their companies’ drugs to patients. Pharmaceutical companies also sometimes advertise and market their drugs for various “off-label” uses, which are not approved by the Food and Drug Administration (FDA).Off-label uses are often experimental, not supported by long-term clinical studies, and pose safety risks for patients. Inducing providers to prescribe drugs for unapproved uses through illegal kickbacks can be the basis for False Claims Act (FCA) liability for Medicare and Medicaid fraud.

Pharma fraud cases under the FCA have resulted in eye-popping recoveries. In 2020, Novartis agreed to pay over $642 million to resolve claims that it violated the Anti-Kickback Statute. Similarly, in 2022, Biogen settled kickback allegations for $900 million to settle allegations of paying kickbacks to influence the prescribing of its drugs.

You can read more on our Pharmaceutical fraud lawyer page.

Telehealth Fraud

CMS greatly expanded access to telehealth services during the pandemic by lifting traditional restrictions and adding new types of telehealth services covered by Medicare and Medicaid. According to one study, the number of telehealth visits for Medicare beneficiaries jumped from 840,000 visits in 2019 to more than 52 million visits in 2020.

With this boom in popularity, telehealth fraud is also more prevalent. Common types of telehealth fraud include billing for telehealth office visits when there was no live interaction between the patient and provider, billing multiple telehealth encounters over consecutive days when they did not occur, and upcoding the level of service provided. Telehealth has also been exploited in DME fraud schemes where remote physicians are paid kickbacks to sign orders for unnecessary equipment or services without ever properly evaluating the patient.

For more details on specific types of Medicare fraud and abuse, visit our Healthcare Fraud page.

8 Steps to Report Medicare Fraud and Abuse- What Do I Need to Know About Being a Medicare Fraud Whistleblower?

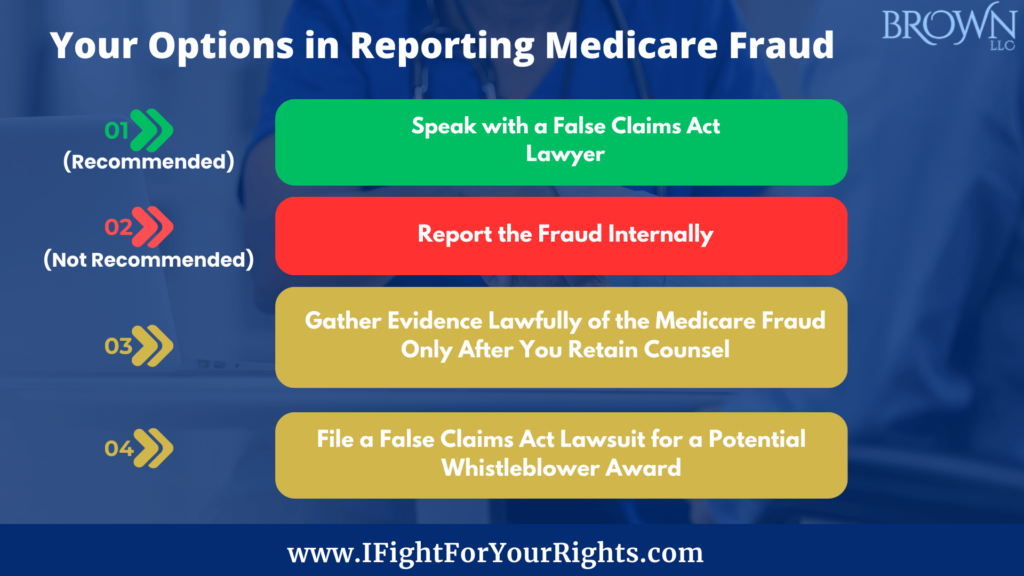

Reporting Medicare fraud and abuse is not only the right thing to do — it is necessary to protect patients, taxpayers, and the integrity of the Medicare program. However, knowing how to report Medicare fraud and abuse can be complex and intimidating, especially for those unfamiliar with the healthcare industry, and the legal system.

This section details the critical steps and considerations for reporting fraud, protecting whistleblower rights, and the potential for receiving a whistleblower award. If you’re interested in becoming a Medicare or Medicaid whistleblower, follow these 8 steps:

1. Understand Fraud and Abuse

Understand what constitutes Medicare and Medicaid fraud and abuse. Examples include billing for services or supplies that were never provided, unnecessary medical services, and altering medical records to support false claims.

2. Gather Evidence

Gathering evidence of Medicare fraud properly is critical to establishing your case, but done the wrong way, it can expose you to potential liability. So, before collecting any documents, it is essential to consult with an experienced whistleblower law firm.

There are legal pathways, including HIPAA exceptions, that allow whistleblowers to gather protected health information (PHI) under specific circumstances. A Medicare and Medicaid fraud law firm will advise you on lawfully and safely building a compelling case. Evidence may include medical records, billing data, emails, contracts, or witness statements. You should not do this on your own, but to protect yourself by doing it under the guidance of an experienced Medicaid fraud whistleblower law firm.

To protect your rights, a law firm experienced in handling Medicare whistleblowers and the Medicaid fraud whistleblower will guide you in assembling a compelling case.

3. Select one of the Best Whistleblower Law Firms

The choice of legal representation can significantly impact the outcome of your case and protect your rights as a whistleblower. Accomplished firms like Brown, LLC, with a proven track record in False Claims Act cases, offer confidential consultations to help you navigate this complex process. If you’re interested in Medicare fraud rewards, we will help you submit a Medicaid or Medicare fraud report the right way through the False Claims Act, which requires using a qui tam attorney.

4. Collaborate with Your Whistleblower Attorney

Once you retain whistleblower counsel, collaborate candidly to maximize your case. Your attorneys will review your evidence, evaluate your case’s strengths and weaknesses, and help determine the best course of action, including, but not limited to, filing under the False Claims Act.

5. File a Whistleblower Complaint Under Seal

If you decide to proceed with a False Claims Act complaint, your attorney will draft and file it on your behalf. This complaint will detail the Medicare fraud and abuse allegations, supported by the evidence gathered. While maintaining confidentiality by initially filing the case secretly under seal, your attorney will ensure the complaint is submitted to the appropriate authorities, such as the Department of Justice or the Office of Inspector General. However, at some point, generally a few years down the road, your identity will become public.

6. Cooperate with the Government Investigators

After filing your complaint, cooperate fully with the investigation by providing any additional evidence or information requested. Your whistleblower law firm will prepare you for government interviews and ensure timely responses to follow-up requests from the authorities. There’s a lot of hurry up when they need something and wait when they don’t, but you need to be patient – it’s all part of the process.

7. Proactively Plan for the Future

A major concern for many Medicare fraud whistleblowers is employer retaliation. The False Claims Act provides measures to combat retaliation, but proactive planning for potential outcomes is crucial. This includes decisions about remaining with or leaving an employer involved in fraudulent activities. Generally, you’ll have a couple of years to plan before your identity is disclosed, so you can work on a safe landing with your parachute during that time period.

8. Receive a Whistleblower Award

Should the government successfully recover funds based on your report, you may receive up to 30% of the amount recovered. Your attorney will assist in negotiating the terms of your award so you are justly compensated for your role in exposing Medicare fraud and abuse.

Reporting Medicare fraud and abuse is critical to protect healthcare integrity and public funds. With legal assistance from a whistleblower law firm with a track record of success like Brown, LLC, Medicare whistleblowers are indispensable in the fight against fraud. When you spot Medicare fraud, don’t hesitate to take action. By acting quickly, whistleblowers not only uphold ethical standards but also stand to gain substantial rewards for their efforts. Delay may result in you not being the first to file which could mean you wind up with nothing for your efforts or worse, the government may view you as a bad actor for failure to report the Medicare fraud in a timely manner. All of these considerations should be discussed with your qui tam law firm.

Whistleblowers who report Medicare and Medicaid fraud the right way can receive monetary awards under the False Claims Act. To learn more about your rights as a potential Medicare fraud whistleblower or Medicaid fraud whistleblower, you should speak with an experienced qui tam Medicare fraud law firm like Brown, LLC. Led by a former FBI Special Agent, Brown, LLC has recovered in excess of a billion dollars, although past results don’t guarantee future success. Learn your rights – call today for a free and confidential whistleblower consultation.

Call now for a free confidential consultation with an experienced Brown, LLC lawyer at (877) 561-0000 or Report Online.

FAQs on Medicare Fraud Whistleblowing

If you’re considering blowing the whistle on Medicare fraud or abuse, you need to understand your rights, protections, and potential rewards. Here are some of the most common questions about reporting Medicare fraud and abuse.

Can whistleblowers remain anonymous?

Initially, yes. Filing a qui tam under the False Claims Act ensures confidentiality during the government’s investigation phase. This helps protect the whistleblower from retaliation. However, at some point, your identity will be disclosed. There are other more elegant strategies to try to stay anonymous from start to finish, but each carries legal risks and trade-offs. You should discuss those options with your whistleblower law firm..

How do you address Medicare fraud?

Remain vigilant in recognizing signs of fraud, such as billing discrepancies, upcoding and kickbacks. Reporting fraud directly to the government may not entitle you to a whistleblower award. The company has access to an attorney, so you should speak with a Medicare fraud whistleblower law firm.

How is Medicare fraud determined?

Government investigations involve thorough data analysis, witness interviews, and sometimes undercover operations, typically led by the Department of Justice (DOJ) and other agencies. The DOJ relies on insiders to provide visibility into illegal practices to trigger the investigation, so the role of the whistleblower is essential in unearthing the fraud.

What are examples of Medicare fraud and abuse?

Common examples of Medicare fraud include billing for services not provided, unnecessary medical services, off-label promotion of pharmaceutical products, self-dealing and kickbacks. Each case often has unique characteristics that require legal analysis to determine its strength.

What whistleblower rewards are available?

In successful cases under the False Claims Act, whistleblowers can receive between 15% and 30% of the government’s total recovery. In addition, a Medicare or Medicaid whistleblower who files a qui tam lawsuit may be eligible for other forms of compensation, including lost wages or damages resulting from retaliation, and in cases involving private insurance fraud in states like California or Illinois, whistleblowers may recover up to 50% of the amount recovered.

What Happens After You Report Medicare Fraud?

Once you file a Medicare fraud whistleblower case under the False Claims Act, your case is placed under seal, meaning it remains confidential while the government investigates. You will have a case pending in court, but the defendant and the public will not know about it.

The Department of Justice (DOJ) and the U.S. Attorney’s Office in the district where you filed will review your complaint and decide whether they want to conduct a relator interview which is a meeting where the government asks questions about the fraud you are reporting. During this process, the whistleblower is referred to as the relator, meaning the individual relating the fraud through their information.

If the government decides to proceed, it will conduct additional witness interviews, analyze billing data, and gather evidence to determine whether to intervene. Intervention means the government formally joins your case, dramatically increasing the chances of success.

If the government intervenes, it often leads to settlement negotiations or, much less frequently, full-scale litigation. If the government declines to intervene, you and your whistleblower counsel can most likely still pursue the case privately on the government’s behalf. Although pursuing a declined case is typically more challenging, it can also entitle you to a higher percentage of any whistleblower reward if successful.

The First-to-File Rule and Why Reporting Medicare Fraud in a Timely Manner Matters

The False Claims Act operates under a strict “first-to-file” rule, sometimes abbreviated as F2F. Under this F2F rule, only the first whistleblower who properly files a qui tam lawsuit about a particular fraud scheme is eligible for a whistleblower reward. If another whistleblower files a similar case afterward, their claim may be barred entirely. Worse yet, because False Claims Act cases are filed under seal, you may not know for years that someone else filed ahead of you.

The first-to-file rule exists to encourage prompt reporting of fraud by rewarding whistleblowers who act quickly. Early reporting helps the government uncover fraud sooner and increases the chances of stopping the misconduct before more taxpayer dollars are lost.

Because of this rule, timing is critical. Even if many people know about the same fraud, only the first to file secures the right to pursue the claim and share in any government recovery. Consulting with an experienced Medicare fraud whistleblower law firm early can make the difference between securing a substantial award or losing your rights altogether.

Retaliation Protections for Medicare Whistleblowers

Whistleblowers are protected by strong anti-retaliation provisions under the False Claims Act, specifically 31 U.S.C. § 3730(h). If you experience retaliation for reporting Medicare or Medicaid fraud, such as termination, demotion, harassment, or discrimination, you may be entitled to significant remedies as the law is structured to deter this type of conduct.

These Medicare whistleblower protections apply whether you report the fraud internally or externally, but it’s best to speak with a whistleblower law firm to understand how to structure your fraud reporting. If retaliation occurs, whistleblowers may recover double back pay, reinstatement to their former position, special damages, and attorneys’ fees and costs. Consulting with an experienced Medicare fraud whistleblower law firm early is critical to help you properly report Medicaid fraud, but also how to proactively protect your rights and plan for your future.

Examples of Major Medicare Fraud Whistleblower Cases

Through the False Claims Act, Medicare fraud whistleblowers have helped the government recover billions of dollars and in turn have received in aggregate hundreds of millions of dollars of Medicare fraud whistleblower rewards for their courage and efforts. Some notable examples include:

- Abbott Laboratories:

Abbott agreed to pay $1.5 billion to resolve allegations of illegally inflating drug prices reported to Medicare and Medicaid, allowing healthcare providers to profit at taxpayer expense. The case exposed widespread average wholesale price (AWP) fraud. - Novartis (2020): Novartis agreed to pay over $642 million to resolve allegations that it paid illegal kickbacks to doctors to induce prescriptions of its products reimbursed by federal healthcare programs.

- Biogen (2022): Biogen settled whistleblower claims for $900 million, accused of paying kickbacks to influence the prescribing behavior of physicians treating multiple sclerosis patients.

- Sutter Health (2021): Sutter Health agreed to pay $90 million to resolve allegations that it inflated Medicare Advantage risk scores to obtain higher government reimbursements.

Brown, LLC has former Department of Justice alumni and has helped recover over $1 billion in settlements and judgments. Our whistleblower team brings insider knowledge of how False Claims Act cases are investigated and prosecuted, positioning our clients for success. If you believe you have witnessed Medicare or Medicaid fraud, contact Brown, LLC today for a free, confidential consultation. Protect your rights and help hold wrongdoers accountable.

*Aggregate recoveries in matter handles as counsel or co-counsel, including taxpayer recoveries