What Is the False Claims Act?

The False Claims Act (FCA) is a federal law that provides penalties, such as triple damages, and other mechanisms to protect the taxpayers from fraudulent claims made by individuals and entities seeking payment from the government. For the last decade, each year, billions of dollars have been recovered through the False Claims Act and hundreds of millions of dollars have been given out as whistleblower awards. The FCA was originally passed in 1863 to combat fraud during the Civil War and was sometimes referred to as the Lincoln Law. It has been revised multiple times and is now in effect in all U.S. jurisdictions.

The FCA also encourages individuals to report fraud against the government by providing financial incentives to whistleblowers that extends up to 30% of what the government recovers. The statute is very labyrinthine and the courts have ruled that an individual cannot proceed with an FCA claim pro se, and must use the services of a whistleblower law firm.

What Is the Main Purpose of the False Claims Act?

The main purpose of the False Claims Act (FCA) is to combat fraud against the federal government. It allows individuals, known as whistleblowers or qui tam relators, to file lawsuits on behalf of the government if they believe someone is submitting false or fraudulent claims for government funds.

Who Is Covered by the False Claims Act?

The False Claims Act applies to any person or entity that submits false or fraudulent claims for payment to the government. This includes any individual, business, or government contractor that makes a false or fraudulent claim for payment from the government. The FCA also applies to any individual or entity that knowingly avoids payment to the government or aids another person or entity in making a false or fraudulent claim.

However, functionally, False Claims Act litigation stems around the systemic defrauding of the government. The government has limited resources to prosecute claims, and smaller claims are often uncollectable, so unless there’s at a minimum several hundred thousand dollars implicated, and that’s on the smaller side, then its unlikely the case will result in the government taking the matter.

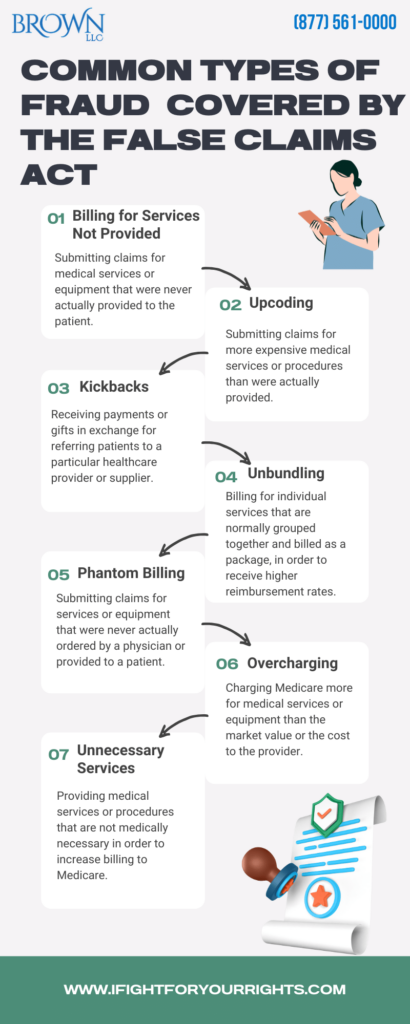

What Types of Fraud Are Covered by the False Claims Act?

The False Claims Act covers a wide range of fraudulent activities, including but not limited to:

Medicare Fraud

- Billing for services not provided: This type of fraud involves submitting claims for medical services or equipment that were never actually provided to the patient.

- Upcoding: This involves submitting claims for more expensive medical services or procedures than were actually provided.

- Unbundling: This involves billing for individual services that are normally grouped together and billed as a package, in order to receive higher reimbursement rates.

- Kickbacks: This involves receiving payments or gifts in exchange for referring patients to a particular healthcare provider or supplier.

- Phantom billing: This involves submitting claims for services or equipment that were never actually ordered by a physician or provided to a patient.

- Phantom patients: This involves submitting claims for patients who do not actually exist. This can be done by creating fake patient records or using the identities of real patients without their knowledge.

- Duplicate billing: This involves submitting multiple claims for the same medical service or equipment, often using different billing codes in order to receive multiple payments.

- Overcharging: This involves charging Medicare more for medical services or equipment than the market value or the cost to the provider.

- Medically unnecessary services: This involves providing medical services or procedures that are not medically necessary in order to increase billing to Medicare.

Medicaid Fraud

Similar to the items listed for Medicare Fraud, but billing into the Medicaid system. Oftentimes, where there’s Medicare Fraud, there will also be Medicaid Fraud. Medicaid Fraud may also include DME fraud for Durable Medical Equipment, which may be gratuitously prescribed or the DME company will solicit Medicare of Medicaid patients for the product and have bogus doctors who don’t even see the patients write prescriptions so they can bill the government program.

PPP Loan Fraud

The act of knowingly providing false or misleading information on an application for a Paycheck Protection Program (PPP) loan in order to obtain funds that an individual or business is not entitled to. The PPP is a government loan program created by the U.S. Small Business Administration (SBA) to help small businesses and other organizations impacted by the COVID-19 pandemic to cover payroll and other essential expenses. PPP Loan Fraud tends to be actionable if the company was ineligible to receive the funds in the first place or if it just absconds with the money or if falsifies its head count or payroll to obtain a larger loan that it was entitled to. If the money flows to the employees then its doubtful it is actionable as that was it’s intended purpose.

Defense Contractor Fraud

Defense Contractor Fraud under the FCA includes submitting invoices for goods or services that were not delivered or were defective, charging inflated prices for goods or services, or failing to comply with contractual obligations or regulatory requirements, such as procuring goods from a prohibited source.

Pharmaceutical Fraud

Some of the largest False Claims Act whistleblower awards and settlements have come from instances of pharmaceutical fraud such as:

- Off-label marketing: marketing or promoting a drug for uses that have not been approved by the U.S. Food and Drug Administration (FDA).

- Kickbacks: offering or receiving financial incentives or other benefits in exchange for the promotion or sale of certain drugs.

- Price manipulation: intentionally setting drug prices higher than allowed by law or submitting false pricing information to government programs.

- Drug safety issues: failing to disclose safety risks or concealing adverse side effects of a drug.

- Overbilling: submitting claims for reimbursement for drugs that were not provided or for services that were not performed.

Kickbacks

Under the False Claims Act (FCA), a kickback is defined as any kind of bribe, rebate, or other financial or non-financial incentive that is given or received in exchange for referrals of goods or services that are paid for by the government. Kickbacks are illegal under the FCA, and anyone who offers or receives a kickback can be subject to civil and criminal penalties. Kickbacks can take many forms, but they are typically intended to influence the decision-making process of an individual or organization with respect to government contracts or programs. In the context of healthcare, for example, kickbacks may be offered to physicians, hospitals, or other healthcare providers in exchange for referrals of patients who are covered by government-funded healthcare programs such as Medicare or Medicaid. Under the FCA, it is illegal to offer, solicit, or receive kickbacks in connection with government contracts or programs

Stark Law Violations (self-dealing)

The Stark Law, also known as the Physician Self-Referral Law, prohibits physicians from making referrals for certain designated health services to entities with which they or their immediate family members have a financial interest. This law is intended to prevent conflicts of interest in healthcare by ensuring that medical decisions are based on the best interests of the patient rather than financial gain. Stark Law violations under the FCA can occur when physicians or healthcare providers submit claims for reimbursement to the government for designated health services that were referred in violation of the Stark Law. This can include situations where a physician refers a patient to a hospital or laboratory in which the physician has a financial interest, and the hospital or laboratory then bills the government for the services provided.

Customs Fraud

The act of submitting false or fraudulent claims for payment to the U.S. government related to the importation of goods. Specifically, customs fraud occurs when individuals or companies knowingly make false statements or misrepresentations to U.S. Customs and Border Protection (CBP) in connection with the importation of goods. Examples of customs fraud under the FCA include:

- Falsely claiming that imported goods are eligible for duty-free treatment under a particular trade agreement or tariff provision.

- Falsifying or undervaluing the quantity or quality of imported goods to evade customs duties or fees.

- Misrepresenting the country of origin of imported goods to avoid anti-dumping duties or other trade restrictions.

- Submitting false documentation or information to CBP in connection with the importation of goods.

- Failing to pay required customs duties or fees.

- Submitting any other types of False Claims for payments

- False Marking: Importers may falsely mark goods to avoid restrictions or tariffs.

- Circumvention: Importers may circumvent trade restrictions by transshipping goods through a third country or mislabeling them.

- False Claims for Drawback: Importers may falsely claim duty drawbacks for goods that were not exported.

- Misclassification: Importers may misclassify goods to pay lower duties or avoid trade restrictions.

- Undervaluation: Importers may undervalue goods to pay lower duties. Undervaluation may be outright depressing the knowing fair market value (“FMV”), or failure to include all streams of value, such as failure to include royalty payments or other payments that must be imputed in the value.

What Role Does the Government Play in False Claims Act Litigation?

The government holds the taxpayers monies and is supposed to protect those funds and hold accountable those that illegally pilfer monies from it. Thus, the government has a great deal of say in the trajectory of a False Claims Act litigation. First, the case is filed confidentially under seal so only the government knows and the court, not the defendant. The case may be under seal for many years as the government investigates the matter. The plaintiff is known as the relator since it is relating the claims of the government through its complaint. The government can decide to intervene in which case it will take the helm and the relator’s whistleblower award is capped at 25%. The government can decide to decline intervention and let the whistleblower proceed with private counsel, in which case the whistleblower reward can be as high as 30% of what the government recovers. At any point the government can tell you that it doesn’t believe it was harmed or that the violation was not material and may ask you to dismiss your case or ask the Court to compel you to dismiss the matter. Further, any settlement needs to be signed off by the government, so the government has a huge role in False Claims Act litigation. The real power of the statute however is the private-public partnership in litigation and the government’s resources are expanded as it can lean on the relator’s counsel to do a great deal of hard work to help facilitate a False Claims Act settlement.

Statute of the False Claims Act

The False Claims Act is codified in 31 U.S.C. § 3729-3733. The Act was originally passed in 1863 but has been amended several times since then. The Fraud Enforcement and Recovery Act of 2009, increased penalties and expanded the scope of the Act to include any false or fraudulent claims made to the government.

Specifically, the Act prohibits any person or company from knowingly submitting false or fraudulent claims to the federal government. This includes false or fraudulent claims for payment, services, or property, as well as any false or fraudulent statements used to get a false or fraudulent claim paid. It also includes any conspiracy to commit fraud.

What Are the Penalties for Violating the False Claims Act?

Violating the False Claims Act can result in severe civil and criminal penalties, including fines and/or imprisonment. Civil penalties for violating the FCA include treble damages, which can triple the amount of money owed to the government. Criminal penalties for violating the FCA include fines and/or imprisonment for up to 10 years.

What Are the Benefits for Whistleblowers Under the False Claims Act?

The False Claims Act provides financial incentives to individuals who report fraud against the government. These financial incentives include a reward of up to 30% of the money.

Frequently Asked Questions

What is a qui tam whistleblower lawsuit?

A qui tam lawsuit is a type of whistleblower lawsuit in which a private citizen with knowledge of fraud against the government files a claim on behalf of the government to recover losses. The individual who brings the claim is known as a “relator” and is rewarded with a portion of the proceeds if the lawsuit is successful.

What types of false claims are prohibited by the False Claims Act?

The False Claims Act prohibits any individual or organization from knowingly submitting, or causing the submission of, false claims or records for payment or approval by the government. Examples of false claims can include submitting false information on a claim for payment, making false statements in order to obtain a contract, or billing for services or products that were not provided.

What is the first-to-file bar in False Claims Act qui tam cases?

The first-to-file bar is a rule in False Claims Act qui tam cases that prohibits a later-filed suit from being successful. This means that if two people become aware of the same fraudulent activity, the first one to file a qui tam lawsuit will be the only one to be able to receive a reward or proceeds from the suit, which is why it’s critical to report any suspected systemic fraud as early as possible and to consult with a whistleblower law firm.

What is the requirement to file a False Claims Act qui tam action under seal?

False Claims Act qui tam actions must be filed “under seal” in order for the government to have time to investigate the case before it is made public. The seal is typically in place for at least 60 days, and the government can request that it be extended. The seal keeps the matter confidential, so the Defendant is unaware of the action and often lasts for years.

Are False Claims Act whistleblowers protected against retaliation?

Yes, False Claims Act whistleblowers are protected from any form of discrimination or retaliation they may face as a result of coming forward to report fraud. Employers are prohibited from retaliating against whistleblowers, such as by firing or demoting them, or otherwise punishing them for reporting fraud.

What is a reverse false claim?

A reverse false claim is a type of false claim in which an individual or organization knowingly uses a false record or statement to avoid paying the government money that is due. This type of claim is prohibited under the False Claims Act and can result in severe civil and criminal penalties.

What is the statute of limitations for a False Claims Act qui tam action?

The statute of limitations for a False Claims Act qui tam action is six years, but there may be certain tolling or extensions. You may not rely on this representation to compute the statute of limitations for your potential False Claims Act matter. You must retain counsel to obtain a formal opinion as to any statute of limitations issues that may impact a claim that you wish to file.

What is the public disclosure bar in the False Claims Act?

The public disclosure bar is a provision in the False Claims Act that limits qui tam lawsuits from being successful if the underlying fraud has already been publicly disclosed. This provision is intended to protect the government from litigation that is already publicly available, and to encourage individuals to come forward and disclose fraud that has not yet been made public.

What is the original source exception to the public disclosure bar?

The original source exception is an exception to the public disclosure bar in the False Claims Act that allows a qui tam lawsuit to proceed even if the underlying fraud has already been publicly disclosed. This exception applies if the individual who brings the lawsuit is the original source of the information that led to the disclosure and the source voluntarily came forward

What is materiality under the False Claims Act?

Materiality under the False Claims Act is a legal concept that determines whether a false claim is significant enough to be actionable under the statute. A false claim is considered material if it is likely to influence the government’s decision to pay or approve the claim. The concept of materiality has been overextended by zealous defense firms, but it was meant to cut down on peripheral issues that weren’t a real factor in the government’s payment of a claim.

What is “Scienter” Under the False Claims Act?

Scienter is a legal term that refers to the intent to defraud the government. In False Claims Act cases, the government must prove that the defendant knowingly and deliberately submitted false claims with the intent to defraud the government.

Is a Violation of the Anti-Kickback Law Also a Violation of the False Claims Act?

Yes, a violation of the Anti-Kickback Law is also a violation of the False Claims Act. The Anti-Kickback Law prohibits individuals or organizations from offering or receiving kickbacks or other forms of remuneration in exchange for referrals of government funds or services. If an individual or organization violates this law, they can be held liable under the False Claims Act.

Does the False Claims Act Prohibit Bid-Rigging?

Yes, the False Claims Act prohibits bid-rigging, which is when an individual or organization colludes to manipulate the outcome of a bidding process in order to obtain a contract or payment from the government. Bid-rigging is considered fraud and can be subject to civil and criminal penalties under the False Claims Act.

Does the False Claims Act Prohibit Fraudulent Inducement of a Contract?

Yes, the False Claims Act prohibits fraudulent inducement of a contract, which is when a person or entity knowingly makes false statements or promises to induce the government to enter into a contract.

Can a violation of Good Manufacturing Practices give rise to False Claims Act Liability?

Yes, a violation of Good Manufacturing Practices can give rise to False Claims Act liability if the violation causes the product to be falsely represented as meeting government standards or requirements, and the government pays for the product based on that false representation. This generally would implicate pharmaceutical fraud, but can spill over to any area of manufacturing that the government is paying for.

Is there a heightened pleading requirement for False Claims Act qui tam cases?

Yes, there is a heightened pleading requirement for False Claims Act qui tam cases. Under 9(b) The relator must provide a detailed statement of the alleged fraud, including the who, what, when, where, and how of the fraud, and must provide specific facts to support each element of the claim.

Does the False Claims Act authorize treble damages?

Yes, the False Claims Act authorizes treble damages, which means that the defendant may be required to pay three times the amount of damages that the government sustained as a result of the fraud.

Must a False Claims Act qui tam relator have firsthand knowledge of all aspects of the fraud?

No, a False Claims Act qui tam relator does not have to have firsthand knowledge of all aspects of the fraud. However, the relator must have direct and independent knowledge of the information on which the allegations are based, and must be able to provide specific and detailed information to support the allegations.