Which Programs Generated the Most Whistleblower Rewards?

Table of Contents

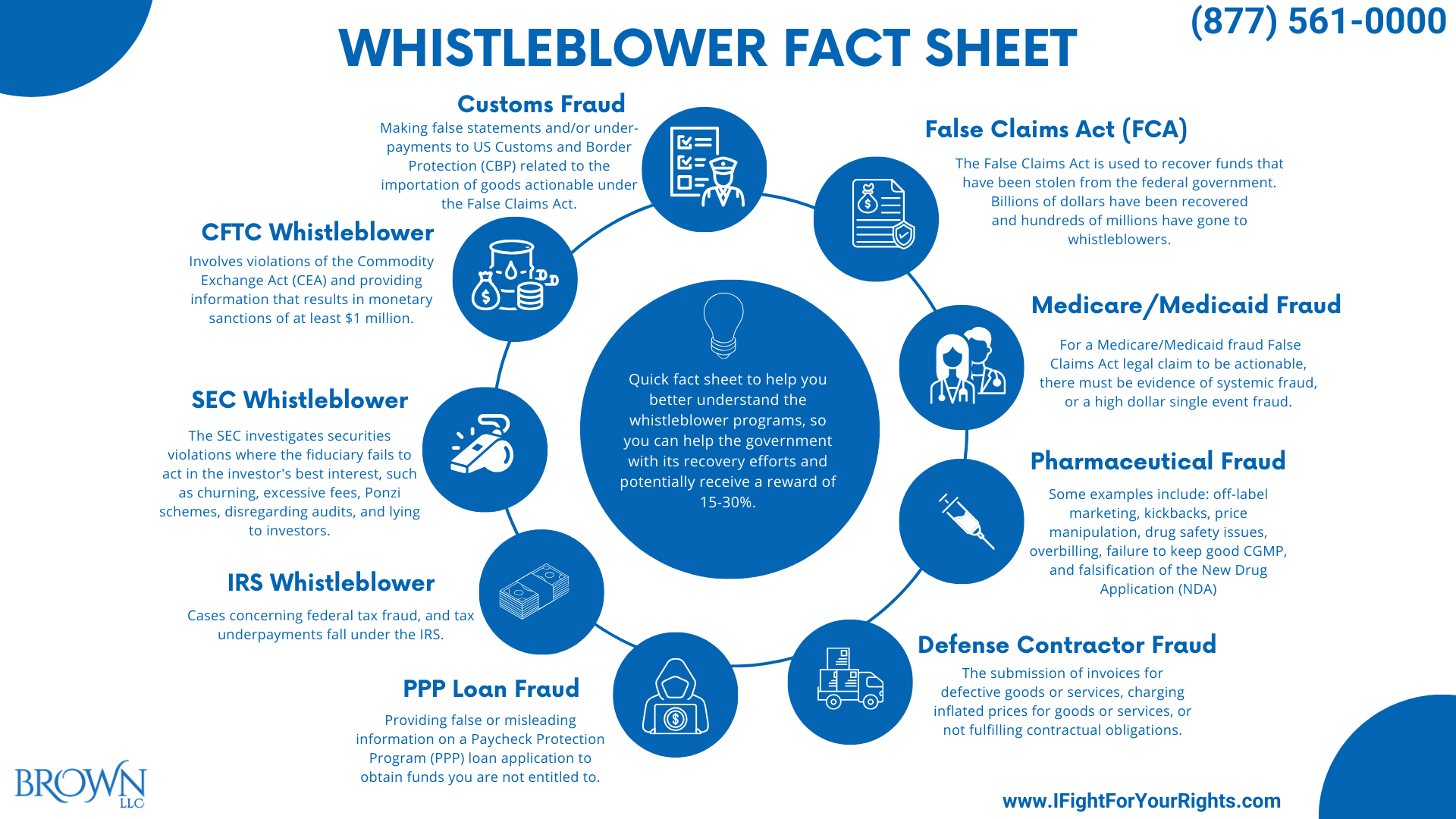

If you’re thinking about blowing the whistle and don’t know where to start, this quick fact sheet gives you an overview about which whistleblower program you may be eligible to participate in, potentially allowing you to share in the government’s recovery. It’s important to note that unless your case falls into an identifiable whistleblower program, you may be without any protection whatsoever.

There are some streams of statutes that solely protect qualified whistleblowers from retaliation, and others that protect, as well as offer, an opportunity to receive a portion of the proceeds, with it being important to know which is which. If your potential legal claim doesn’t fall under an identifiable statute, you may have no protection, so if you’re thinking about blowing the whistle you need to do it the right way. If you’re still weighing whether the risk is worth the reward, this piece on the potential risks and rewards of becoming a whistleblower provides valuable insight into what you may encounter during the process.

The best route is to consult with a pharmaceutical fraud lawyer early in the process to make sure you’re heading in the right direction. This fact sheet is for those who are wondering what agency will be handling the fraud I’m reporting, and what whistleblower rewards am I eligible to receive if I win? Ultimately, both the size and the eligibility for any awards will be contingent on many factors:

- The type of fraud you’re reporting

- The amount of money implicated

- The extent of your cooperation

- The agencies or government entities that have jurisdiction

- Which laws are being violated?

- Did you promptly file and/or are you the first to file the case?

The False Claims Act remedies when an entity defrauds the federal government out of money. In recent years billions of dollars of taxpayer dollars have been recovered through the False Claims Act.

- Whistleblower rewards will generally encompass 15%-30% of the funds recovered with some states like Tennessee and the US Virgin Islands having provisions enabling whistleblowers to gain 33%-50% of the recovered funds.

Medicare Fraud, Medicaid Fraud, Defense Contractor Fraud, PPP Loan Fraud, Customs Fraud, and Pharmaceutical Fraud are common types of fraud cases addressed by the FCA.

Medicare Fraud

- The FCA allows whistleblowers to receive up to 30% of the recovered funds as a False Claims Act reward.

- For a Medicare fraud whistleblower FCA legal claim to be actionable, there must be evidence of systemic fraud, or a high dollar single event fraud.

- If someone is wrongfully the beneficiary of Medicare benefits, it will rarely result in something actionable under the FCA.,

- There are many common forms of fraud that fall under the umbrella of Medicare Fraud

- Upcoding and unbundling

- Billing for services not rendered or not medically necessary

- Incident-to billing fraud

- Kickbacks and Physician self-referrals

- Pharmaceutical fraud

- CGMP violations

- NDA violations

- Off Label Promotion

- Telehealth fraud

Medicaid Fraud

- Medicaid fraud is materially like Medicare fraud but has some important distinctions.

- While Medicare fraud cases are always conducted at the federal level, Medicaid fraud can occur at the state level, the federal level, or both. This can impact the size of rewards, particularly if a state has provisions for whistleblower awards that vary from the federal government.

Defense Contractor Fraud

- Submitting invoices for goods or services not delivered, or that are defective, charging inflated prices for goods or services, failing to comply with contractual obligations or regulatory requirements fall under Defense Contractor Fraud.

PPP Loan Fraud

- Providing false or misleading information on an application for a Paycheck Protection Program (PPP) loan to obtain funds not entitled to constitutes PPP loan fraud.

Some examples of PPP Loan Fraud include:

- Falsely inflating payrolls or head counts to obtain a higher loan

- Deflating head count and/or revenue, and/or concealing interrelated companies to become eligible (may be very viable)

- Falsifying a quarterly income drop to receive a second draw PPP loan

- If the business was rightfully eligible for the loan, and distributed the monies to the employees, but failed to properly segregate the funds and/or appears to have not needed it, the case is generally not viable.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Pharmaceutical Fraud

- Pharmaceutical fraud often constitutes some of the larger FCA whistleblower awards and settlements.

- Notable Examples include:

- Off-label marketing entails promoting a drug for uses not approved by the FDA.

- Kickbacks are offers for financial incentives and/or benefits in exchange for promoting or selling certain drugs.

- Price manipulation simply refers to deliberately positioning drug prices higher than allowed by law or submitting false pricing information to government programs.

- Drug safety issues entail failing to disclose safety risks or concealing adverse side effects of a drug.

- Overbilling is submitting claims for reimbursement of drugs not provided or services not rendered.

- Failure to keep good CGMP (Current Good Manufacturing Processes)

- Falsification of the New Drug Application (NDA)

Customs Fraud

- Customs Fraud entails making false statements or misrepresentations of payment to US Customs and Border Protection (CBP) related to the importation of goods.

- Notable examples include:

- Falsely claiming imports are eligible for duty free status under a specific trade agreement or tariff

- Falsifying or undervaluing quality or quantity of imports to circumvent customs duties or fees

- Misrepresenting the country of origin to avoid anti-dumping duties or trade restrictions

- Submitting any kind of false documentation or information to CBP in relation to the importation of goods

- Failing to pay required customs duties or fees

- Falsely marking goods to avoid tariffs or restrictions

- Circumventing trade restrictions by transshipping goods through third country or mislabeling them

SEC Whistleblower

- The SEC’s Whistleblower Program addresses securities violations in which the fiduciary fails to keep the best interest of its clients at heart, like churning, excessive fees, Ponzi Schemes, failing to maintain audit trails and lying to investors.

- Tips can be submitted anonymously on your own, but it is highly recommended to hire an experienced SEC whistleblower attorney, as filing something incorrectly can lead to your potential case stalling out or worse.

- SEC whistleblower rewards are contingent on the novelty of the information provided, whether it is publicly available, as well as the level of cooperation given by the whistleblower, but can be up to 30% of the recovery and in recent years hundreds of millions of dollars have been given in SEC whistleblower awards.

- Cryptocurrency fraud may be addressed concurrently with the CFTC.

CFTC Whistleblower

- Manipulations of commodities and futures fall under the CFTC’s whistleblower program.

- The qualifications to be a CFTC whistleblower involve reporting violations of the Commodity Exchange Act (CEA) specifically and providing information that results in monetary sanctions of at least $1 million. These are conditions that must be met to be considered for a reward. Hundreds of millions of dollars have gone to CFTC whistleblowers.

- Cryptocurrency fraud may be addressed concurrently with the SEC.

IRS Whistleblower

- Case concerning federal tax fraud, and tax underpayments would fall under the IRS.

- To be eligible for an IRS whistleblower award, you must provide verifiable and discerning information to the IRS that leads to a recovery of a minimum of $2 million in unpaid taxes.

- Tax fraud committed by an individual must have that individual’s yearly income over $200k and the quality of evidence must be good as well.

A potential IRS whistleblower reward would fall between 15% and 30% of the recovered tax payments if one is allocated by the IRS.

As you can see these are just a handful of the varied whistleblower programs that have generated the largest whistleblower awards over the last few decades. If you think you have information that could fall into one of these categories, you should speak with a whistleblower law firm to learn your rights.