IRS Whistleblower Program: Tax Fraud

The Internal Revenue Service (IRS) is responsible for ensuring that taxpayers comply with tax laws and pay their accurate taxes. However, with millions of taxpayers filing returns each year, it is not uncommon for tax fraud and evasion to occur. To help identify and prosecute these cases, the IRS established the Whistleblower Program in 2006, which provides reward for report tax fraud to individuals who provide information leading to the collection of unpaid taxes, penalties, and interest.

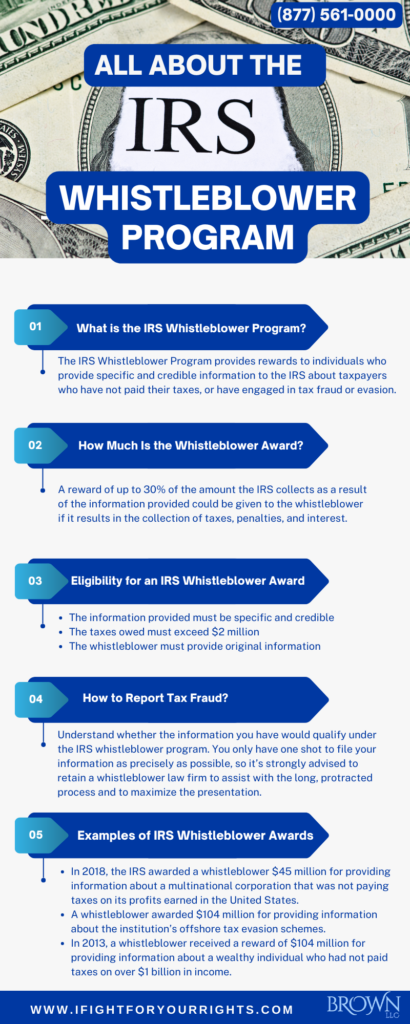

What is the IRS Whistleblower Program?

The IRS Whistleblower Program rewards IRS whistleblowers, who provide the IRS with specific and credible information about potential tax non-compliance, fraud, or evasion. If the information provided leads to the collection of taxes, penalties, and interest, the whistleblower may receive a reward for reporting tax fraud of up to 30% of the amount collected by the IRS. With the use of an IRS whistleblower program there’s a chance for the IRS whistleblower to stay anonymous from start to finish, but one should not always bank on that anonymity.

Criteria for Eligibility for an IRS Whistleblower Reward

- The information provided must be specific and credible. The information provided should include the taxpayer’s name, address, and social security number or taxpayer identification number, as well as details of the fraudulent activity or noncompliance.

- The taxes owed must exceed $2 million. The IRS will only consider information related to cases in which the tax, penalties, and interest owed exceed $2 million for individual taxpayers or $10 million for corporate taxpayers.

- The whistleblower must provide original information. The information provided must not be previously known to the IRS or in the public domain.

- The whistleblower must provide the information voluntarily, that is it can’t be a result of a legal obligation or as part of their job duties.

The information provided must be timely and significant to the IRS’s ability to collect taxes, penalties, and interest. So, just like anything else in the law, the longer you sit with the information the more stale it becomes and the government may either think you unclean hands or helped facilitate the conduct. In either event, you should still go over your options with an IRS whistleblower law firm that offers a free, confidential consultation.

How to Report Tax Fraud

The first thing you should do is understand whether the information you have would qualify under the IRS whistleblower program. You only have one shot to file your information as precisely as possible, so it’s strongly advised to retain a whistleblower law firm to assist with the long, protracted process and to maximize the presentation.

The IRS whistleblower law firm will assist in completing various forms including Form 211, Application for Award for Original Information, to the IRS. The form should include as much detail as possible about the fraudulent activity or noncompliance, including the taxpayer’s name, address, and social security number or taxpayer identification number, as well as details of the fraudulent activity or noncompliance. Through the use of an IRS whistleblower law firm they will shield your identity as the whistleblower. Over 100 million in judgments and settlements trials in state and federal courts.

We fight for maximum damage and results.

Speak with the Lawyers at Brown, LLC Today!

Report Tax Fraud: Reward

After receiving the information, the IRS will review the case and determine whether the information provided is specific, credible, and timely, and whether it meets the criteria for a reward under the Whistleblower Program. If the case is successful and the IRS collects taxes, penalties, and interest as a result of the whistleblower’s information, the IRS whistleblowers may be eligible for a reward of up to 30% of the amount collected. IRS whistleblowers have played a significant role in recouping billions of dollars in lost tax revenue.

Examples of IRS Whistleblower Awards

The IRS Whistleblower Program has been successful in identifying and prosecuting cases of tax fraud and evasion. For example, in 2018, the IRS awarded a whistleblower $45 million for providing information about a multinational corporation that was not paying taxes on its profits earned in the United States. The whistleblower’s information led to the collection of $1.5 billion in taxes, penalties, and interest.

In another case, a former employee of a financial institution received an IRS whistleblower reward of $104 million for providing information about the institution’s offshore tax evasion schemes. The information provided led to the collection of $5 billion in taxes, penalties and interest.

If you have information about tax fraud or evasion, you may be eligible for a reward under the IRS Whistleblower Program. Contact an IRS whistleblower attorney to discuss your options and determine the best course of action.