Understanding Phantom Billing

One of the most common types of health care fraud is known colloquially as “Phantom Billing” and has serious civil and criminal consequences under various state and federal statutes particularly when federal funds are involved like Medicare. Medicare Fraud Phantom billing occurs when healthcare providers submit claims for reimbursement to the government for services or procedures they did not perform or in some cases patients that don’t exist, “Phantom Patients.” In contrast to the fake services that weren’t provided, the compensation to the provider is very real and if certain providers realize they can get away with it and it enhances their profits then they just realize they can write themselves a blank check for whatever they want.

Many people gripe about co-pays, but a co-pay is a cross check against phantom billing as the individual may receive a co-pay bill for a service they never received and then complain to their physician or to a Medicare lawyer. A hallmark of a dirty practice that is phantom billing on an account is multiple occurrences in which an individual receives a co-pay bill for a service that was never performed and when complaining to the practice, they just indicate they will write it up. Or viewing Medicare’s explanation of benefits and seeing that it doesn’t coincide with the services performed.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Examples of Phantom Billing

The frequency of phantom billing in healthcare is alarmingly high, and it takes various forms that are often hard to catch without the assistance of an insider. Instances of this type of Medicare fraud include:

- A healthcare provider who submitted claims for power wheelchairs his patients neither needed nor received.

- A physician who was found to have billed the federal government for hundreds of fillings and root canals, which were outright false because they were allegedly performed on patients who had no teeth to even treat

- A medical equipment company who submitted false claims for equipment like oxygen generators and breathing machines that were materially different from and more expensive than what patients actually received, which at times could be considered upcoding

The Costs of Phantom Billing

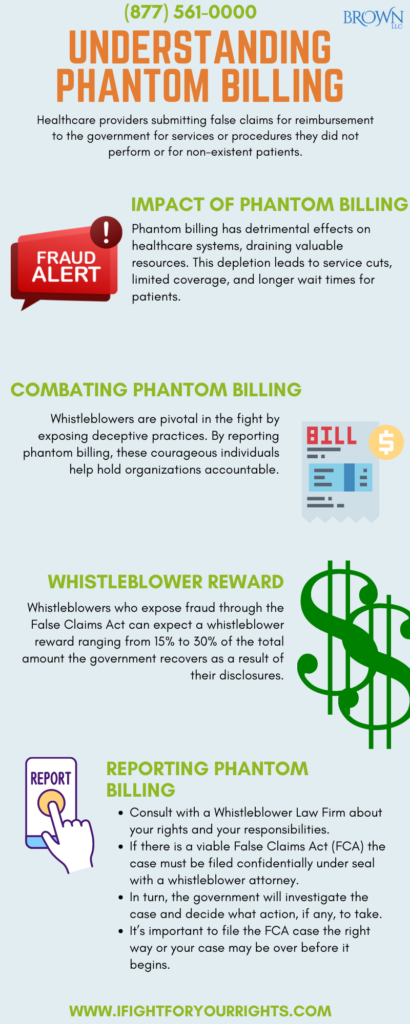

Phantom billing directly impacts programs like Medicare, fraudulently depleting available funds and unnecessarily utilizing resources to process payments for goods or services not rendered.

The costs of phantom billing affect taxpayers who fund these programs, resulting in higher healthcare costs for everyone . Patients who require Medicare services also suffer when resources are drained, leading to service cuts, limited coverage, less access and long wait times to speak with government workers due to limitations on resources.

Reporting Phantom Billing

Under the federal False Claims Act (FCA), the U.S. government investigates healthcare providers who defraud the government. Reporting Medicare fraud, including phantom billing, can be done through various methods, depending on the individual’s relationship to the fraudulent activity, but must be reported through the use of a pharmaceutical fraud lawyer if you wish to seek a whistleblower reward.

Whistleblowers: Individuals with firsthand knowledge of phantom billing fraud can report it with a qui tam law firm. The False Claims Act provides financial incentives, allowing whistleblowers to share in the government’s monetary recovery of up to 30% in whistleblower rewards.

Qui Tam Lawsuits: A qui tam lawsuit is a type of whistleblower lawsuit that is typically filed under the False Claims Act (FCA) on behalf of the government through a private individual.

Phantom Billing Whistleblower Award

The False Claims Act incentivizes whistleblowers to come forward, recognizing the professional and personal risks they frequently take to expose phantom billing or any other type of Medicare fraud and prevent fraud against the government.

If the government intervenes and the case is settled or tried successfully, the whistleblower, or relator, is entitled to 15% to 25% of the government’s total recovery as a whistleblower award. If the whistleblower proceeds and succeeds without the intervention of the government, the whistleblower reward ranges up to 30% of the government’s total recovery. Even if the percentage is higher with non-intervention, cases tend to settle more with government intervention, so a smaller percentage of a larger recovery is often preferable to a larger percentage of a smaller recovery.

Why Should You Contact a Whistleblower Law Firm?

If you are aware of phantom billing, you may be able to file a whistleblower lawsuit and if the case wins you could be compensated for doing good with your knowledge. Whistleblower lawsuits are an effective tool for combating healthcare fraud and abuse. If you are aware of phantom billing, you should speak with a whistleblower law firm about your options. It’s also worth noting that a “relator” (the person who files a qui tam lawsuit) must be represented by a lawyer in order for the case to be filed under the False Claims Act.

By reporting instances of phantom billing and other forms of Medicare fraud, individuals play a crucial role in combating these illegal activities, ensuring proper use of taxpayer funds, and protecting the integrity of healthcare systems.