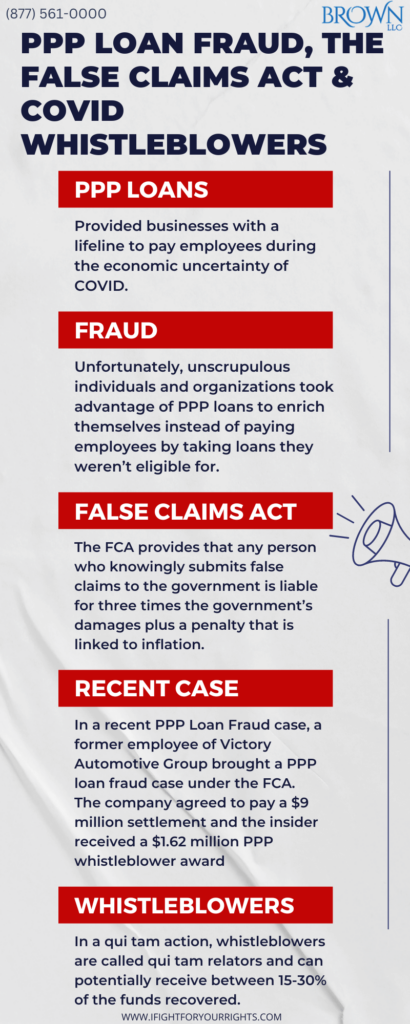

PPP Loan Fraud, The False Claims Act & COVID Whistleblowers

The Paycheck Protection Program (PPP) loans assisted hundreds of thousands of businesses by handing them a much-needed lifeline during the time of economic uncertainty when the government was haphazardly interrupting businesses for indeterminate lengths of time. It helped keep people employed when work was light, and the future was bleak. Unfortunately, the individual benefits of the PPP loans have been counterbalanced by unscrupulous individuals and organizations who exploited the program to enrich themselves through fraud. PPP loan fraud entails companies who would not ordinarily qualify for the loan to often falsify their disclosures to be granted a loan or inflate the amount they were entitled to. False and misleading statements have been made on PPP loan applications relating to company size, the number of employees, payroll, layoffs as well as the hiding of interrelated companies to name some examples. The fraud goes both ways, with inflated payrolls and headcounts to receive additional funds, and to deflated headcounts to circumvent initial eligibility requirements. Therefore, PPP Loan fraud has led to billions of dollars being lost to fraudsters rather than genuine recipients utilizing the funds to keep people on payroll.

PPP False Claims Act Whistleblower Cases

The first PPP False Claims Act whistleblower case in which the US intervened was filed against Pan African Interchange LLC on April 14, 2022, pursuant to the qui tam provisions of the False Claims Act (FCA). The FCA provides that any person who knowingly submits, or causes to submit, false claims to the government is liable for three times the government’s damages plus a penalty that is linked to inflation.[1] More importantly, it also allows for a whistleblower to sue a person or entity that has participated in defrauding the government to recover damages and penalties on behalf of the government. Whistleblowers may also receive a PPP loan fraud whistleblower award up to 30% of the recovery and job protection against retaliation.

In this landmark case, Pan African Interchange LLC applied for two loans and falsely certified that it would not receive more than one loan therefore having violated both the PPP terms and the FCA. Pan African Interchange LLC unlawfully refused to return the second loan. Eventually, the matter was settled through repayment of the second loan with an additional amount also to be paid as a penalty. Subsequently, there have been an increasing number of prosecutions for COVID-19 Relief Fraud schemes. Whistleblowing is one of the most effective methods of fighting PPP Loan fraud as insiders can provide vital evidence to pursue PPP loan fraud through a False Claims Act law firm and in turn the individuals can receive a whistleblower reward from 15-30% of the recovery, if any.

In a recent case, a former employee of Victory Automotive Group, brought a case against the company for PPP loan fraud, acting as a whistleblower under the False Claims Act. The company agreed to pay $9 million in a settlement and the relator himself received $1.62 million PPP loan fraud whistleblower award for exposing his employer. The case not only recovered US taxpayer funds, but also led to a generous reward to the relator for his cooperation with the authorities. VAG’s application for a PPP loan certified it was a small business with fewer than 500 employees. However, VAG shared common operational control with automobile dealerships across the country and its affiliates had more than 3,000 employees in total. For that reason, VAG was not eligible for the $6,282,362 PPP loan it received, which was later forgiven in full.

The act of coming forward as a whistleblower is a legal step known as lodging a Qui Tam action, which is part a Latin phrase meaning “In the name of the King,.[2] Qui Tam refers to the legal process where a whistleblower files suit on behalf of the government, and can share in the recoveries of the litigation if it is successful. Qui tam actions are provided for under the FCA, which combat fraud pertaining to disaster relief, customs, kickbacks as well as upcoding and false billing in healthcare, such as Medicare fraud or Medicaid fraud to name some examples.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Whistleblowing and Qui Tam Actions

In a qui tam action, whistleblowers are called qui tam relators and can receive between 15-30% of the funds recovered. Whistleblower rewards encourage and promote insiders to disclose fraud. Since the 1980s, rewards to whistleblowers have amounted to over $7.3 billion. A qui tam relator should possess strong, preferably insider evidence of fraud to increase their chances of success and pair with one of the best whistleblower law firms who can frame the case in the best possible light. Whistleblowers cases are initially confidentially filed under seal, and the records are not available to the public for varying length of time, based on an array of factors, such as based on the length of time the government needs to investigate and based on the decisions of the judge sitting on the case, who may determine when the seal is lifted. A copy of the case, containing the complaint with all material evidence, must be served to the US Attorney in the district where the complaint is being brought.

Process of Reporting PPP Loan Fraud

Once you have identified a PPP loan fraud you should have a consultation with a qui tam law firm and eventually engage the services of a False Claims Act attorney who will represent you in the legal action. After the case is filed confidentially under seal, the government has the right to intervene if it wants to join the case. In the event the government elects not to proceed, you may be within your right to proceed on the government’s behalf. Understanding that whistleblowing may carry some risks for the whistleblower, the FCA protects whistleblowers by making it illegal to retaliate against them in the workplace when they are acting as a whistleblower and makes employers liable to pay backpay to retaliated employees’ multiple times over, and may even provide for reinstatement in some cases.

Whistleblowers are critical to maintaining the integrity of initiatives like the PPP and recovering taxpayer funds. The government relies on whistleblowers to come forward when fraud has been identified and offers ample protections under the FCA. To ease the burden of whistleblowing, experienced FCA attorneys will always assist and guide you in a qui tam lawsuit. Receiving a monetary reward for facilitating the uncovering of fraud is always great but blowing the whistle amounts to more than monetary rewards, but also restoring integrity.