How the False Claims Act (FCA) and Foreign Corrupt Practices Act (FCPA) May Provide Another Avenue for Whistleblowers

On February 24th, 2022, Russia began a full-scale air, land, and sea invasion of Ukraine. The world’s nations swiftly responded with stiff economic sanctions imposed on Russia, and comprehensive assistance packages were sent to Ukraine. The United States leads all nations—by a wide margin—in terms of aggregate aid sent to Ukraine. Between January 24th, 2022, and October 31st, 2023, the United States committed over $75 billion in aid. Germany, the second largest donor, provided just over $22 billion in that same time frame. While these aid bills passed with bilateral support, there were some who worried that a lack of thorough oversight might enable unchecked fraud and in fact it has been uncovered that there has been a substantial amount of fraud by certain individuals in the Ukraine with United States Taxpayer’s money. Under the False Claims Act individuals with knowledge about fraud with foreign aid may be eligible for whistleblower awards under the False Claims Act and through the mechanisms of the Foreign Corrupt Practices Act.

US Aid to Ukraine: Totals and Breakdown

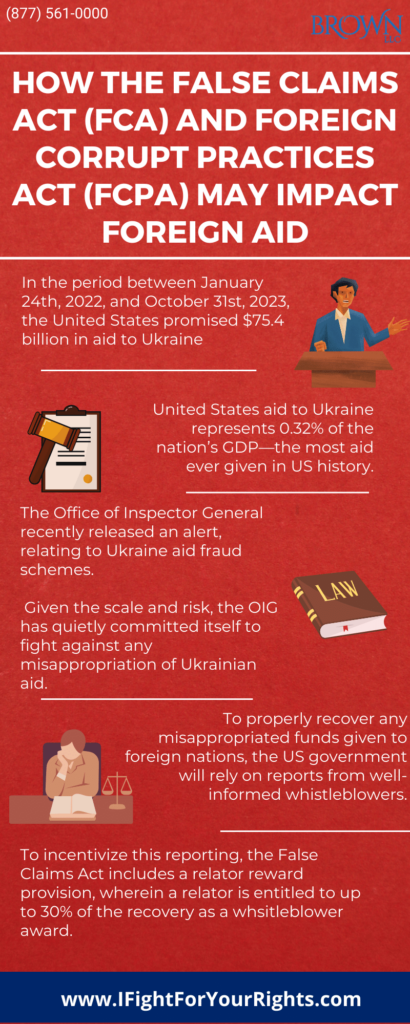

In the period between January 24th, 2022, and October 31st, 2023, the United States promised $75.4 billion in aid. Of that $75.4 billion, $2.7 billion was to be used for emergency food, health care, refugee support, $26.4 billion was to be used for budgetary aid, $18.3 billion was to be used for security assistance, $23.4 billion was to be used for military equipment, and $4.5 billion was to be used for military equipment grants and loans. United States aid to Ukraine represents 0.32% of the nation’s GDP—the most aid ever given in US history.

Defense Contractor Fraud in Ukraine

When Congress was first discussing how to best respond to the Ukrainian request for assistance, Senator Rand Paul offered his reservations regarding unmonitored aid to Ukraine. “A little over a year ago, I proposed an amendment to the massive $40 billion Ukraine spending package that would have entrusted a proven and effective Inspector General to oversee and track how funds are spent in Ukraine. My amendment was rejected, and today, over $113 billion in taxpayer dollars has been sent to Ukraine without proper oversight.”[1]

Senator Paul’s concerns are not unfounded. Ukraine has a history of defense contractor fraud, and given the unprecedented levels of funding, the opportunity for defense contractor fraud is at all-time highs. It is generally intuitive that fraud would occur at higher rates where there is a greater volume of available funding. Given the extreme conditions in Ukraine, the unprecedented influx of foreign aid, and the impaired ability to conduct thorough internal and external audits, this risk of fraud is only compounded.

Moreover, Ukrainian defense contractors have been involved in defense contractor fraud a number of times in recent decades. For example, in December of 2023, Ukraine’s SBU security service and the Defense Ministry reported “a scheme for fraudulent purchase of artillery shells that involved embezzlement of the equivalent of nearly $40 million.”[2] This is just one instance of defense contractor fraud involving Ukrainian contractors. One of the most high-profile cases came in 2019, when the “son of a close business partner of [then] President Petro Poroshenko [was] accused of selling smuggled Russian components to Ukrainian defense factories at wildly inflated prices.”[3]

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Potential Fraud Schemes

The Office of Inspector General recently released an alert, relating to Ukraine aid fraud schemes. Mentioned in the OIG report are unlicensed Money Transfer Agents (MTA), black market exchanges, deals in Rubles, enrollment of ghost beneficiaries, sales of beneficiary cards, USAID-branded commodities exchange in open markets, conflicts of interests between local vendors and project staff, inflated costs above local or fair market rates, duplication of costs for the same service, quid pro quo humanitarian assistance, and email compromise schemes.[4] Given the scale and risk, the OIG has quietly committed itself to fight against any misappropriation of Ukrainian bound aid. On their website, a relatively unassuming page discusses the possibility of fraud: “USAID OIG is committed to ensuring comprehensive, independent oversight of USAID’s support of Ukraine and its people in response to Russia’s invasion. Our oversight work, through Audits and Investigations, will identify key areas where USAID programming is at risk or can be improved while holding those who corrupt or abuse these critical programs accountable.” This accountability process will chiefly rely on two variables: the False Claims Act, and informed whistleblowers.

The Foreign Corrupt Practice Act

The Foreign Corrupt Practices Act, or FCPA, was passed in 1977, and aims at preventing US citizens and entities from engaging in the bribery of foreign officials for the purposes of their business gain. According to the Department of Justice, “Specifically, the anti-bribery provisions of the FCPA prohibit the willful use of the mails or any means of instrumentality of interstate commerce corruptly in furtherance of any offer, payment, promise to pay, or authorization of the payment of money or anything of value to any person, while knowing that all or a portion of such money or thing of value will be offered, given or promised, directly or indirectly, to a foreign official to influence the foreign official in his or her official capacity, induce the foreign official to do or omit to do an act in violation of his or her lawful duty, or to secure any improper advantage in order to assist in obtaining or retaining business for or with, or directing business to, any person.” [5]The FCPA also requires companies with US listed securities to comply with a host of accounting provisions and internal controls. Any gains that come downstream of FCPA violations also double as False Claims Act violations. With such large swaths of aid being directed abroad, the likelihood of those FCPA and thereby FCA violations is at historic highs, as is the opportunity for whistleblowers to collect awards for exposing the misconduct.

The False Claims Act

The False Claims Act (FCA) was introduced during the Civil War and was originally designed to combat defense contractor fraud. While the FCA has been widely expanded since then, it still serves this original purpose. To properly recover any misappropriated funds offered for the purposes of Ukrainian defense and relief, the US government will rely on the voluntary reports from well-informed whistleblowers. To incentivize this reporting, the False Claims Act includes a relator reward provision, wherein a relator is entitled to up to 30% of a recovery if the government doesn’t intervene, and up to 25% if the government does decide to intervene. If a government contractor bribes a foreign official for example, and thereby commits a FCPA violation, a realtor may file a FCA action since any following financial gains from that FCPA violation may now also be considered FCA violations. That also means any downstream FCPA illicit gains may be eligible for recovery, which of course factors into the overall reward sum of the realtor.

In either case, a relator is still eligible for defense contractor or foreign aid whistleblower awards, and has sophisticated legal protections under the False Claims Act and other related whistleblower protections. However, while insider information about fraud and timely reporting generally coincides with a successful False Claims Act action, these reports may find little traction without quality qui tam counsel. It is therefore of the highest importance, if someone has inside information relating to a violation of the FCA, to seek the best whistleblower lawyer from a dedicated whistleblower law firm. Attorneys from these seasoned firms have proven time and time again to be the best lawyers for whistleblowers, since they have the requisite experience and knowledge needed to persuasively present FCA lawsuits and ensure that all steps are taken to maximize the chance of a successful recovery and reward for their clients.

[5] https://www.justice.gov/criminal/criminal-fraud/foreign-corrupt-practices-act