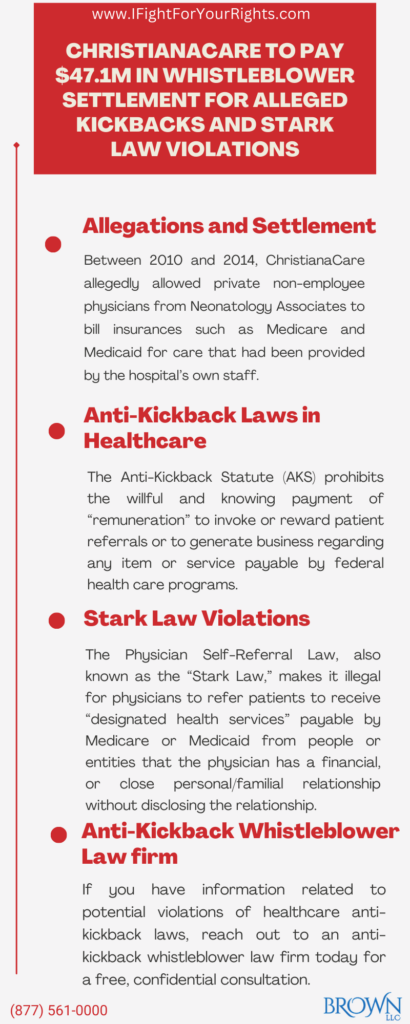

ChristianaCare to Pay $47.1M in Whistleblower Settlement for Alleged Kickbacks and Stark Law Violations

The Whistleblower Allegations and False Claims Act Settlement

On January 4, 2024, U.S. Attorney David C. Weiss reported that ChristianaCare paid $42.5 million to settle healthcare fraud allegations under the False Claims Act and the Delaware False Claims Reporting Act.[1] ChristianaCare is Delaware’s largest healthcare system with three hospitals and many other healthcare facilities in the northern Delaware area. This is the largest False Claims Act settlement in Delaware history.[2]

These allegations against ChristianaCare initially came to light back in 2017, after a whistleblower disclosed the system’s alleged kickback scheme and other violations. The whistleblower was ChristianaCare’s former chief compliance officer who filed fraud claims in a federal False Claims Act civil lawsuit in the U.S. District Court for Delaware three years after being fired by ChristianaCare’s CEO and President. His whistleblower suit alleged that between 2010 and 2014, the hospital allowed private non-employee physicians from Neonatology Associates to bill insurances such as Medicare and Medicaid for care that had been provided by the hospital’s own staff. In return, ChristianaCare would receive patient referrals from these private physicians. The whistleblower lawsuit asserted that ChristianaCare’s claims to government-funded healthcare programs strove to persuade the non-employee neonatologists and surgeons to refer their patients to ChristianaCare in violation of the “Stark Law” (or physician self-referral law) as an unlawful kickback scheme. It is a common scheme where health care entities pay inducements for Medicare patients and under the Anti-Kickback statute the conduct of paying for patients can be viewed both criminally and civilly and can be addressed through the False Claims Act. Similarly, the Stark Law prohibits self-dealing in which an entity refers Medicare or Medicaid patients to other entities it has an economic interest in without fully disclosing the relationship.

The settlement was not an admission of guilt. Rather, it was ChrstianaCare’s way of resolving the kickback charges. ChristianaCare agreed to pay $42.5 million to the United States and Delaware, $4.6 million to the whistleblower’s attorneys, and a share of over $12 million to the whistleblower.[2]

Federal Fraud and Abuse Laws in Healthcare

Among the most important physician Federal fraud and abuse laws that apply to physicians are the False Claims Act (FCA), the Anti-Kickback Statute (AKS), and the Physician Self-Referral Law (Stark Law). An individual may file charges of taxpayer fraud on behalf of the government and then share in any resulting settlement under the False Claims Act, however the individual must use a False Claims Act law firm. The civil FCA’s whistleblower provision allows a private individual to file a lawsuit qui tam on behalf of the United States and entitles that whistleblower to a percentage of any recoveries if the case is resolved or a judgment is obtained based on the whistleblower’s original information filed in a timely and correct fashion. In cases in which the government intervenes, a whistleblower is entitled to up to 25% of the recovery as a whistleblower award. In cases where the government does not intervene, a relator is eligible for up to 30% of the recovery as a whistleblower reward. Some state False Claims Acts, like Illinois and California, allow rewards up to 50% of the recovery. Whistleblowers can be anyone in a position to know the information, including, but not limited to current or ex-business partners, hospital or office staff, patients, or competitors.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Anti-Kickback Laws in Healthcare

The Anti-Kickback Law (AKS) prohibits the willful and knowing payment of “remuneration” to invoke or reward patient referrals or to generate business regarding any item or service payable by Federal health care programs (for example, medical supplies or Medicare patients). Remuneration is broadly construed and can include anything of value such as meals, free rent, or excessive compensation for medical consultancies. In other words, paying for referrals is illegal, especially when taxpayer funds and patient interests are at stake.

Physicians can often become targets of kickback schemes because they are usually responsible for deciding which drugs or supplies a patient uses, which specialist a patient sees, and what healthcare services patients receive. Thus, pharmaceutical companies, fellow physicians and healthcare providers may court physicians with the aim of establishing them as a lucrative referral source–despite the explicit illegality of such a quid pro quo relationship.

Stark Law Violations

The Physician Self-Referral Law, also known as the “Stark law,” makes it illegal for physicians to refer patients to receive “designated health services” payable by Medicare or Medicaid from people or entities that the physician has a financial, or close personal/familial relationship with (unless an exception applies).[3] Ownership and investment interests as well as compensation arrangements are considered financial relationships. The Stark Law is a “strict liability” violation, meaning even in the absence of intent, a person can still violate Stark Law simply by having an improper financial relationships.

Anti-Kickback Whistleblower Law firm

ChristianaCare’s False Claims Act settlement is another example of the strident enforcement against kickbacks as applied through the False Claims Act. Other hospitals that use a model providing private physicians with free services in the form of hospital-employed nurse practitioners and physician assistants are at risk of a whistleblower lawsuit. If you have information related to potential violations of healthcare anti-kickback laws, reach out to an anti-kickback whistleblower law firm today to understand your rights. Lawsuits involving the AKS, FCA, or Stark Law require highly experienced attorneys and highly capable firms who have a track record of litigation in this area. For a whistleblower to properly maximize their chance of a reward, and to ensure they are as protected as they can be under the law, it is of crucial importance to retain the best whistleblower attorney for your case, so check their history of success, whether the whistleblower law firm has handled similar cases in the past and whether the firm has any former Department of Justice and/or Federal Bureau of Investigation attorneys or agents as those are the entities that you would be interfacing with for your case.

[1] https://www.justice.gov/usao-de/pr/christianacare-pays-425-million-resolve-health-care-fraud-allegations-0#:~:text=As%20a%20result%2C%20the%20complaint,also%20known%20as%20the%20Stark

[2] https://www.delawareonline.com/story/news/2023/12/21/christianacare-settles-whistleblower-lawsuit-with-47-1-m-payment/71142398007/

[3] https://oig.hhs.gov/compliance/physician-education/fraud-abuse-laws/#:~:text=The%20Physician%20Self%2DReferral%20Law%2C%20commonly%20referred%20to%20as%20the,relationship%2C%20unless%20an%20exception%20applies.