Medicare & Medicaid Fraud

The False Claims Act allows whistleblowers who blow the whistle properly to claim up to 30% of what the government recovers as a Medicare Whistleblower Award. Medicare Whistleblower Award. It is estimated that there are hundreds of billions of dollars a year lost due to fraud, which means whistleblowers could stand to receive aggregate awards in the billions if they file a qui tam lawsuit with the right whistleblower law firm.

Call(877) 561-0000 now for a free confidential consultation with an experienced Medicare fraud law firm that has helped recover hundreds of millions of dollars or Report Online

What Happens When You Report Medicare Fraud Online?

Types of Medicare Fraud

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts.

We fight for maximum damage and results.

Upcoding & Unbundling

“Upcoding” refers to the submission of false or improper billing codes to obtain higher reimbursement from Medicare & Medicaid. Healthcare providers can upcode by making a false diagnosis for a more serious condition, exaggerating the amount of time they spent with patients, or billing for more expensive procedures than they provided.

A violation similar to upcoding is called “unbundling.” Many medical services are supposed to be “bundled” together so that the healthcare provider receives only one lump sum payment for related procedures under one billing code. By splitting up these services into different codes, healthcare providers can illegally obtain duplicative payments from the government, that should have been paid in one bundle.

Billing for Services Not Rendered or Not Medically Necessary

To be covered by Medicare & Medicaid, medical services and procedures require a doctor’s order attesting to the medical necessity of such services, and a significant amount of Medicare/Medicaid fraud involves the billing of medically unnecessary services, such as pointless diagnostic tests like ultrasounds or x-rays, or unneeded durable medical equipment (DME) like back and knee braces.

Incident-to Billing Fraud

Generally, Medicare pays non-physician providers (NPPs), such as nurse practitioners and physician assistants, at a rate lower than what a physician would receive for the same type of care. But if the NPP’s care is “incident to” the care provided by a physician, the NPP can bill their services as though performed by the physician, to obtain the higher reimbursement rate. When they bill as if the physician was there when in fact the doctor wasn’t it is known as “incident-to billing” fraud.

Kickbacks & Physician Self-Referrals

Kickbacks are bribes paid in exchange for patient referrals to specific providers or facilities, or even a specific manufacturer of a drug or durable medical equipment. The offering, making, and receiving of any such kickbacks are prohibited by the Anti-Kickback Statute, 42 U.S.C. § 1320a-7b, and submitting any claims for services tainted by a kickback constitutes Medicare and Medicaid fraud.

Similar to a kickback, a self-referral occurs when a physician refers a patient to a provider or entity that the physician has a financial relationship with. In such circumstances, the physician may have a financial incentive to refer patients to that entity or other provider. Physician self-referrals are proscribed by the Stark Law, 42 U.S.C. §§ 1395nn and 1396b(s).

You can read more on our Kickbacks page.

Pharmaceutical Fraud

Pharmaceutical companies do some wonderful things, but they sometimes cross lines in pursuit of profit. Pharmaceutical companies pay physicians kickbacks, including lavish meals and compensation for “speaker programs,” to endorse and prescribe their companies’ drugs to patients. Pharmaceutical companies also sometimes advertise and market their drugs for various “off-label” uses, which are not approved by the Food and Drug Administration (FDA).

In 2020, Novartis agreed to pay over $642 million to resolve claims that it violated the Anti-Kickback Statute. Similarly, in 2022, Biogen settled kickback allegations for $900 million.

You can read more on our Pharmaceutical fraud lawyer page.

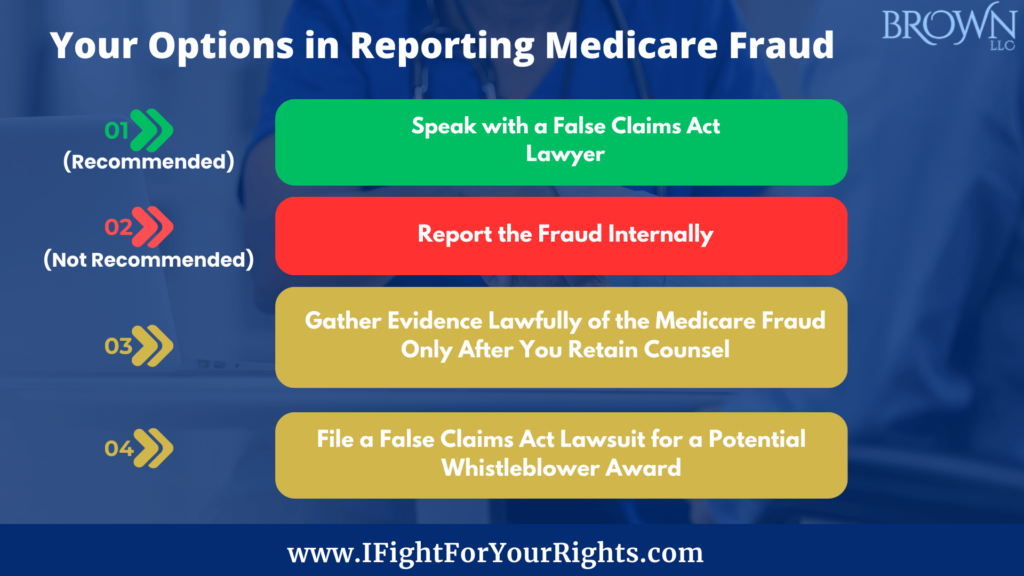

8 Steps to Report Medicare Fraud and Abuse

As a Medicare fraud whistleblower,reporting Medicare fraud and abuse is not only the right thing to do but also necessary to protect patients and the integrity of the Medicare program.

1. Understand Fraud and Abuse

Get to know the full scope of what constitutes Medicare and Medicaid fraud and abuse. Examples include billing for services or supplies that were never provided, unnecessary medical services, and altering medical records to support false claims.

2. Gather Evidence

Gathering evidence of Medicare fraud the right way may be essential in establishing your case. However, before collecting any evidence, it’s imperative to consult with a specialized whistleblower law firm. This step ensures you gather evidence legally and ethically.

As a whistleblower, law firm like Brown, LLC can provide guidance on gathering evidence that complies with the law and protects your rights as a whistleblower. To protect your rights, a law firm experienced in handling Medicare whistleblowers and Medicaid whistleblowers will guide you in assembling a compelling case.

3. Select a Whistleblower Law Firm

The choice of legal representation can significantly impact the outcome of your case. Early legal counsel is crucial for protecting your rights as a whistleblower and ensuring you’re recognized as the original source of the information. Accomplished firms like Brown, LLC, with a proven track record in False Claims Act cases, offer confidential consultations to help you navigate this complex process

4. Collaborate with Your Attorney

Discuss your allegations and evidence with your chosen firm in this critical phase. Your attorney will thoroughly review your evidence, helping you understand the strengths and weaknesses of your case. They will also advise you on the best course of action.

5. File a Whistleblower Complaint

If you decide to proceed with a False Claims Act complaint, your attorney will draft and file it on your behalf. While maintaining confidentiality by initially filing the case secretly under seal, your attorney will ensure the complaint is submitted to the appropriate authorities, such as the Department of Justice or the Office of Inspector General. However, at some point, generally a few years down the road, your identity will in all likelihood be disclosed.

6. Cooperate in Investigations

After filing your complaint, cooperate fully with the investigation by providing any additional evidence or information requested. Your whistleblower law firm will prepare you for government interviews and ensure timely responses to follow-up requests from the authorities.

7. Be Proactive in Planning

A major concern for many Medicare fraud whistleblowers is employer retaliation. The False Claims Act provides measures to combat retaliation, but being proactive in planning for potential outcomes when the lawsuit becomes public is crucial. Generally, you’ll have a couple of years to plan before your identity is disclosed so you can work on having a comfortable parachute if you’re looking to leave.

8. Receive a Whistleblower Award

Should the government successfully recover funds based on your report, you may receive up to 30% of the amount recovered. Your attorney will assist in negotiating the terms of your award so you are justly compensated for your role in exposing Medicare fraud and abuse.

Reporting Medicare fraud and abuse is critical to protect healthcare integrity and public funds. With legal assistance from a whistleblower law firm with a track record of success like Brown, LLC, Medicare whistleblowers are indispensable in the fight against fraud. When you spot Medicare fraud, don’t hesitate to take action.

To learn more about your rights as a potential Medicare fraud whistleblower or Medicaid fraud whistleblower, you should speak with an experienced qui tam Medicare fraud law firm like Brown, LLC. Led by a former FBI Special Agent, Brown, LLC has recovered hundreds of millions of dollars, although past results don’t guarantee future success. Learn your rights – call today for a free and confidential whistleblower consultation.

Call now for a free confidential consultation with an experienced Brown, LLC lawyer at (877) 561-0000 or Report Online.

FAQs on Medicare Fraud Whistleblowing

Can whistleblowers remain anonymous?

Initially, yes. Filing under the False Claims Act ensures confidentiality during the investigation phase. This helps protect the whistleblower from retaliation or other negative consequences. However, at some point, your identity will be disclosed. There are other more elegant options to try to stay anonymous from start to finish like using a dummy corporation or a straw realtor, but for each option, there’s a risk.

How do you address Medicare fraud?

Be vigilant in recognizing signs of fraud, such as billing discrepancies and kickbacks. Reporting directly to the government may not entitle you to a reward; a legal consultation is strongly advised.

How is Medicare fraud determined?

The DOJ relies on insiders to provide visibility into the illegal practices to trigger the investigation, so the role of the whistleblower is essential in unearthing the fraud.

What are examples of Medicare fraud and abuse?

Common examples include billing for services not provided, unnecessary medical services, off-label promotion of pharmaceutical products, self-dealing and kickbacks.

What whistleblower rewards are available?

In successful cases, whistleblowers can receive up to30% of the total recovery. It’s also worth noting that a Medicare or Medicaid whistleblower who files qui tam lawsuits may be eligible for other types of compensation, including lost wages or damages resulting from any retaliation.