The SEC Whistleblower Program

The SEC Whistleblower Program was established to encourage insiders and other individuals to report securities violations to the SEC.

Whistleblowers can receive up to 30% of the monetary sanctions collected in a successful SEC whistleblower enforcement action, which can result

in a whistleblower award in the millions, if not tens of millions of dollars for doing the right thing, the right way. Additionally, the statute is

robustly committed to protecting whistleblowers’ confidentiality and prohibiting retaliation against them. In fact, with an SEC whistleblower

attorney, an insider who properly blows the whistle can in all likelihood remain anonymous from start to finish.

The program was established under the Dodd-Frank Wall Street Reform and Consumer Protection Act and bolstered by the Sarbanes-Oxley Act to

encourage whistleblowers to come forward with information about violations of securities laws. Searching for the best SEC whistleblower lawyers to represent you? Brown, LLC is here to help!

What Legal Support Is Available for Whistleblowers in Securities Fraud Cases?

Our SEC whistleblower law firm can walk you through the whistleblower process, help you weigh the pros and cons of blowing the whistle, and file the matter anonymously. The SEC whistleblower team consists of several Department of Justice alumni with over a billion dollars recovered* and they can:

- Advise you from start to finish on the SEC whistleblower process

- Evaluate whether the issue may constitute an actionable SEC violation

- Help negotiate an SEC whistleblower award for our clients

- Take steps to shield your identity

- Invoke the correct statutes and processes to help protect you from

retaliation - Provide ongoing legal support and counsel throughout the whistleblower

process

Speak with the Lawyers at Brown, LLC Today!

Over a billion in judgments and settlements and trials in state and federal courts. Our

lawyers fight for maximum damage and results. Contact our legal team

now to protect your rights and get the justice you deserve

If you believe you have information about a securities law violation, you can reach out to our experienced SEC whistleblower lawyers to properly file a confidential report (TCR) through the SEC Whistleblower Program. Our firm has a proven track record of success in representing whistleblowers, ensuring that their claims are pursued effectively, and marshaling settlements and judgments in over a billion dollars. After filing the TCR, the SEC will evaluate the information and triage it to determine the best course of action and, if appropriate, take enforcement action and, if so, possibly provide a monetary award to the whistleblower. However, the SEC may issue the award without even telling you! So, it’s important to work with one of the top SEC whistleblower law firms that know the process.

Note: It’s important to consult with an SEC whistleblower attorney familiar with SEC whistleblower laws and regulations and the SEC Whistleblower Program to make sure your complaint is filed anonymously and to work to enhance your chance of obtaining an SEC whistleblower award. The best SEC whistleblower attorneys will offer comprehensive guidance and advocacy throughout the process, maximizing your potential for success.

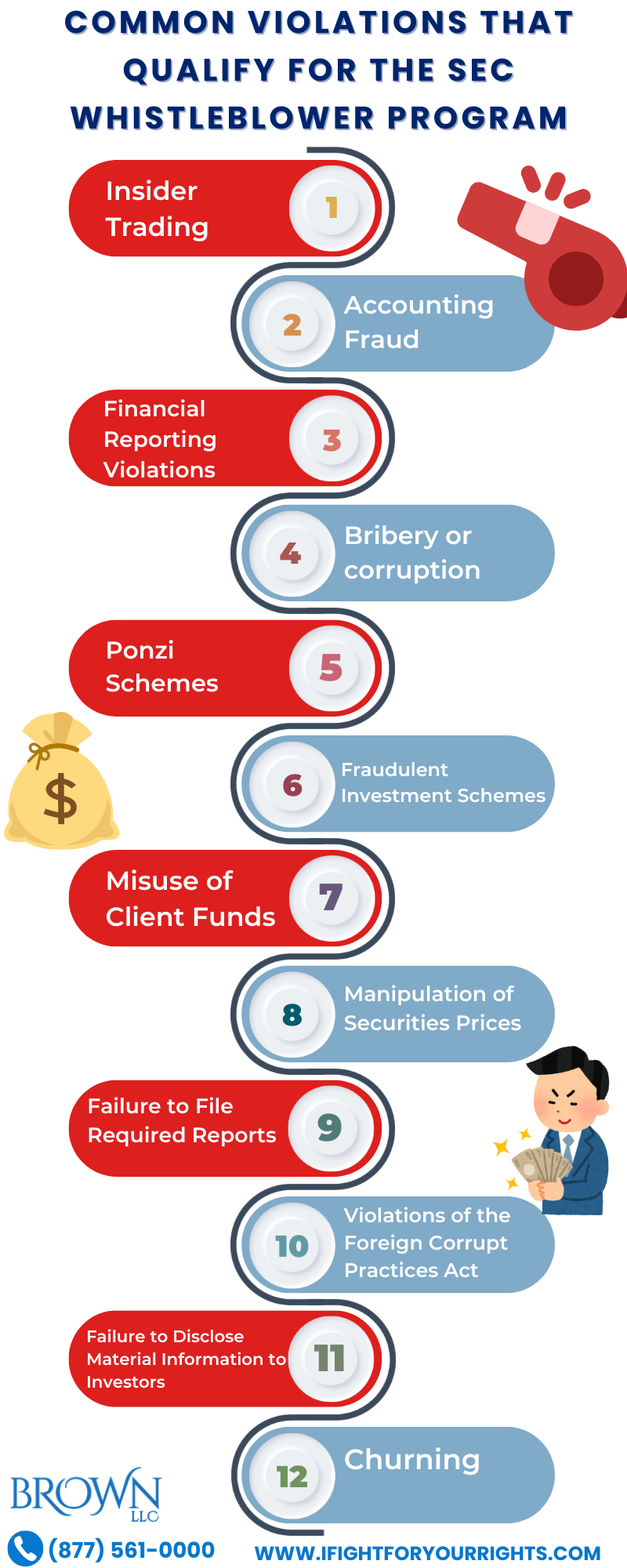

What regulatory violations qualify for the SEC whistleblower program?

What factors does the SEC consider in determining the amount of the award?

Can you submit your tip anonymously?

What employment protections against retaliation are available for SEC whistleblowers?

What are the some of the largest SEC whistleblower awards?

What is considered “original information” to qualify for an award?

How long does it take to receive the SEC whistleblower award?

Can I submit a tip to the SEC if I was involved in the fraud or misconduct?

What regulatory violations qualify for the SEC whistleblower program?

The SEC accepts a wide range of information that could be considered a violation of federal securities laws. It’s important to file an SEC complaint through a law firm to make sure the information is submitted properly, concisely, and invokes the correct regulations and laws. An SEC whistleblower submission could include information about:

- Insider trading

- Accounting fraud

- Financial reporting violations

- Bribery or corruption

- Ponzi schemes

- Pump & Dumps

- Market Manipulation

- Fraudulent investment schemes

- Misuse of client funds

- Manipulation of securities prices

- Failure to file required reports with the SEC

- Violations of the Foreign Corrupt Practices Act

- Failure to disclose material information to investors

- Churning

- Destruction of Audit Trails

- Failure to keep proper documentation

- Release agreements that interfere with the ability of the SEC to investigate

- Any systemic act that puts the interest of the fiduciary ahead of the interest of the client

What factors does the SEC consider in determining the amount of the award?

When considering the amount of an award, the SEC considers several factors, including:

- Importance of the Information: The SEC considers the importance of the information provided by the whistleblower. The information must be fresh, credible, and capable of leading to successful enforcement action.

- Level of Assistance Provided: The SEC also considers the whistleblower’s level of assistance, such as whether the whistleblower provided ongoing assistance throughout the investigation and enforcement action.

- Extent to Which the Information Led to a Successful Enforcement Action: The SEC considers the extent to which the whistleblower’s information led to a successful enforcement action, such as the size of the penalties and the number of individuals charged.

Can you submit your tip anonymously?

Yes, you can submit your whistleblower tip to the SEC anonymously. However, you must have a representative, such as an SEC whistleblower attorney, file the tip on your behalf. Whistleblowers can submit information anonymously to the SEC through an attorney or other legal representative who acts as a liaison between the SEC and the whistleblower. This procedure protects the whistleblower’s identity while still allowing the SEC to obtain the information needed to pursue an enforcement action. However, there is no guarantee that you will remain anonymous from start to finish, so it’s critical that you review this option with your SEC attorney. Even though the Securities and Exchange Commission offers a range of protections as part of the SEC’s whistleblower program, you should still consult with a whistleblower law firm to ensure you are protected and to evaluate the best path for proceeding with your whistleblower claims.

What employment protections against retaliation are available for SEC whistleblowers?

The first wave of protections from retaliation are the fact that the insider can report the matter anonymously, thus minimizing the risk of direct retaliation. SEC whistleblowers are also protected from retaliation by their employer for reporting potential securities law violations to the SEC. The Dodd-Frank Wall Street Reform and Consumer Protection Act and the Sarbanes Oxley Act provide employment protections for SEC whistleblowers provided they blow the whistle the right way, including:

- Prohibiting retaliation: Employers cannot fire, demote, harass, or otherwise discriminate against an employee in the terms and conditions of employment for reporting potential securities law violations to the SEC.

- Right to file a complaint: If an employee believes that they have been retaliated against, they have the right to file a complaint with the Department of Labor within 180 days of the retaliatory act.

- Right to a court action: If the Department of Labor does not issue a decision within 180 days or issues a decision unfavorable to the employee, the employee has the right to file a court action.

- Reinstatement and double back pay: If a court finds that retaliation has occurred, the employee may be entitled to reinstatement and double back pay.

What are the some of the largest SEC whistleblower awards?

- $114 million SEC Whistleblower Award in 2020

- $110 million SEC Whistleblower Award in 2021

- $50 million SEC Whistleblower Award in 2021

- $50 million SEC Whistleblower Award in 2020

- $39 million SEC Whistleblower Award in 2018

The exact amounts of SEC Whistleblower Awards are determined based on a number of factors, including the significance of the information provided, the extent to which the information led to the successful enforcement of a securities law violation, and the amount of monetary sanctions collected in the enforcement action.

What is considered “original information” to qualify for an award?

For the purposes of an SEC Whistleblower Award, “original information” is information derived from the whistleblower’s independent knowledge or analysis that is not already known to the SEC from any other source. The data must also be submitted to the SEC for the first time and pertain to a potential violation of federal securities laws. For the information to be considered “original information,” the following criteria must be met:- Not obtained from public sources: The SEC must not have obtained the information from public sources such as the media, government reports, or court records.

- The information must not be derived entirely from an independent source, such as an investigation conducted by a government agency, a self-regulatory organization, or a foreign authority.

- The information must be submitted to the SEC for the first time and must not have been previously provided to the SEC or any other federal, state, or law enforcement authority.

- Significantly assists the SEC: The information must significantly assist the SEC in its enforcement actions and not simply duplicate information that the SEC already has.

How long does it take to receive the SEC whistleblower award?

The time it takes to receive an SEC Whistleblower Award varies greatly and is determined by a number of factors, including the complexity of the case, the number of individuals involved, and the time required for the SEC to conduct its investigation and take enforcement action.

It can take several years on average from the time information is submitted to the SEC until the SEC takes enforcement action and the whistleblower is eligible for an award. The vast majority of tips do not result in an award, and the office is overwhelmed with information so it’s critical to tee up the information in the best possible light the first time you present it to the SEC investigators. The SEC Whistleblower Office will make a determination on the award and may or may not notify the whistleblower once the enforcement action is resolved, if the case is successful. With an experienced SEC whistleblower advocate on your side, the presentation of the case is strengthened, enhancing the likelihood of a successful outcome for your SEC whistleblower claim.

Can I submit a tip to the SEC if I was involved in the fraud or misconduct?

Individuals who have violated securities laws may still submit information to the SEC as whistleblowers and be eligible for an award through the SEC

Whistleblower Program. However, you should review your potential culpability and have your law firm evaluate the pros and cons of filing the TCR

with the SEC. Functionally, if you report the misconduct you are in a superior position than if someone else did, but if you benefited significantly from

the scheme, you will need to do a cost-benefit evaluation of whether it’s better to come clean or just hope the SEC doesn’t find out and thus, always

having to look in your rear view mirror.

Once you submit the information to the SEC, the SEC can share it with other agencies, such as the Department of Justice, so it is critical to consult an

experienced attorney before evaluating your exposure. The SEC lawyers can guide you through the complexities of the legal framework, provide

insights into securities fraud or investment fraud cases, and advise on typical proceedings in federal court if the case goes in that direction or the

administrative and regulatory process trajectory most SEC cases follow.

Our whistleblower attorneys have extensive experience with the Securities and Exchange Commission’s whistleblower program and can provide a

free, confidential consultation. They are only paid if they win your case and can speak with you after hours or on weekends when it’s most

convenient for you.

*Aggregate recoveries in matter handles as counsel or co-counsel, including taxpayer recoveries