Important Case Acceptance Criteria Regarding PPP Loan Fraud

Due to a high volume of inquiries, please note that Brown, LLC will only handle PPP loan fraud cases that meet the following criteria:

- The alleged fraud exceeds $2 million

- The company had its PPP loan forgiven

- The company has the financial capacity to pay back at least double the loan amount, and you can provide detailed information supporting this capacity

- You are an insider with specific, detailed information about the alleged fraud

- We do not accept cases based solely on a belief that the company did not need the funds

If you have information that meets these criteria, our experienced whistleblower attorneys can assist you in reporting PPP loan fraud under the False Claims Act. Properly filing a claim may make you eligible for a substantial whistleblower award. If not, we can not assist, please call other whistleblower law firms or report the matter to the Department of Justice.

Report PPP Loan Fraud Under the False Claims Act for a Potential Whistleblower Award

If you suspect an employer or financial institution has abused the Paycheck Protection Program (PPP), you should speak with a PPP loan fraud lawyer at a whistleblower law firm, Brown, LLC. We can help you understand how to report PPP fraud and properly file a claim under the False Claims Act. By filing a False Claims Act lawsuit correctly through experienced whistleblower attorneys, you may potentially receive a significant PPP whistleblower award for reporting PPP loan fraud.

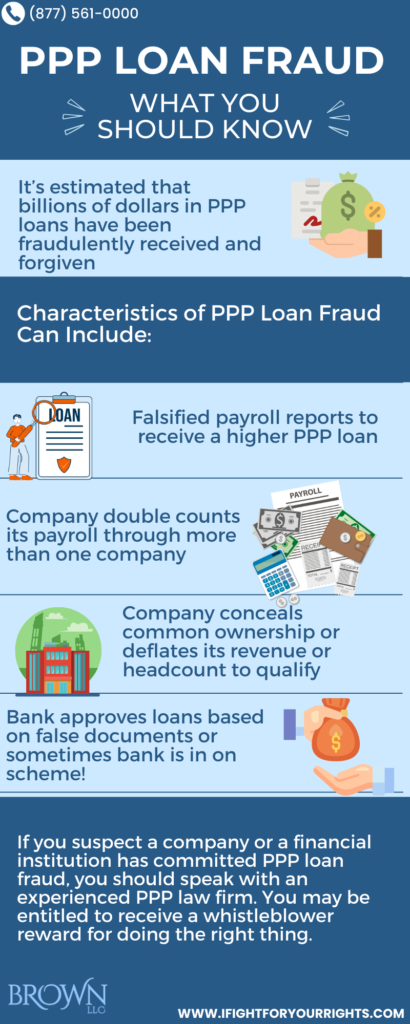

Types of PPP Loan Fraud

An employer could engage in PPP loan fraud by falsifying its payroll to obtain extra funds it’s not entitled to, using those funds for personal benefit instead of keeping employees on payroll, and seeking forgiveness of the loan while falsely claiming it kept laid-off employees. Financial institutions may also engage in bank fraud by approving PPP loans they knew or should have known were fraudulent.

The False Claims Act and Whistleblower Rewards

The False Claims Act incentivizes private individuals to report fraud against the government. Under the Act, a successful whistleblower can receive up to 30% of the funds recovered by the government.

During the pandemic, as the government made hundreds of billions of dollars available through the PPP to support businesses, unscrupulous businesses and individuals quickly moved to exploit the system, by obtaining monies they were not entitled to at the expense of the taxpayers. It’s estimated that billions of dollars have been fraudulently claimed, with numerous individuals already facing prosecution for federal crimes. These fraudsters have misused taxpayer money for personal gain, in some cases purchasing luxury items and enriching their livelihoods.

Fortunately, honest employees can help federal agencies identify fraudulent PPP loan applicants who provide false information about business expenses or payroll. However, to navigate this process effectively and determine if a case qualifies as government fraud warranting criminal prosecution (and potentially entitling the whistleblower to a reward), it’s essential to work with a competent PPP loan lawyer.

Reporting PPP Fraud Correctly

There’s a right way and a wrong way to report PPP fraud. The correct approach is to file a False Claims Act lawsuit through a PPP loan fraud lawyer at a whistleblower law firm. This method can potentially lead to a financial award if the case is successful. In contrast, reporting fraud directly to the government without filing a False Claims Act lawsuit, while helpful for exposing wrongdoing, will not result in any financial compensation for the whistleblower, even if the case succeeds. The Department of Justice is prioritizing the investigation of a PPP loan fraud report and is eager to work with whistleblowers and qui tam attorneys who have experience in litigating through the False Claims Act.

Characteristics of PPP Fraud

- Company falsified it’s payroll reports to receive a higher PPP loan

- Company double counts its payroll through more than one company

- Individual fabricates a bogus company to receive a PPP Loan

- Bank approves loan applications it knows are false

- Bank approves loans based on false documents

How to Tell if Your Employer Has Committed PPP Loan Fraud?

To determine if your employer has committed PPP loan fraud, start by confirming whether they received a PPP loan. You can consult various public databases for this information, or a PPP loan fraud lawyer at Brown, LLC can assist you free of charge in checking for any PPP loan fraud audit records.

Building a successful PPP fraud case under the False Claims Act requires insider information. You’ll need evidence that the company either falsified documents to receive an unduly large loan, or misrepresented their loan forgiveness by falsely claiming they used the loan proceeds to retain employees when they actually reduced their workforce. This is where the experience of a PPP lawyer becomes indispensable.

It’s important to note that mere suspicion of a company obtaining a loan when it didn’t need the money is likely not enough for a case, especially if the money was used to keep employees on payroll during the pandemic as intended. Before taking any action, it’s best to seek legal counsel with a PPP loan fraud lawyer. They can help assess whether federal prosecutors would have enough evidence to pursue a criminal conviction for PPP fraud charges.

How PPP Loans Affect Employees

PPP loans, while granted to employers, are primarily designed to benefit employees. A significant portion (75%) of PPP loan funds were intended to go directly to employee payroll costs. Many employees may be unaware that these funds are for their benefit, which some employers exploit. If your company has received a PPP loan, they are required to account for how they spend those funds.

To build a successful PPP fraud case, you’ll need evidence supporting your allegations that your employer either misrepresented payroll data to obtain a PPP loan or misused the funds. This could include documentation of a reduced workforce despite claims of retention or proof of funds being used for non-payroll purposes.

How Do I Report the PPP Loan Fraud Lawsuit?

If you suspect a company or a financial institution has committed PPP loan fraud, you should contact the PPP fraud lawyers at Brown, LLC, for a free consultation. Our PPP attorneys will explain your rights and show you how to report PPP loan fraud. Give us a call today at (877) 561-0000 and take the first step toward holding fraudsters accountable.