When a Physician’s License is Misused for Medicare/Medicaid Fraud

Medicare/Medicaid Fraud Cases Resulting in Billions in Whistleblower Awards

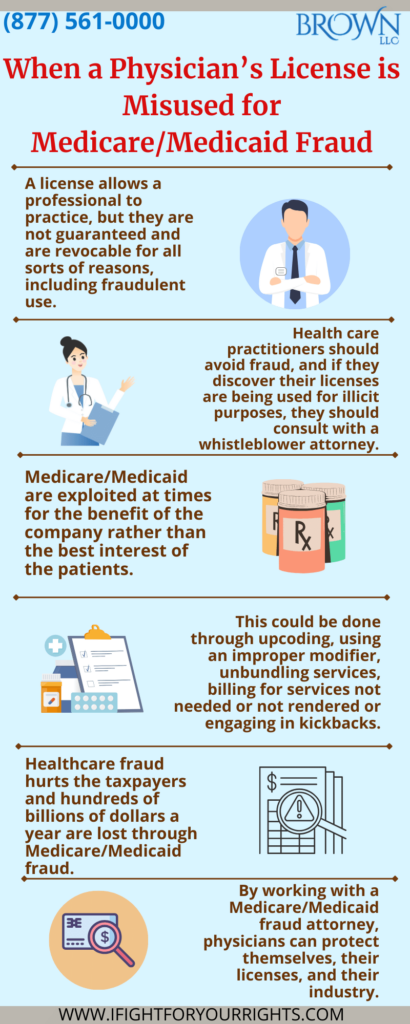

Most physicians enter the field of medicine genuinely wanting to do what’s right. It’s a profound departure when their licenses are used, either knowingly or unknowingly, to commit Medicare or Medicaid fraud. Licensing is the process in which a governing board allows a professional, like a physician, to work in their chosen field. The medical license is hard-earned and subject to revocation for a variety of reasons. A professional license shall not be used for deceptive means. It is critical for health care practitioners to steer clear from fraud. If a physician discovers their professional license has been used for illicit purposes, they must promptly and diligently report it to preserve the sanctity of the license. Their medical license is the foundation of their profession and whistleblowers work to keep the disease of medical fraud at bay.

MEDICARE, and its sister, MEDICAID, are federal healthcare programs that provide healthcare to millions of elderly citizens and individuals without the means to privately pay for insurance in the United States. While it is offered with the greatest intentions, it is often exploited for the benefit of the company rather than the best interest of the patient, with a variety of schemes, such as upcoding, using an improper modifier, unbundling services, billing for services not needed or not rendered or engaging in kickbacks to name a few. Healthcare fraud hurts the taxpayers and its estimated that $100 billion dollars of taxpayer money are lost through Medicare fraud each year.

When Medicare is exploited by cheating and fraud, it’s not just a civil matter, itis a crime against the United States. The majority of cases involving a Medicare fraud whistleblower evolve from the qui tam provisions of the federal False Claims Act (“FCA”) under 31 U.S.C. §§ 3729 – 3733, first enacted in 1863. Overbilling the government is not a modern concept, the origin of the FCA was the Civil War, and was initially enacted to combat fraud against the government during war time and do to its historical origin emanating from when Abraham Lincoln was president, it is sometimes colloquially referred to as “The Lincoln Law.”.

Healthcare fraud occurs when individuals or entities knowingly make a misrepresentation of fact or attempt to obtain payment from the government health insurance program by means of a false claim. To report such a situation through the False Claims Act, an individual must hire a whistleblower attorney to file a qui tam complaint. There is a limited amount of time to file under the False Claims Act, and only the first to file has rights, so it’s critical to consult with a whistleblower law firm in a prompt manner if you’re license has been used for wrongful purposes.

Although some physicians knowingly, or unknowingly, participate in fraud against the governmental health system, they have the power to make things right by acting as a whistleblower and disclosing the schemes. Doctors get tricked and deceived by healthcare sales representatives, equipment manufacturers, and schemers. Recently, a Federal jury in Florida convicted a Florida man of scheming to defraud Medicare of over $67 million by tricking physicians into authorizing thousands of genetic tests that were unnecessary and not used in the treatment of the Medicare beneficiaries.

Misuse of a medical license is a reason for physicians to come forward and report fraud. In a recent case before the Justice Department against a former executive of a Medicare Advantage Organization operating Medicare Advantage Plans in South Florida, the executive and her co-conspirators obtained physician log-in credentials to wrongly access electronic medical records – submitting false and fraudulent information seeking payment from the Dept. of Health & Human Services’ Centers for Medicare & Medicaid Services (“CMS”). Federal charges have been filed and the losses to the Medicare & Medicaid Services will be assessed.

It is important for physicians, through Medicare/Medicaid fraud attorneys, to protect themselves, their licenses, and their industry and be proactive against healthcare schemers.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Medicare/Medicaid Fraud Cases Resulting in Billions in Whistleblower Awards

A Medicare/Medicaid fraud attorney from a whistleblower law firm represents the whistleblowers involvement and strive to obtain the maximum possible award for their clients, typically ranging from 15% – 25% (and as high as 30%), depending on whether the government intervenes in the matter or not.

Two of the top ten (Numbers 1 and 4) payouts in 2022 went to whistleblowers reporting healthcare fraud under the False Claims Act:

Number 1:

The Biogen whistleblower received a record $266.4 Million whistleblower award in a non-intervened case for exposing that the pharmaceutical company paid illegal kickbacks (fake speaking and consulting fees, etc.) to induce physicians to prescribe Biogen’s multiple sclerosis drugs. The whistleblower was a former Biogen executive VP. Biogen agreed to pay $900 million to settle the False Claims Act case.

Number 4:

The Mallinckrodt whistleblowers shared $29.6 Million in whistleblower awards for their participation in a $260 million recovery against the pharmaceutical company under the False Claims Act. The allegations stated that Mallinckrodt failed to pay amounts it owed under the Medicaid Drug Rebate Program, and subsidized copayments to induce Medicare-reimbursed drug purchases in violation of the Anti-Kickback Statute (“AKS”). The whistleblower in the Medicaid rebate case provided information that led to the recovery of $123.6 million for the federal government. The whistleblower received 20% of the federal government’s share, $24.7 million as a whistleblower award, and two (2) whistleblowers in the copayment case were awarded $4.9 million, or 19% of that federal settlement as a whistleblower reward

As a physician you have a lot to lose if you’re license is used to commit a fraudulent scheme and a lot to gain if you get ahead of the curve and report the fraud in the right way utilizing such tools as the False Claims Act. If you started in the profession to heal others, safeguarding taxpayers funds by reporting Medicare Fraud helps heal the system and allows the limited pool of monies to be used to help people in need, rather than to feed schemers greed.