SEC Whistleblower: Rewards and Rules

Table of Contents

What is an SEC whistleblower?

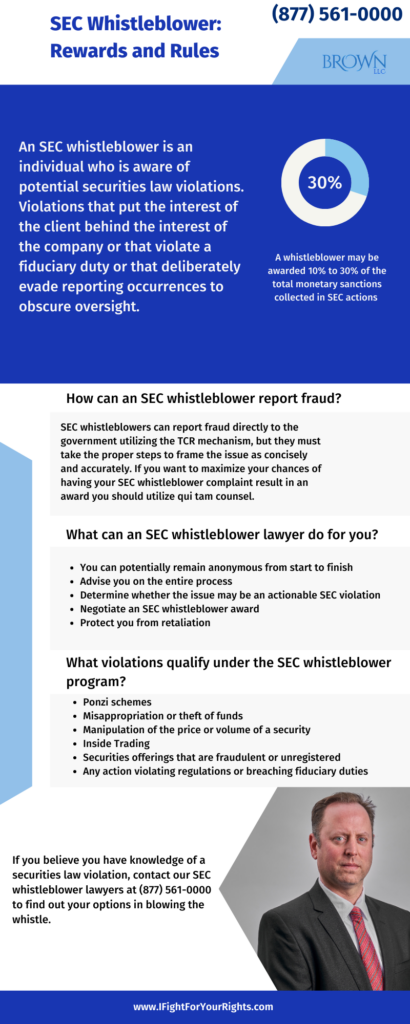

The SEC Whistleblower Program was established to encourage and incentivize individuals to report securities violations to stabilize a free market that was ripe with exploitation. An SEC whistleblower is an individual who is aware of potential securities law violations, violations that put the interest of the client behind the interest of the company or that violate a fiduciary duty or that deliberately evade reporting occurrences to obscure oversight.

Whistleblowers’ inside knowledge of the circumstances and individuals involved can assist the Commission in identifying potential fraud and other violations much earlier than would otherwise be possible. This enables the Commission to minimize investor harm, better preserve the integrity of the United States’ capital markets and hold those responsible for illegal conduct accountable.

The program has made significant contributions to the agency’s ability to enforce securities laws. Since the program’s formation, enforcement actions based on original information provided by credible whistleblowers have resulted in orders totaling more than $5 billion in monetary sanctions. Under the program, the Commission has awarded more than $1.3 billion and counting to deserving whistleblowers.

What is the financial compensation for an SEC whistleblower?

The SEC Whistleblower Program rewards eligible whistleblowers who provide original information that leads to successful SEC enforcement actions with total monetary sanctions in excess of $1 million. A whistleblower may receive 10% to 30% of the total monetary sanctions collected in SEC actions and related actions brought by other regulatory or law enforcement authorities as a reward for reporting tax fraud. A strong feature is the ability for an individual to cloak themselves in anonymity. If a whistleblower is represented by an SEC whistleblower attorney in connection with their tip, the SEC Whistleblower protections allow them to submit tips anonymously.

How can an SEC whistleblower report fraud?

SEC whistleblowers can report fraud directly to the government utilizing the TCR mechanism, but they must take the proper steps to frame the issue as concisely and accurately as possible to augment the chance they receive an award. Because submitting paperwork can be challenging, and even more so when interfacing with a government agency, it is best to hire an SEC whistleblower attorney who can guide you every step of the way and help increase your chances of receiving an SEC whistleblower award.

It’s also important to consult with an attorney familiar with SEC whistleblower rules and the SEC Whistleblower process to make sure your complaint is filed accurately and if you want to file your complaint anonymously.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

The Dodd-Frank Act

The Dodd-Frank Act, or Dodd-Frank, established a number of new government agencies tasked with overseeing the law’s various components and, by extension, various aspects of the financial system to encourage whistleblowers to come forward with information about violations of securities laws.

Whistleblowers who report potential securities law violations to the SEC are also protected from retaliation by their employers. The Dodd-Frank Wall Street Reform and Consumer Protection Act and the Sarbanes-Oxley Act both provide employment protections for SEC whistleblowers who do so correctly.

Dodd-Frank also strengthened and expanded the whistleblower program by implementing the Sarbanes-Oxley Act (SOX) of 2002. Specifically, it expanded the definition of a covered employee to include employees of a company’s subsidiaries and affiliates, established a mandatory bounty program under which whistleblowers can receive 10% to 30% of the proceeds from a litigation settlement.

The most recent reward changes under the SEC whistleblower program

In 2022, the Securities and Exchange Commission amended two rules governing its whistleblower program. The first rule change allows the Commission to compensate whistleblowers for information and assistance related to non-SEC actions in certain circumstances. The second rule confirms the Commission’s authority to consider the dollar amount of a potential award only for the purpose of increasing an award, not lowering an award.

“Today’s amendments enact two changes to help enhance the whistleblower program. The first amendment expands the circumstances in which a whistleblower who assisted in a related action can receive an award from the Commission for that related action rather than from the other agency’s whistleblower program. Under the second amendment, when the Commission considers the size of the would-be award as grounds to change the award amount, it can do so only to increase the award, and not to decrease it. I think that these rules will strengthen our whistleblower program. That helps protect investors.” said SEC Chair Gary Gensler.

What can an SEC whistleblower lawyer do for you?

An SEC whistleblower law firm like Brown, LLC, can help you navigate the whistleblower process, weigh the benefits and drawbacks of blowing the whistle, and file the matter anonymously on your behalf. The SEC whistleblower team can do the following:

- Advise you on the whistleblower SEC rules from start to finish.

- Determine whether the issue may be an actionable SEC violation.

- Assist clients in negotiating an SEC whistleblower award.

- Take precautions to protect your identity.

- Invoke the appropriate statutes and procedures to protect yourself from retaliation.

- Continuing legal assistance throughout the whistleblower process

What violations qualify under the SEC whistleblower program?

The SEC investigates potential violations of the federal securities laws. The more specific, credible, and timely a whistleblower tip, the more likely it will be forwarded to investigative staff for additional follow-up or investigation. For example, if the tip identifies individuals involved in the scheme, provides examples of specific fraudulent transactions, or refers to non-public materials proving the fraud, it is more likely that the tip will be investigated.

The following are some examples of the type of behavior that the SEC is looking for:

- A Ponzi scheme, a Pyramid scheme, or a High-Yield Investment Program are all examples of Ponzi schemes.

- Misappropriation or theft of funds or securities

- Manipulation of the price or volume of a security

- Trading by insiders

- Securities offering that is fraudulent or unregistered

- Statements about a company that are false or misleading (including false or misleading SEC reports or financial statements)

- Unlawful naked short selling

- Bribery of foreign officials or improper payments to them

- Fraudulent behavior in municipal securities transactions or public pension plans

- Cryptocurrencies and Initial Coin Offerings

- Other securities-related fraudulent behavior

- Wining and Dining and concealing the entertainment budget

- Other breaches of fiduciary duty

- Forcing employees to sign a document of non-cooperation with government investigations

If you believe you have knowledge of a securities law violation, contact our SEC whistleblower attorneys at (877) 561-0000 to file a confidential report (through the SEC Whistleblower Program. The SEC will evaluate the information and, if necessary, take enforcement action and award monetary compensation to the whistleblower.