Our Nation’s Soldiers & Sailors at Risk from Fraud – The False Claims Act Can Help

Imagine parachuting behind enemy lines for love of country and the parachute failing to deploy, or a gun hamming in the heat of the battle – these are things that could occur if vendors referred to as defense contractors sell substandard parts to the United States government and they make it to the hands of our military. It’s not just the taxpayers who suffer when the government is ripped off, as these examples illustrate, it’s the safety of those who defend our country. Thankfully, the False Claims Act (“FCA”) can help. The False Claims Act incentivizes whistleblowers to report systemic fraud and in turn can obtain up to 30% of what the government recovers as whistleblower rewards. The FCA has recovered billions upon billions of dollars for the taxpayer and the insiders have obtained in aggregate over a billion dollars of whistleblower awards over the last two decades. The False Claims Act originates from the Civil War when Congress wanted to combat defense contractors selling inferior parts to the military and was colloquially known as the Lincoln Law after President Lincoln. However, in the last two decades it has really ramped up enforcement and recovery and some of the biggest False Claims Act settlements have been addressing defense contractor fraud with some of the best whistleblower law firms.

Defense contractor fraud poses an existential risk to national security and an economic risk to the taxpayers. It’s not just potential harm to our military, but if our national defense is weakened through shady vendors, it’s not an understatement to suggest things like security vulnerabilities could compromise the safety of our people and our country. This blog explores various types of defense contractor False Claims Act violations and highlights False Claims Act settlements that underscore the importance of detecting and addressing fraudulent practices in the defense industry.

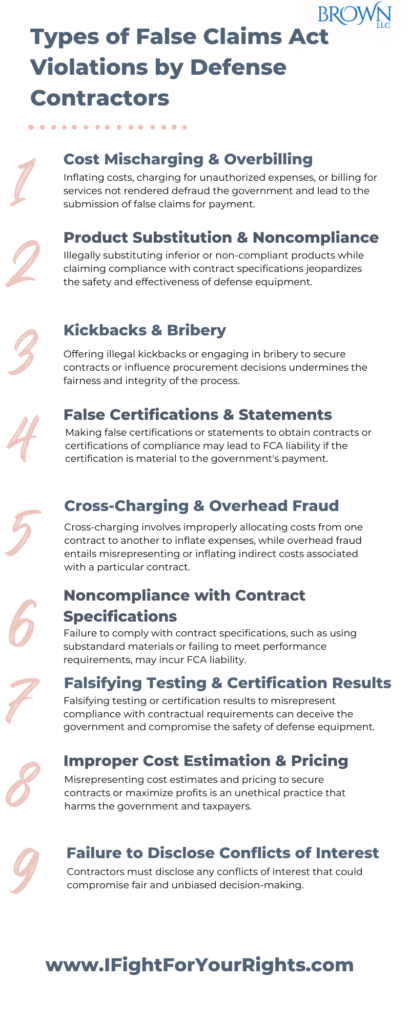

Types of False Claims Act Violations by Defense Contractors

Cost Mischarging and Overbilling:

Overbilling can take many forms and is one of the chief ways vendors rip off the government, whether they lie about actual labor hours, secrete true pricing to upcharge on a false product or just supply less of a quantity than promised but hope no one’s counting, there’s countless ways for vendors to overbill and generally unless there’s an insider to blow the whistle, the government may be too busy to notice. Defense contractors may engage in cost mischarging and overbilling schemes by inflating costs, charging for unauthorized expenses, or billing for services not rendered. All of these practices defraud the government and lead to the submission of false claims for payment.

Product Substitution and Noncompliance:

Contractors may unlawfully try to substitute inferior or non-compliant products while claiming compliance with contract specifications. This violation jeopardizes the safety and effectiveness of defense equipment and defrauds the government by providing substandard goods and puts people at risk. Some contractors buy from prohibited countries and conceal its origin which may be a de facto violation as well.

Kickbacks and Bribery:

Defense contractors who offer illegal kickbacks or engage in bribery to secure contracts, gain preferential treatment, or influence procurement decisions may be guilty of a crime as well as False Claims Act civil penalties. Providing something of value or receiving something of value to induce a undermines the fairness and integrity of the procurement process and violates the FCA. Even if the bribery implicates a foreign power or entity it will violate the Foreign Corrupt Practices Act (FCPA) and if the company is publicly traded may have SEC whistleblower implications as well like the Ericson whistleblower who received over $200 million whistleblower award for disclosing alleged bribery for business.

False Certifications and Statements:

Inherent in any False Claims Act case is a false certification. A contractor who makes false certifications or statements to obtain contracts or certifications of compliance may have FCA liability if the certification or statement is material. This can include, but is not limited to misrepresenting qualifications, capabilities, or compliance with contract requirements. The certification must be material to the government’s payment and lead to an actual payout from the government. Over 100 million in judgments and settlements trials in state and federal courts.

We fight for maximum damage and results.

Speak with the Lawyers at Brown, LLC Today!

Cross-Charging and Overhead Fraud:

Defense contractors may not engage in cross-charging schemes under the False Claims Act, where costs from one contract are improperly allocated to another contract to inflate expenses without express permission from the government. Overhead fraud involves misrepresenting or inflating indirect costs associated with a particular contract. Look out for inconsistencies in cost allocation, unusual expenses, or discrepancies in billed overhead rates.

Noncompliance with Contract Specifications:

If a contractor doesn’t comply with contract specifications, such as using substandard materials or failing to meet performance requirements and fails to disclose the conduct it may incur FCA liability. Be vigilant for instances where contractors cut corners, deliver defective products, or fail to meet quality control standards outlined in the contract.

Falsifying Testing and Certification Results:

Contractors might falsify testing or certification results to falsely represent compliance with contractual requirements. Pay attention to discrepancies between reported test results and actual performance, lack of proper documentation or evidence of testing, or instances where certification claims cannot be substantiated. Faulty testing doesn’t always mean faulty product, but there’s a strong inference. In building a False Claims Act false testing case, it’s helpful to show the real world implications and how the falsely certified test leads to inferior products that the government pays for. Quantification of damages sometimes is challenging, so the more detailed the information is the better in establishing damage.

Improper Cost Estimation and Pricing:

Defense contractors sometimes misrepresent cost estimates and pricing to secure contracts or maximize profits. Watch for instances of inflated cost proposals, failure to disclose accurate pricing information, or discrepancies between proposed costs and actual expenses incurred.

Failure to Disclose Conflicts of Interest:

Any conflicts of interest that could compromise fair and unbiased decision-making should be disclosed. Be alert to situations where contractors have undisclosed relationships, financial ties, or affiliations that may influence contract awards.

A representative Defense Contractor False Claims Act settlements include:

United States v. United Technologies Corporation

United Technologies Corporation (UTC) faced allegations of submitting false claims and providing defective parts to the military. United Technologies Corporation was found liable for over $473 million in damages and penalties due to an Air Force contract in which it was alleged that the proposed prices for the engine contract misrepresented how UTC calculated those prices, which resulted in the government overpaying hundreds of millions dollars. Specifically, the government alleged that UTC omitted in its price proposal historical discounts that it received from suppliers, and instead knowingly used outdated information that excluded such discounts. Under the False Claims Act the whistleblower could have received over $120 million whistleblower reward.

The UTC case underscores the importance of the False Claims Act and how defense contractors must be held accountable for wrongful conduct or else the taxpayers overpay and in other instances involving substandard parts how its beyond economics, its safety and national security. If you see something, say something, and take the time to have a free, confidential whistleblower consultation to understand your rights about blowing the whistle on defense contractor fraud.