Janssen Found Liable by a Jury for Illegal HIV Drug Marketing – Potentially Faces $1B Judgment

Table of Contents

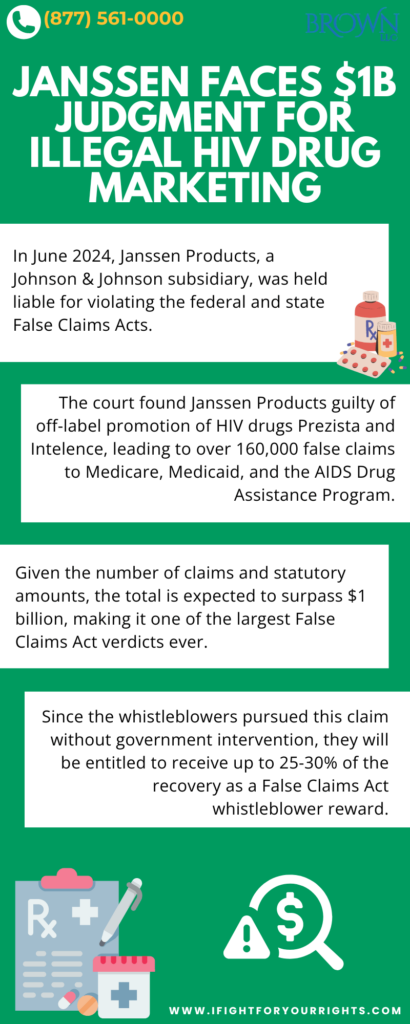

Janssen Products, a pharmaceutical subsidiary of Johnson & Johnson, was found liable by a jury for a violation of both the federal False Claims Act, as well as respective state False Claims Acts in June 2024. The decision wraps up a case first brought to light by whistleblowers over a decade ago in 2012. The jury found that Janssen Products participated in off-label promotion and marketing of two HIV drugs, Prezista and Intelence. As a result of Janssen’s improper marketing activities, over 160,000 false claims were submitted to Medicare, Medicaid, and the AIDS Drug Assistance Program for reimbursement.

The whistleblowers in this claim were Janssen employees and sales representatives, which highlights the importance of insiders bringing information to light that would otherwise remain unknown. The judgment on the damages is still pending review. Given the number of claims and statutory amounts for false claims, the amount could exceed $1 billion and be one of the largest False Claims Act jury verdicts in history. Under the False Claims Act a whistleblower is entitled up to 30% of the amount recovered if the government doesn’t intervene like in the instant matter, so with a billion-dollar potential verdict there could be up to $300 million in whistleblower rewards.

Janssen’s Alleged Off-Label Promotion and Marketing Scheme

Janssen’s alleged misconduct spanned over 8 years between 2006 and 2014. During this period, the pharmaceutical company conducted a nationwide scheme of promoting its HIV drugs, Prezista and Intelence, for off-label usage. Off-label marketing is a specific offense that refers to the promotion of drugs for uses that have not been approved by the Food and Drug Administration (FDA). In general, the FDA will approve drugs for certain limited usage. In this case, Janssen’s management team specifically allowed for the authorization to market the drug in ways that were neither medically necessary nor approved as safe and effective. Janssen promoted unapproved uses of the drug to boost drug sales despite the potential patient harm and fraudulent financial claims against the government. In a 122-page amended complaint filed in 2017, Janssen faced criticism for deceptively marketing Prezista as “lipid-neutral” from 2006 to 2014. This characterization potentially conflicts with the drug’s FDA-approved label, which indicates a “significant negative effect” on lipids.

Additionally, the complaint alleged that starting in 2007, J&J’s sales representatives made claims about Prezista’s purported superior “binding affinity,” based on a study not included in the FDA’s labeling and deemed to have “limited scientific value.”

If you’re a healthcare worker facing similar ethical dilemmas or misconduct within your clinic, you may find this guide useful: How to Report Your Clinic for Healthcare Fraud.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Settlement Versus Trial Under the False Claims Act

This case differed from most claims under the False Claims Act in that the case proceeded to verdict and was ultimately decided by a jury. False Claims Act cases rarely go to trial. In fact, the Department of Justice estimates that between 80-90% of all claims under the False Claims Act are resolved through settlements or dismissals

In this case, the primary whistleblowers were former employees of Janssen. Whistleblowers under the False Claims Act are known as relators. When a whistleblower brings a claim under the False Claim Act, the claim is known as a “qui tam” action. These cases are presented under seal to the government, who then has the ability to either intervene and take over the case, or instead decline any involvement and allow instead the relator and their counsel to pursue the claim on their own. In cases where the government intervenes, a relator may receive up to 15-25% of a recovery as a whistleblower reward. If the government does not intervene, a realtor may earn as much as 30% of the recovery. It’s important to speak with a whistleblower law firm to understand your rights as a whistleblower.

Government Intervention Under the False Claims Act

In the Janssen matter the whistleblowers first filed their complaint in 2012. The Department of Justice investigated the False Claims Act complaint and decided not to intervene. While the government typically chooses to try the strongest available cases (which often settle as a result of their strength), there are a number of meritorious cases that are tried without government involvement. As reflected in this case, the government’s decision not to intervene does not necessarily mean that the claim cannot be successful. The government has to weigh the amount of resources available to the Department of Justice at the time and whether the claim aligns with the current department’s currently prioritized enforcement targets.

According to Jason T. Brown, a well-known whistleblower lawyer, “This is some terrific perseverance from the whistleblowers and their whistleblower law firm. It’s often thought that 12 jurors decide the fate of cases, but in this instance, it took 12 years to bring it to the jury and hold Janssen accountable. Janssen has indicated that they are appealing the verdict, and oftentimes the matter will settle on appeal for a reduced rate when this much money is at stake.”

Whistleblower Entitled to Percentage of Potential One Billion Dollar Award

The jury in this case found that 159,574 false claims had been submitted for reimbursement based on the marketing scheme by Janssen. Under the False Claims Act, civil penalties can range anywhere from $5,500 to $11,000 per false claim. Even more egregious offenses can lead to treble damages under the False Claims Act, meaning that penalties can be tripled. 31 U.S.C. § 3730(d). In total, the damages in this case may exceed $1 billion dollars. Since the whistleblowers pursued this claim without government intervention, they may be entitled to receive up to 25-30% of that amount as a False Claims Act whistleblower reward.

Despite the potential for a $1 billion award, recently, the 11th Circuit, in Yates v. Pinellas Hematology & Oncology, P.A., held that the Eighth Amendment’s Excessive Fines Clause applies to penalty awards in FCA cases in which the government does not intervene, so according to whistleblower lawyer Jason T. Brown expect a damages challenges based on the Excessive Fines Clause and also expect that the trial court is not likely to impose the high end of the penalty scale, unless there has been some egregious conduct. Inherently, ripping off the taxpayers by engaging in an off label promotion scheme is egregious, but the False Claims Act already contemplates punishing the overbilling fraud, so you can’t bootstrap and use the liability itself as a predicate for a maximum fine without building a sufficient record about other inappropriate conduct.

This is a common scheme in the pharmaceutical world and sales reps should be keyed in when a company asks its sales forces to promote a product inconsistent with what the FDA approved it for.