How to Report Private Insurance Fraud

Table of Contents

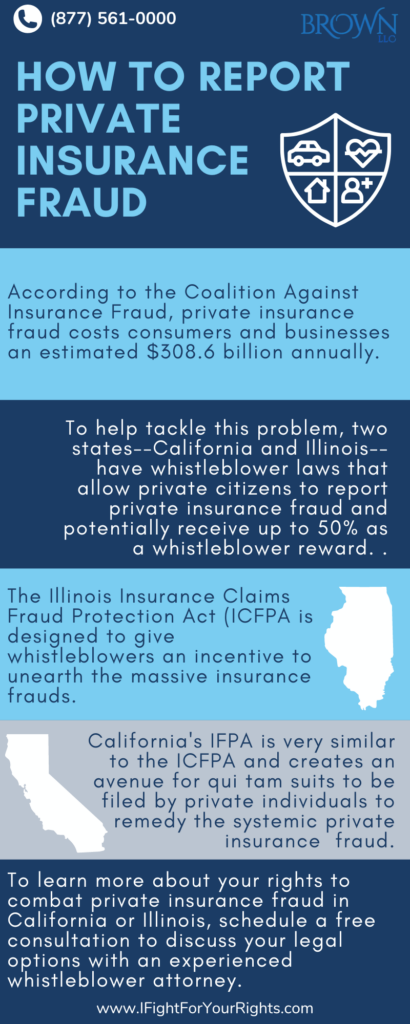

Many Americans own some sort of private insurance, whether for health, auto, or even worker’s compensation. Because of its widespread use, private insurance fraud is a serious issue that hurts countless individuals and families a year and contributes to significant increases in policyholders’ rates. According to the Coalition Against Insurance Fraud, private insurance fraud costs consumers and businesses an estimated $308.6 billion annually. Additionally, the FBI estimates that fraud can cost families an extra $400-$700 in premiums a year. [1] To help tackle this problem, two states–California and Illinois–have whistleblower laws that allow private citizens to report private insurance fraud and also recoup fraudulently acquired funds. In order to successfully report private insurance fraud, it is important to talk with a whistleblower attorney to get assistance on how to report private insurance fraud.

Arguably, the most important whistleblower law in the United States is the False Claims Act. The FCA can only be used to recover funds from schemes that defraud federally funded programs, but some of its provisions serve as models for many state-specific whistleblower laws. For instance, the FCA’s “qui tam” provisions allow private citizens with evidence of fraud (also known as “relators”) to file a lawsuit on behalf of the US government. Depending on if the government decides to step in, the relator is entitled to anywhere from 15% to 25% of the amount recovered by the federal government. The state False Claims Act’s in Illinois and California are even more lucrative for relators. In California, relators are entitled to up to 50% of the recovery proceeds, and in Illinois, relators are entitled to up to 30%. Both the federal FCA and the state FCAs in Illinois and California also have anti-retaliation provisions that protect whistleblowers from being fired or otherwise retaliated against by their employer if they report wrongdoing.

Illinois Insurance Claims Fraud Protection Act

The Illinois Insurance Claims Fraud Protection Act (ICFPA) was passed in 2001. While state government has the power to independently pursue insurance fraud claims, the ICFPA is designed to give whistleblowers more agency in administering justice. The ICFPA has its own “qui tam” provisions that allow private citizens to file cases on behalf of the state government against individuals or organizations that have defrauded private insurance programs. In Illinois, the Illinois attorney general is the sole investigator of potential allegations of private insurance fraud and can decide if they will join the case or not [2].

Examples of insurance fraud:

The IFPA was created to counter fraud perpetrated against insurers (including health, auto, and worker’s comp insurance) by individuals and/or organizations/companies.

Some examples include:

• Fraudulent health insurance billing such as overbilling or phantom billing

• Fraudulent billing of auto insurance providers by repair shops and/or duplicate insurance claims for services or parts

• Providing “kickbacks” to recruit patients or clients

• Fraudulent employee statistics to lower workers’ compensation insurance rates

If the state does intervene in the case, the whistleblower’s reward will be a minimum of 30%, and at least 40% if they do not. Penalties for private insurance fraud may be as much as three times the damages in the claim, as well as $5,000-$10,000 for each fraudulent claim, plus attorney fees and costs. The ICFPA also has a number of whistleblower protection provisions that protect whistleblowers from retaliation. These provisions are specifically designed to incentivize people to come forward and report wrongdoing, as without whistleblowers, it would be significantly harder for state governments and private insurance companies to uncover and combat fraud.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

California’s Insurance Fraud Prevention Act (IFPA)

California’s IFPA was established under Section 1871.7 of the California Insurance Code in 1993 and is very similar to the ICFPA. Modeled closely after the FCA, the IFPA creates an avenue for qui tam suits to be filed by private individuals on behalf of the government against parties committing private insurance fraud in the state of California.[3] While there are many kinds of insurance fraud that can occur, health insurance fraud is one of the most lucrative and common places for fraud to occur. The IFPA has specific clauses that impose civil liability on those who commit healthcare crimes. Prohibited conduct includes:

– knowingly making or causing to be made “any false or fraudulent claim for payment of a health care benefit,” and knowingly presenting or causing to be presented “any false or fraudulent claim for the payment of a loss or injury, including payment of a loss or injury under a contract of insurance.”

– knowingly employ[s] runners, cappers, steerers, or other persons “to procure clients or patients to perform or obtain services or benefits under a contract of insurance or that will be the basis for a claim against an insured individual or his or her insurer.”

Just like in the ICFPA, the IFPA fines are three times the amount of money lost by the fraud victims as well as $5,000-$10,000 for each fraudulent violation. The total recovery of an IFPA suit is calculated by looking at the amount of assets left over after reasonable attorneys’ fees, costs, and expenses for the relator and the state have been reimbursed. A relator’s portion of a reward varies depending on how much they contributed to the prosecution. Typically, a relator will receive between 30-50% of the total recovery depending on if–and by how much–the government intervened.

One major difference between the IFPA and the FCA is that there are two government agencies in California that can pursue a case under the IFPA: local district attorneys and the California Commissioner of Insurance. Both parties can file an IFPA case, and if a whistleblower is filing a qui tam action, both agencies are provided with the complaint and either may intervene. This system greatly increases the potential range of private insurance fraud and intervention in qui tam cases, meaning more recovery for whistleblowers and private insurance companies alike. [4]

First Step to Reporting Private Insurance Fraud

To learn more about your rights and becoming a whistleblower to combat private insurance fraud in California or Illinois, schedule a free consultation to discuss your legal options with an experienced whistleblower attorney. If you know about private insurance fraud and are considering reporting potential fraud or violations of the law, contact a Private Insurance Fraud Whistleblower law firm like Brown, LLC.

[1]https://content.naic.org/cipr-topics/insurance-fraud

[2] https://www.kroll.com/-/media/assets/pdfs/news/disputes-and-investigations/il-icfpa-article.pdf

[3]https://codes.findlaw.com/ca/insurance-code/ins-sect-1871-7/

[4] https://www.insidethefalseclaimsact.com/ca-insurance-frauds-prevention-act/

[5]https://ifightforyourrights.com/whistleblower/new-jersey-insurance-fraud/