How to Report Money Laundering with a Whistleblower Law Firm

The Anti-Money Laundering Act of 2020 (AMLA) introduced a powerful whistleblower reward incentive program aimed at bolstering the enforcement of anti-money laundering (AML) laws and Bank Secrecy Act (BSA) regulations. This program incentivizes individuals to report money laundering and AML violations for up to 30% of what the government recovers. In this article, we delve into the details of the AMLA whistleblower program and guide you through the process of reporting AML violations.

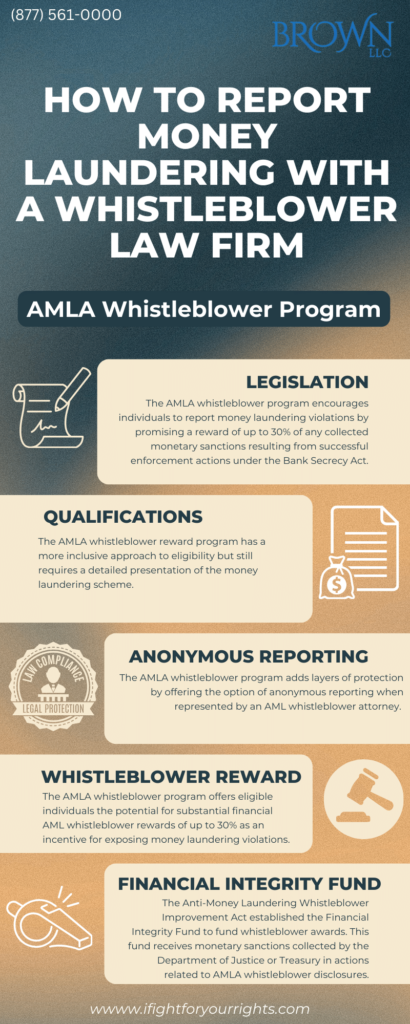

Understanding the AMLA Whistleblower Program

The AMLA whistleblower program encourages individuals to report money laundering and other AML violations like KYC (Know Your Client) violations by promising a reward of up to 30% of any collected monetary sanctions resulting from successful enforcement actions under the Bank Secrecy Act. To be eligible for an award, whistleblowers must provide original information voluntarily. So if the feds are already a-knocking it’s probably too late. Recent legislation, including the Anti-Money Laundering Whistleblower Improvement Act, expands the program’s scope to include violations of U.S. sanctions, such as those under the International Emergency Economic Powers Act, Trading With the Enemy Act, and Foreign Narcotics Kingpin Designation Act. The sanctions prohibitions are huge, since there are many prohibitions of directly doing business with Russia right now, and concealing origins of funds to and from Russia may trigger some of the money laundering laws and entitle insiders to large bounties if they federal government can rightfully seize the funds in time if violative of the sanctions.

Who Qualifies for an AMLA Whistleblower Reward?

The AMLA whistleblower reward program distinguishes itself from certain other whistleblower initiatives by adopting a more inclusive approach to eligibility criteria. Notably, it does not impose restrictions based on an individual’s job duties or responsibilities within an organization. This remarkable feature means that even individuals who are responsible for compliance or audit functions within financial institutions or other entities can potentially qualify for rewards. This inclusive approach recognizes that those closest to the operations of an organization may have unique insights into money laundering activities and can play a vital role in exposing such illicit practices. By allowing compliance and audit personnel to participate, the AMLA whistleblower program fosters a culture of accountability and encourages internal vigilance, ultimately enhancing the program’s effectiveness in combating money laundering. However, there still may be issues of privilege that you should discuss with your AML whistleblower law firm if you’re a lawyer or an accountant.

Furthermore, the AMLA whistleblower program goes beyond geographical boundaries by extending its eligibility to non-U.S. citizens. This international inclusivity is a significant departure from some whistleblower programs that may limit participation to U.S. citizens or residents. By welcoming the participation of individuals from diverse backgrounds and nationalities, the AMLA program not only broadens its reach but also acknowledges the global nature of financial transactions and money laundering schemes.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Anonymous Reporting

The AMLA whistleblower program prioritizes the safety and privacy of those who come forward with crucial information about money laundering activities. It offers the option of anonymous reporting when individuals are represented by an AML whistleblower attorney, providing whistleblowers with a protective shield against potential retaliation. This anonymity is especially vital in cases involving powerful entities.

Determining the Whistleblower Reward

The AMLA whistleblower program offers eligible individuals the potential for substantial financial AML whistleblower rewards as an incentive for exposing money laundering violations. Whistleblowers who come forward with valuable information leading to government-imposed monetary sanctions exceeding $1,000,000 can receive awards of up to 30% of those sanctions. This award structure is designed to not only encourage individuals with critical knowledge of money laundering schemes to step forward but also to ensure that whistleblowers are appropriately compensated for their role in upholding financial integrity and security.

The combination of factors that determine the final award amount, including the significance of the information, level of assistance, and programmatic interest, ensures that the reward system remains equitable and effective. By offering potential whistleblowers the opportunity to receive a substantial percentage of monetary sanctions, the AMLA whistleblower program plays a crucial role in incentivizing those in the know to spill the beans on money laundering thereby deterring money laundering activities and protecting the integrity of the financial system.

Funding AMLA Whistleblower Awards

The Anti-Money Laundering Whistleblower Improvement Act established the Financial Integrity Fund to fund whistleblower awards. This fund receives monetary sanctions collected by the Department of Justice or Treasury in actions related to AMLA whistleblower disclosures. To date, although there have been no successful recoveries under AMLA, it is a nascent program, and the agency is looking to make a splash with the inaugural whistleblower award, the bigger the better, so if you have inside information about considerably money laundering, don’t delay, tee it up for them to potentially go down in history as the first (anonymous) whistleblower to obtain a meaty recovery.

Money laundering undermines national security when illicit funds travel to and from prohibited entities or the fruits of criminality are enabled and legitimized through the use of banks. The AMLA whistleblower program plays a critical role in enhancing national security by incentivizing individuals to report money laundering and AML violations. With anonymous reporting options the program empowers whistleblowers to step forward and contribute to the fight against illicit finance, ultimately strengthening the enforcement of anti-money laundering laws and regulations. If you have information about AML violations, consider taking action and reporting them through an AMLA whistleblower law firm.