DOJ Reports Record $6.8 Billion in False Claims Act Recoveries for FY 2025: What It Means for Whistleblowers

Table of Contents

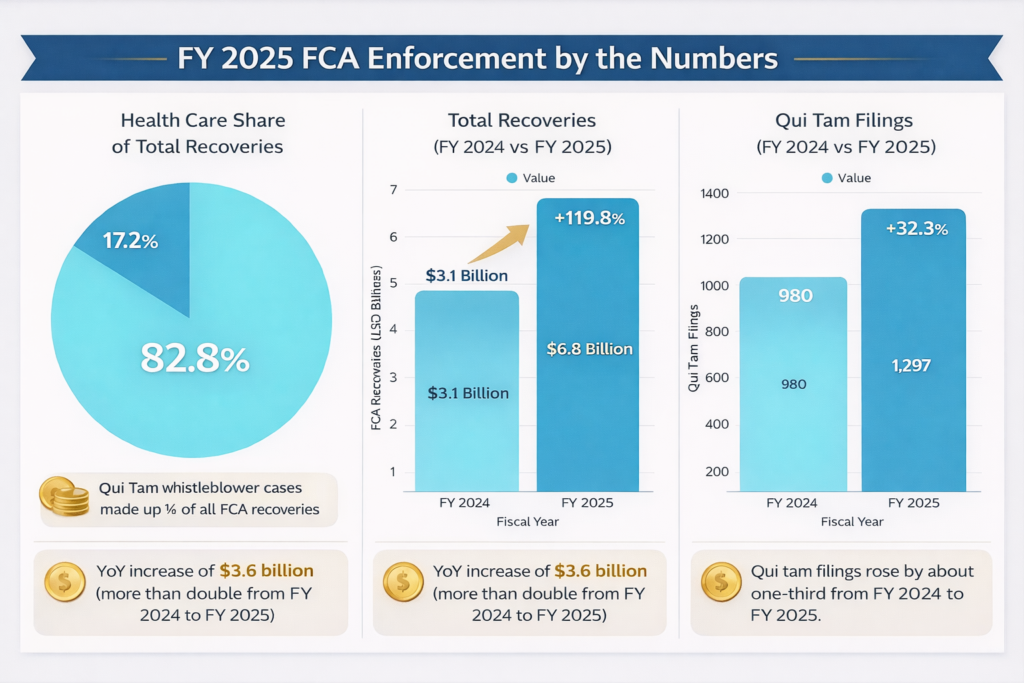

On January 16, 2026, the U.S. Department of Justice announced False Claims Act settlements and judgments have exceeded $6.8 billion for the federal fiscal year ending September 30, 2025, the largest single-year recovery total in the statute’s history and once again Brown, LLC was one of the leading whistleblower law firms in terms of recovery with multiple cases that settled for over $100 million.

Whistleblowers filed 1,297 qui tam lawsuits, a new record, while the government opened 401 new investigations. Health care dominated recoveries, with more than $5.7 billion tied to matters involving the health care industry, including Medicare, Medicaid, and TRICARE. The DOJ’s published statistics also show $330 million paid in whistleblower awards during FY 2025, underscoring the central role insiders play in detecting and stopping fraud against taxpayer-funded programs.

The takeaway is that enforcement is accelerating, whistleblower filings are rising sharply, and the government continues to prioritize cases involving health care billing, kickbacks, medically unnecessary care, procurement fraud, defense contractor fraud, cybersecurity compliance, pandemic relief programs, and customs and tariff evasion, as well as a growing and still-developing interest in using the False Claims Act to address antitrust-related misconduct..

Jason T. Brown, the head of Brown, LLC, commented, “For every yin there is a yang. As the government brings bigger enforcement actions, smaller but significant cases inevitably fall through the cracks. With limited resources, DOJ will increasingly rely on experienced whistleblower law firms to help move cases forward. The $6.8 billion recovered this year is only a fraction of the fraud that exists.”

The FY 2025 Headline: Record Recoveries and Record Whistleblower Filings

The DOJ’s FY 2025 announcement highlights three key figures that matter for whistleblowers and compliance teams alike:

- $6.8 billion in total FCA settlements and judgments (often cited as “exceeding $6.8 billion”) for FY 2025.

- 1,297 qui tam suits filed, breaking the prior record set in FY 2024.

- 401 government-initiated matters opened, reflecting continued federal emphasis on civil fraud enforcement.

Notably, the DOJ also reported total FCA settlements and judgments since 1986 now exceed $85 billion, demonstrating how consistently the statute has been used to return money to the public fisc.

Where the money came from: health care leads, but not the only focus

Health care: The Center of Gravity

Health care fraud remained the leading driver of recoveries. The DOJ reported over $5.7 billion of FY 2025 recoveries related to matters involving the health care industry. Allegations include Medicare, Medicaid, and TRICARE, and reflect priorities that repeatedly appear in FCA enforcement:

- Managed care and Medicare Advantage risk adjustment enforcement

- Prescription drug pricing, dispensing, and kickbacks

- Medically unnecessary care and substandard care in settings serving vulnerable patients

The DOJ’s FY 2025 fact sheet reads like a roadmap of current enforcement theories, including allegations of unsupported diagnosis coding in Medicare Advantage, kickbacks and inducements tied to drug prescribing, and billing for services that were unnecessary, overbilled, or not provided.

Defense Procurement: Inflated Pricing and Contract Integrity

The DOJ also highlighted continued prosecutions of fraud in government contracting, especially in defense procurements where defective pricing, inflated costs, cross charging and misuse of confidential bidding information can cause inflated costs to the government and impact national security .

Cybersecurity Compliance: FCA as a Lever for Security Promises

A major takeaway from FY 2025 is how prominently cybersecurity appears as an FCA enforcement theme. The DOJ’s fact sheet points to multiple resolutions involving alleged false certifications of compliance with cybersecurity requirements in federal contracts and grants. For contractors, universities, research entities, and health care organizations handling federal information, “paper compliance” can create FCA exposure if representations are not accurate. This trend reflects DOJ’s increasing use of the FCA to police material contractual representations, not just billing conduct.

Pandemic relief: still active, still being pursued

The DOJ continues to pursue civil fraud matters related to pandemic-era relief programs, including alleged fraud involving PPP loans and COVID-19 testing and treatment billing. Because the False Claims Act generally carries a six-year statute of limitations (although in some circumstances longer), the window to file some of these cases may be closing shortly.

Tariffs and Customs Duties: Trade Fraud in the FCA Spotlight

The DOJ also emphasized efforts to combat conduct that allegedly evades tariffs and customs duties. The FY 2025 fact sheet includes examples involving misclassification of imported goods, misrepresentation of country of origin, and other alleged tactics to reduce duty obligations. This is a reminder that FCA cases are not limited to health care.

Why Whistleblowers Matter: Qui Tam Recoveries and Relator Awards

The FCA’s qui tam provisions allow private individuals to file suit on behalf of the United States. If the case is successful, the whistleblower (relator) typically receives a portion of the recovery as a whistleblower award, often 15%-30% depending on the circumstances.

In FY 2025, the DOJ’s published statistics show:

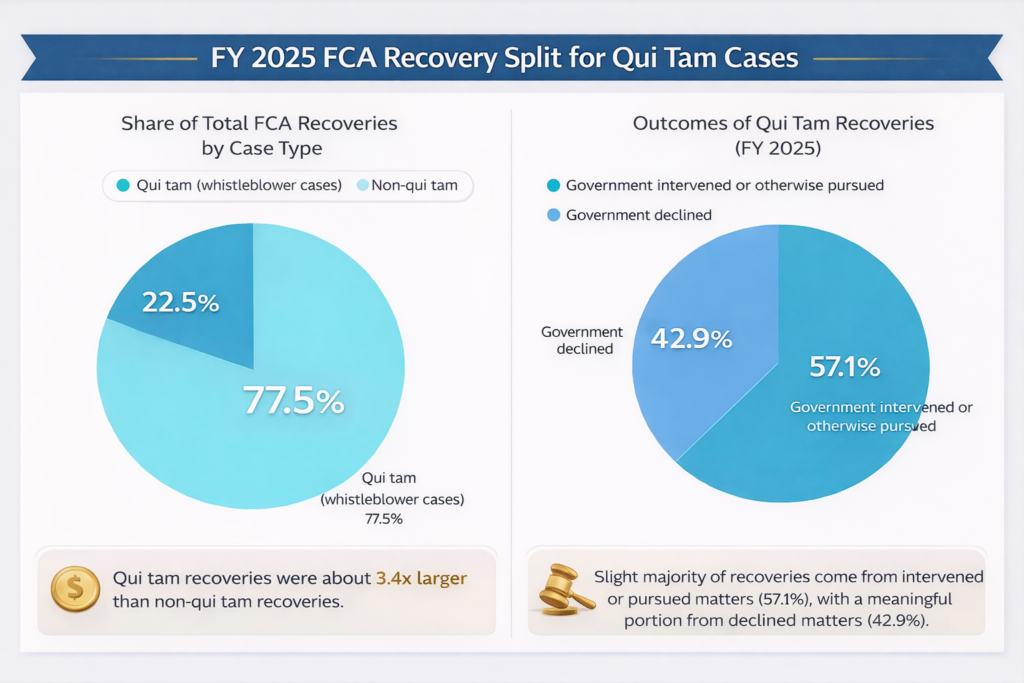

- $5.34 billion of the $6.8 billion total was tied to qui tam matters (including cases filed in earlier years that resolved in FY 2025).

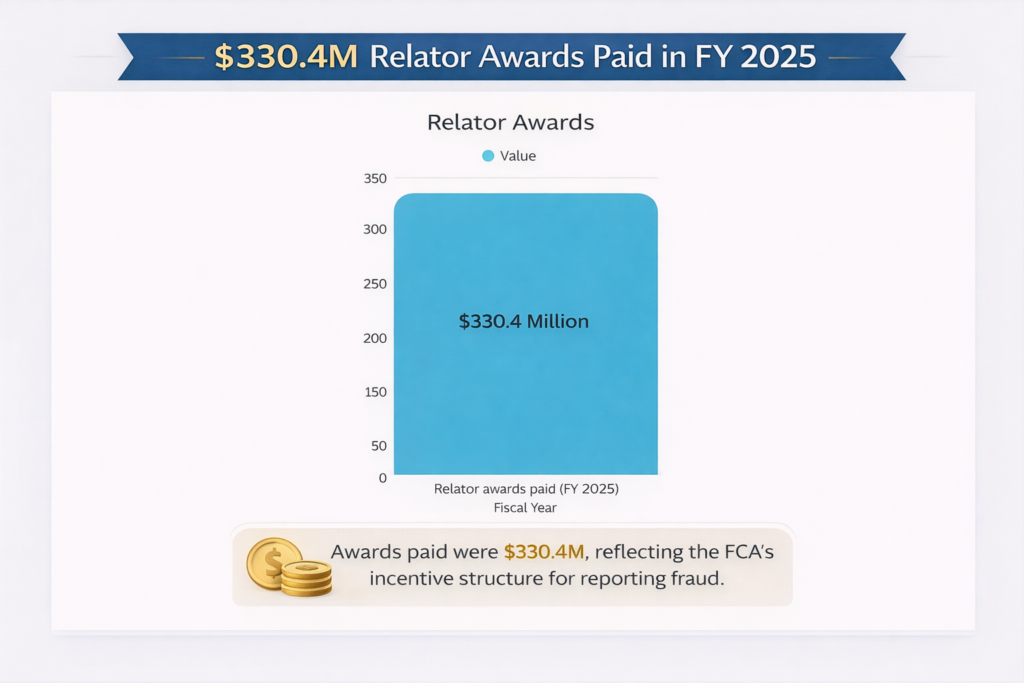

- $330.36 million was paid in whistleblower awards in FY 2025.

Just as notable is the filing surge. The jump from 980 qui tam filings in FY 2024 to 1,297 in FY 2025 is not incremental. It is a step-change that signals rising awareness, expanding enforcement areas (including cybersecurity and trade fraud), and the willingness of insiders to report.

Below are ready-to-use FY 2025 metrics based on the DOJ’s press release and the DOJ’s published FCA statistics. Use them as quick call outs or sidebar content.

FY 2025 FCA Enforcement, By The Numbers

- Total FCA recoveries (FY 2025): $6.8B

- Increase from FY 2024 to FY 2025: +119.8% (more than double)

- Health care share of total recoveries: about 8% (using “over $5.7B” health care figure)

- Qui tam share of total recoveries: about 5%

- Non-qui tam share of total recoveries: about 5%

- Qui tam filings:1,297 (up 3% from FY 2024’s 980 filings)

- Government-opened matters: 401

- Relator awards paid (FY 2025): $330.36M

- Relator awards as a share of qui tam recoveries: about 19%

- Share of qui tam recoveries where the government intervened or otherwise pursued: about 1%

- Share of qui tam recoveries where the government declined: about 9%

FY 2025 recoveries by primary client agency (DOJ statistics)

- HHS-related matters: $5.722B (about 1% of total)

- DOD-related matters: $0.634B (about 2% of total)

- Other agencies: $0.533B (about 7% of total)

What This Means if You Suspect Fraud

Trends like these often correlate with more investigations, more data-driven enforcement, and more scrutiny of billing, documentation, and certifications. If you see red flags at work, timing and strategy matter. FCA cases can involve complex proof issues, including how claims were submitted, what certifications were made, and whether the government’s payment decision was influenced.

If you suspect fraud, understanding timing, evidence preservation, and reporting strategy can matter. Whistleblowers often evaluate counsel based on experience, discretion, and results when searching for the best whistleblower law firm to guide them through the process.

https://www.justice.gov/opa/media/1424121/dl.

https://www.justice.gov/opa/media/1424126/dl.

https://www.law.cornell.edu/uscode/text/31/3729

https://www.justice.gov/sites/default/files/civil/legacy/2011/04/22/C-FRAUDS_FCA_Primer.pdf