IRS Tax Whistleblower Program

Table of Contents

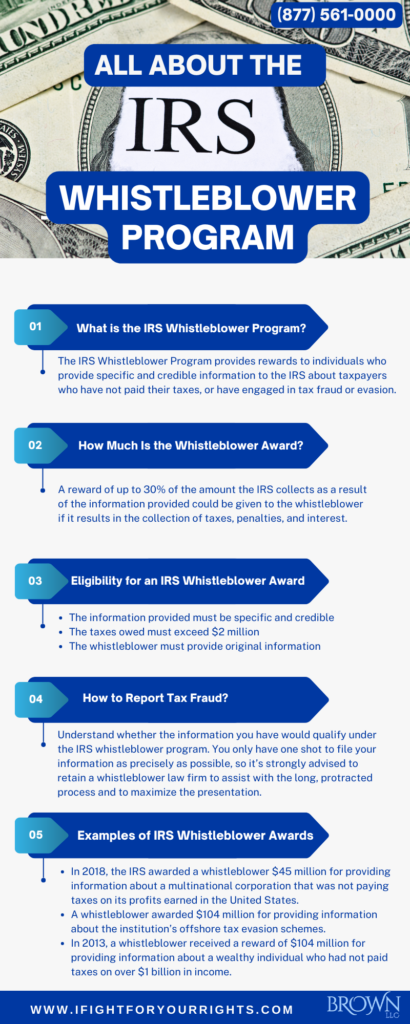

The Internal Revenue Service (IRS) is responsible for ensuring that taxpayers comply with tax laws and pay their accurate taxes. However, with millions of taxpayers filing returns each year, it is not uncommon for tax fraud and evasion to occur. To help identify and prosecute these cases, the IRS established the Whistleblower Program in 2006, which provides reward for report tax fraud to individuals who provide information leading to the collection of unpaid taxes, penalties, and interest.

What is the IRS Whistleblower Program?

The IRS Whistleblower Program rewards IRS whistleblowers, who provide the IRS with specific and credible information about potential tax non-compliance, fraud, or evasion. If the information provided leads to the collection of taxes, penalties, and interest, the whistleblower may receive a reward for reporting tax fraud of up to 30% of the amount collected by the IRS. With the use of an IRS whistleblower program there’s a chance for the IRS whistleblower to stay anonymous from start to finish, but one should not always bank on that anonymity.

Criteria for Eligibility for an IRS Whistleblower Reward

- The information provided must be specific and credible. The information provided should include the taxpayer’s name, address, and social security number or taxpayer identification number, as well as details of the fraudulent activity or noncompliance.

- The taxes owed must exceed $2 million. The IRS will only consider information related to cases in which the tax, penalties, and interest owed exceed $2 million for individual taxpayers or $10 million for corporate taxpayers.

- The whistleblower must provide original information. The information provided must not be previously known to the IRS or in the public domain.

- The whistleblower must provide the information voluntarily, that is it can’t be a result of a legal obligation or as part of their job duties.

The information provided must be timely and significant to the IRS’s ability to collect taxes, penalties, and interest. So, just like anything else in the law, the longer you sit with the information the more stale it becomes and the government may either think you unclean hands or helped facilitate the conduct. In either event, you should still go over your options with an IRS whistleblower law firm that offers a free, confidential consultation.

Who Can Be an IRS Whistleblower?

According to the Internal Revenue Code Section 7623, whistleblowers who qualify for awards are those who provide “specific and credible information regarding tax underpayments or violations of internal revenue laws and that lead to proceeds.” Some common types of IRS whistleblowers include current employees, former employees, board members, and executives. For an IRS whistleblower case to succeed typically it requires a certain level of detail that outsiders lack, so visibility is key.

In contrast to the eligible whistleblowers being broad, the has a set list of people who are ineligible to file claims:

- Employees of the Department of Treasury

- Employees of the Federal Government who obtain information through their official duties

- Individuals required to disclose information required by federal law

- Individuals who obtained access to the information through a contract with the federal government

- Individuals who filed a claim based on information obtained from an eligible whistleblower

Gray areas include accountants and lawyers who perform work for the company, as communications with them may be protected by attorney-client privilege. However, the crime-fraud exception could apply in cases involving certain types of tax fraud.

How to Report Tax Fraud

The first thing you should do is understand whether the information you have would qualify under the IRS whistleblower program. You only have one shot to file your information as precisely as possible, so it’s strongly advised to retain a whistleblower law firm to assist with the long, protracted process and to maximize the presentation.

The IRS whistleblower law firm will assist in completing various forms including Form 211, Application for Award for Original Information, to the IRS. The form should include as much detail as possible about the fraudulent activity or noncompliance, including the taxpayer’s name, address, and social security number or taxpayer identification number, as well as details of the fraudulent activity or noncompliance. Through the use of an IRS whistleblower law firm they will shield your identity as the whistleblower.

Report Tax Fraud: Reward

After receiving the information, the IRS will review the case and determine whether the information provided is specific, credible, and timely, and whether it meets the criteria for a reward under the Whistleblower Program. If the case is successful and the IRS collects taxes, penalties, and interest as a result of the whistleblower’s information, the IRS whistleblowers may be eligible for a reward of up to 30% of the amount collected. IRS whistleblowers have played a significant role in recouping billions of dollars in lost tax revenue.

Examples of IRS Whistleblower Awards

The IRS Whistleblower Program has been successful in identifying and prosecuting cases of tax fraud and evasion. For example, in 2018, the IRS awarded a whistleblower $45 million for providing information about a multinational corporation that was not paying taxes on it’s profits earned in the United States. The whistleblower’s information led to the collection of $1.5 billion in taxes, penalties, and interest.

In another case, a former employee of a financial institution received an IRS whistleblower reward of $104 million for providing information about the institution’s offshore tax evasion schemes. The information provided led to the collection of $5 billion in taxes, penalties and interest.

In September 2024, the IRS finalized a $263 million tax fraud settlement with an individual taxpayer, marking a great success for the lawful taxpayers and the IRS’s Whistleblower Program. This case was brought to light by three whistleblowers two of which were represented by separate IRS whistleblower law firms, who collectively received a 30% award totaling approximately $79 million, the maximum percentage allowed under the program.

If you have information about tax fraud or evasion, you may be eligible for a reward under the IRS Whistleblower Program. Contact an IRS whistleblower attorney to discuss your options and determine the best course of action.

Can IRS Whistleblowers Remain Anonymous?

The IRS is legally obligated to protect the identity of whistleblowers to the greatest extent possible under Internal Revenue Code (IRC) Section 6103 throughout the case and its investigations. If an IRS employee breaches this obligation, they may face penalties that can include potential criminal charges. If the case is resolved without going to court, then the whistleblowers’ identity may never be disclosed. Almost all cases that are filed that don’t succeed through the administrative IRS whistleblower process fail if the IRS contests the award in Tax Court. If it goes to Tax Court because the taxpayer contests the finding or any other reason you can still file a motion under Rule 345 to stay anonymous in court. To stay anonymous you need an IRS lawyer which is why it’s critical if you’re thinking of filing a taxpayer fraud case to have someone licensed in Tax Court like Jason T. Brown head of the whistleblower law firm Brown, LLC. Some of the best IRS whistleblower law firms will argue for you to be anonymous for reasons like the potential for retaliation, reputational damage, or professional harm. The IRS whistleblower laws per se don’t have an anti-retaliation provision so anonymity is at the discretion of the judge.

Common Types of IRS Whistleblower Cases

There are various ways in which someone might try to defraud the IRS. Some common types of IRS whistleblower cases include:

- Underreporting Income: The textbook case of IRS fraud. Individuals or businesses who deliberately underreport income, including concealing foreign income or failing to report cash payment.

- Tax Evasion: Large sum cases can include individuals who use offshore bank accounts or shell companies to hide income by transferring profits as “tax havens” or failing to follow Foreign Bank Account Reporting (FBAR) requirements.

- Payroll Tax Fraud: Employers may commit fraud by misclassifying employees or failing to withhold payroll taxes.

Cryptocurrency Tax Fraud: A newer type of federal tax fraud can include not reporting gains acquired through digital currencies.

- Abusive Tax Shelters

Complex schemes often marketed by professionals to help high-net-worth individuals or corporations avoid taxes by creating artificial losses or shifting income. These may involve sham partnerships, syndicated conservation easements, or overvalued donations. - False Deductions or Credits

Taxpayers may fraudulently inflate deductions (e.g., charitable contributions, business expenses) or claim credits they are not entitled to (e.g., R&D tax credit, Earned Income Tax Credit). - Fraudulent Tax Preparer Conduct

Some tax professionals file false returns on behalf of clients to inflate refunds or understate liability, sometimes without the client’s full knowledge. - Failure to File or Pay Taxes

High-income individuals or businesses may simply fail to file returns, or file but intentionally don’t pay what they owe, sometimes repeatedly. - Use of Nominees or Alter Egos

Individuals or entities may use third parties or straw owners to conceal ownership of income-producing assets or evade IRS collection efforts. - Exempt Organization Abuse

Nonprofits or religious organizations may misuse their tax-exempt status — for example, by funneling profits to insiders, engaging in political activity, or operating for private rather than charitable purposes. - Construction or Real Estate Fraud

Particularly common in cash-heavy industries, such as contractors underreporting income, paying workers off the books, or manipulating cost basis in real estate deals.

Timing and Patience: What to Expect with the IRS Whistleblower Program

Nothing happens fast with the government and with the IRS program it tends to be glacial and take around a decade!

- Initial Review: After you file, the IRS first evaluates whether the claim is credible and actionable. This initial stage can take years, and if they don’t contact you promptly the case is probably dead in the water.

- Investigation and Collection: If the IRS proceeds, it may launch an audit or enforcement action. For large or complex case, especially those involving corporate structures or offshore accounts, this can take years to fully resolve.

- Taxpayer Objections: The taxpayer can object to any determination and tie up the matter in Tax Court for years.

- IRS Award Determination: Only after the IRS successfully collects funds based on your information will it determine your eligibility and the size of the award, adding more time to the process.

Because the process is long, technical, and often opaque, you want a law firm that’s been through it, knows the system, and stays the course.

Why Brown, LLC

At Brown, LLC, we don’t just file whistleblower cases—we fight to see them through. Our team includes former federal prosecutors, DOJ alumni, and top-tier litigators who understand how to build compelling whistleblower submissions and protect your rights at every stage.

Due to the length of time the program takes, Brown, LLC is very selective about the IRS whistleblower cases it will present to the government. Unless you have substantial inside information about a tax fraud in excess of $10 million it is doubtful the firm will handle your matter. Still, the firm offers free confidential IRS whistleblower consultations so you should understand your rights and the likelihood of success of your case by calling.