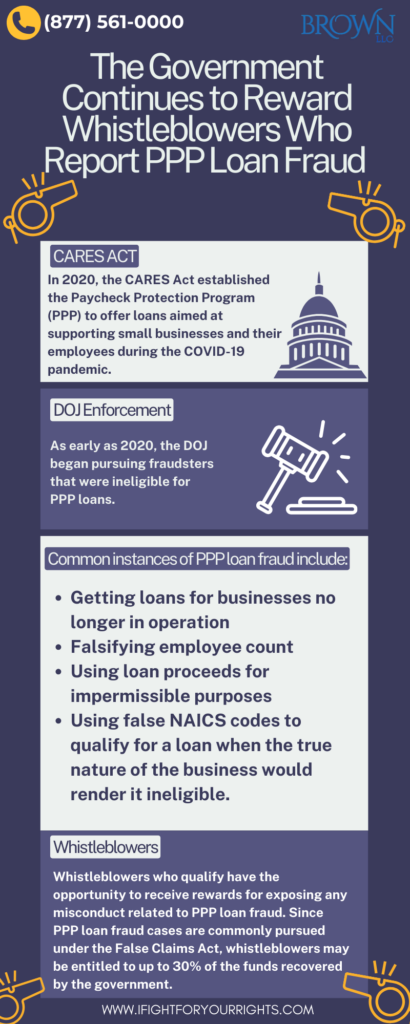

The Government Continues to Reward Whistleblowers Who Report PPP Loan Fraud

Table of Contents

Important Case Acceptance Criteria Regarding PPP Loan Fraud

Due to a high volume of inquiries, please note that Brown, LLC will only handle PPP loan fraud cases that meet the following criteria:

- The alleged fraud exceeds $2 million

- The company had its PPP loan forgiven

- The company has the financial capacity to pay back at least double the loan amount, and you can provide detailed information supporting this capacity

- You are an insider with specific, detailed information about the alleged fraud

- We do not accept cases based solely on a belief that the company did not need the funds

If you have information that meets these criteria, our experienced whistleblower attorneys can assist you in reporting PPP loan fraud under the False Claims Act. Properly filing a claim may make you eligible for a substantial whistleblower award. If not, we can not assist, please call other whistleblower law firms or report the matter to the Department of Justice.

In 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Part of this legislation created the Paycheck Protection Program (PPP), which provided loans to help small businesses stay afloat and support their employees. The U.S. Small Business Administration (SBA) disbursed approximately $1.2 trillion in PPP loans, but in the rush to disburse funds to Americans in need, many fraudulent actors slipped through the cracks.[1] The SBA Office of Inspector General estimates that around $200 billion in fraudulent loans were disbursed.

While the federal government has, across several agencies, recovered over $30 billion, the surface has only been scratched to remedy the extensive PPP loan fraud. Functionally, there is a PPP loan fraud reward for whistleblowers who invoke the False Claims Act (FCA). Mathematically, under the FCA, PPP loan fraud whistleblowers can receive up to 30% as a whistleblower reward, but for arguments sake assuming a 20% PPP award and double damages, that’s roughly $100 billion in potential awards available if you blow the whistle the right way by speaking with a PPP loan fraud attorney.

A Brief Overview of the Paycheck Protection Program

The PPP was created with the express goal of supporting small businesses during the COVID-19 pandemic. Businesses with fewer than 500 employees were eligible for loans to primarily cover the costs of payroll, but also to pay rent and some other line items. The federal government also instated a PPP Loan Forgiveness program, meaning eligible loan recipients no longer had to pay back the loans they received if they complied with the terms of the loan. As a whole, the PPP loans were a great help to small businesses across the country during a time of need—but they were also a major target for fraudsters.

The Evolution of PPP Loan Fraud and DOJ Enforcement

As early as 2020, the DOJ began pursuing fraudsters that were ineligible for PPP loans. These cases were usually overt and relatively easy for the government to investigate and prosecute. For example, in May 2020, a former reality TV star pled guilty to allegations of using over $2 million in PPP loans on a diamond bracelet, a Rolls Royce, and child support payments. Proceeds of the loan also went towards paying associates who assisted the former star in running a Ponzi scheme, which added to his 17-year prison sentence.[2] While this PPP case seems like a bad episode of reality TV, it is a good example as to how obvious early PPP fraud was.

In the past few years, however, the DOJ has scaled its enforcement efforts to include other violations that require more investigation. Some common instances of such PPP fraud include:[3]

- Getting loans for businesses no longer in operation (and in some cases, for entities that never existed);

- Misrepresenting the applicant’s number of employees by either pumping up the head count to receive additional funds or deflating the head count to falsely certify to eligibility;

- Using loan proceeds for impermissible purposes, including purchasing jewelry, cars, cryptocurrency, and travel and in the same time failing to pay the company employees; or

- Using false NAICS codes to qualify for a loan when the true nature of the business would render it ineligible.

Below are some examples of these complex areas of enforcement:

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Affiliation Rules

To determine PPP eligibility, applicants had to disclose if they had any affiliated entities to their business. As businesses scale up in size or are part of a greater corporate structure, such determination requires a detailed analysis of the business and legal relationships between the applicant and its potential affiliates. Factors to consider in this process include ownership, stock options, and common management. Additionally, certain businesses like restaurants, hotels, or franchises are exempt. Strongly interrelated companies are not considered a small business by the SBA, particularly if their headcount exceeded 500 people, so lack of disclosure of affiliation led to them receiving a loan and can be considered fraudulent.

Recent settlements highlight the DOJ’s increased scrutiny of FCA violations for complex cases involving affiliation rules. For example, in December 2023, a Texas-based roofing company paid a $9 million settlement to resolve allegations that it and its affiliates received over $6.5 million in PPP loans that were in violation of the FCA.[5] Read more about the case here.

How to Report PPP Loan Fraud

Eligible whistleblowers can receive a PPP loan fraud reward for reporting any wrongdoing they may be aware of. As PPP loan fraud is often pursued under the False Claims Act, whistleblowers can receive up to 30% of the amount recovered by the government.

Yet as the government increasingly turns its attention to more complex cases, it becomes equally complex for whistleblowers to report wrongdoing. It is in these situations that it’s important to consult a PPP loan fraud attorney near you. Experienced PPP fraud lawyers can help you organize your evidence and file the PPP False Claims Act and present it to the DOJ in the best possible light.

Covid-19 was a tumultuous time in the history of the United States, and prompted lawmakers to pass unprecedented legislation, including the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Enacted in 2020, it stands as a landmark legislation in the United States’ response to Covid-19. However, the Paycheck Protection Program (PPP), which was part of the CARES Act and meant to assist small businesses, offered loans that were subsequently taken advantage of.

Background for the CARES Act and the Paycheck Protection Program (PPP)

The CARES Act was enacted on March 27, 2020, in an effort to combat the financial loss accompanied by the Covid-19 pandemic. This comprehensive package, totaling approximately $1.2 trillion, represents U.S. history’s largest economic relief bill. The CARES Act was designed with multiple objectives, aiming to provide immediate financial assistance to Americans, stabilize the economy, and support businesses facing unprecedented challenges due to the pandemic. Additionally, the Cares Act served as a remedy for the medical crises affecting access to telehealth services and other medical providers. The Paycheck Protection Program, signed into law in April 2020, offered forgivable loans to small businesses that covered up to eight weeks of payroll costs, including benefits, rent, utilities, and mortgage interest. The program aimed to incentivize businesses to keep employees on the payroll during the economic downturn caused by the pandemic. Administered by the Small Business Administration (SBA), the program was notable for its broad eligibility criteria, with it allowing a wide range of businesses, including sole proprietors, independent contractors, and self-employed individuals, to apply for financial support during an unprecedented global crisis. However, both individuals and small businesses alike bit the helping hand offered by the SBA, as the Federal Bureau of Investigations (FBI) estimates over $60 billion in losses from fraud under the program. In an effort to investigate PPP fraud, President Biden introduced a massive anti-fraud bill, totaling over $1 billion, that boosts resources for agencies and prosecutors combating these criminal activities. If you suspect that an organization has committed PPP fraud, you should speak with a PPP law firm to ensure justice.

Instances of PPP Fraud

Loan Fraud Ring

In a multi-state fraud scheme, 3 individuals amassed over $3 million in PPP loans. Through the falsification of various documents, they were able to fraudulently claim this money in Boise, Idaho. All 3 of the individuals were either found guilty or pleaded guilty to PPP loan fraud.

Non-operational Small Businesses

In Minnesota, a man obtained over $800,000 in PPP loans for his small businesses. His construction businesses received a cease and desist letter multiple years prior, and even though he was facing multiple felony charges at the time of the loan, this individual falsified his payroll, criminal record, and licensing to secure aid. However, after being indicted in 2020, he was found guilty on charges of money laundering, aggravated identity theft, and fraud.

Non-existent Small Businesses

A Texas man fraudulently claimed that his wedding planning business had over 120 active employees and needed PPP loan assistance during the pandemic. In actuality, the business had no employees, and the individual used the three million dollars provided to purchase personal items, such as two Teslas, and also finance his home. In 2021, he pleaded guilty on all accounts.

What Does the Future Look Like?

Recently, governmental agencies ranging from the Internal Revenue Service (IRS) to the Department of Justice (DOJ) have been relentless in their pursuit of financial misconduct arising from the Paycheck Protection Program.. For instance, a Texas-based nationwide roofing company received over $6 million in PPP loans during the pandemic. The company utilized a tactic that involved breaking up its affiliate businesses into a group of small businesses so that each received a loan. Their fraudulent activity involved the nondisclosure of all affiliated companies, which allowed them to claim PPP aid. The SBA and DOJ settled with the company, ordering them to pay over $9 million in restitution. A similar case involved a car dealership company based in Florida that claimed each of its dealerships was its own small business. The company received over $6 million in PPP loans but settled to pay over $9 million back to the government. Both of these cases highlight the change in scope from simple instances of fraud, with individuals and small businesses, to more intricate and sophisticated forms of PPP loan fraud coming from larger companies, which each fall under the purview of the False Claims Act. If you are suspicious of similar activity taking place, search for a PPP fraud attorney near you to maximize your chances of both bringing justice and securing a PPP loan fraud reward. False Claims Act qui tam cases require the use of legal representation in order to be eligible for whistleblower rewards, so finding an experienced PPP fraud law firm is a must.

[1] https://www.sba.gov/document/report-23-09-covid-19-pandemic-eidl-ppp-loan-fraud-landscape

[2] https://www.justice.gov/usao-ndga/pr/reality-tv-star-sentenced-ppp-fraud-and-operating-multimillion-dollar-ponzi-scheme#:~:text=ATLANTA%20%2D%20Maurice%20Fayne%2C%20who%20starred,Paycheck%20Protection%20Program%20(PPP)%20loan

[3] https://bluellp.com/2023/02/14/what-is-ppp-fraud/#:~:text=PPP%20fraud%20can%20take%20many%20forms%2C%20but,tax%20returns%2C%20payroll%20records%2C%20or%20financial%20statements.

[5] https://ifightforyourrights.com/blog/national-roofing-company-resolves-ppp-fraud-claims-pays-9m-false-claims-act-settlement/