DOJ Charges Nearly 200 People in $2.7B Nationwide Healthcare Fraud Crackdown

Table of Contents

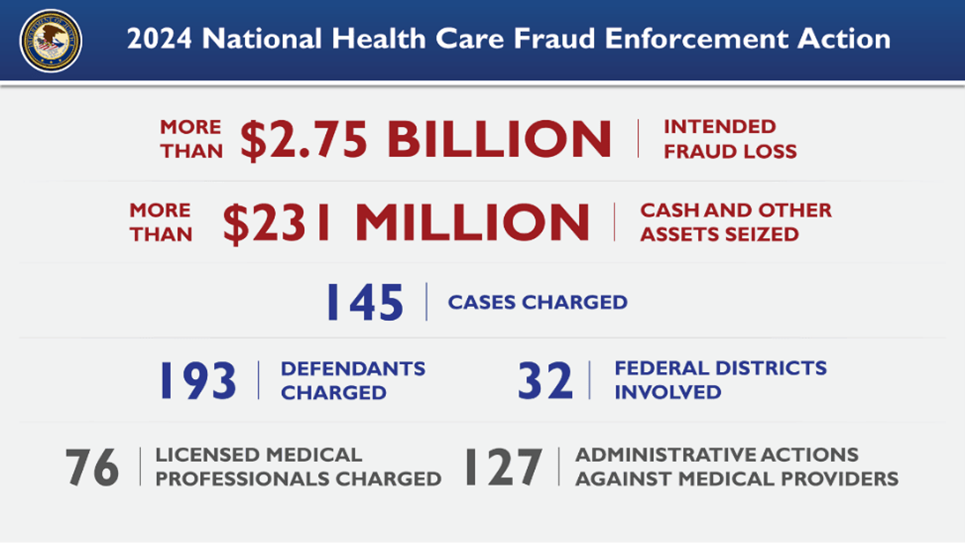

In June 2024, the Department of Justice announced an indictment of 193 defendants for their alleged involvement in over $2.75 billion worth of healthcare false claims. Known as the 2024 National Health Care Fraud Enforcement Action, the event was a coordinated effort between federal and state law enforcement to identify healthcare providers allegedly defrauding Americans. Multiple fraudulent schemes were identified across the nation, including an alleged $900 million fraud scheme occurring in Arizona. The 2024 National Health Care Fraud Enforcement Action highlights the government’s dedication to holding health care providers and prescribers accountable for endangering patients for the sake of profit. These enforcement actions demonstrate the importance of retaining a well-versed healthcare fraud lawyer to evaluate whether you have a viable False Claims Act case to present to the government. The False Claims Act allows a whistleblower who successfully invokes it to receive up to 30% of what the government recovers as a whistleblower reward and in this crackdown, had there been a whistleblower or whistleblowers they may in aggregate receive close to a billion in False Claims Act whistleblower awards.

Notable Allegations in the 2024 National Health Care Fraud Enforcement Action

Of the 193 total defendants listed in the Department of Justice’s announcement, 76 were licensed medical professionals (including doctors, nurse practitioners, etc.). Notable allegations included the following:

- Amniotic & Skin Wound Grafts: Four individuals were alleged to have filed $900 million in false claims for the use of amniotic and skin wound grafts on terminally ill and elderly Medicare patients. The grafts were deemed medically unnecessary and applied without proper treatment for infection. Medicare paid on average more than a million dollars per patient for unnecessary grafts.

- Adderall Distribution: Five defendants from a digital technology company, cloaked as a health care company, were charged with allegations of unlawfully distributing millions of Adderall pills. As part of the scheme, a Florida nurse practitioner allegedly prescribed over 1.5 million pills of Adderall to patients across the United States without interacting with patients that were further enabled through an “auto-refill” policy. The unnecessary prescriptions were alleged to have furthered drug addiction, and the accused allegedly went as far as to continuing prescriptions for patients who had already died of an overdose. Auto-refill cases are potential significant cases under the False Claims Act, where health care practitioners who are supposed to interface with their patients fail to do so and need to do so to check on the wellness of their patient and the risks of continued usage of the medication.

- HIV Medication: Owners and executives of a pharmaceutical drug distributor were alleged to have introduced $90 million of mislabeled and adulterated HIV drugs that were acquired through “buyback schemes” from vulnerable patients. These drugs were alleged to have been resold with falsified documentation to hide the source of the medications, leading to different drugs being sold entirely in some cases. Notably, one patient was alleged to have been knocked unconscious for 24 hours by consuming an anti-psychotic drug.

- Addiction Treatment: Charges were filed in Arizona and Florida against four defendants that allegedly claimed $146 million they weren’t entitled to for treating vulnerable patients for drug/alcohol addiction. In one instance, a defendant allegedly paid kickbacks to recruit patients from both homeless encampments and Native American reservations and never provided services to patients from either group. Kickbacks inherently are prohibited under the Anti-Kickback Statute (AKS) and actionable through the False Claims Act when funds from the federal government such as Medicare or Medicaid are involved.

Other notable allegations include telemedicine fraud, laboratory fraud, and illegal distribution of opioids. The wide variety of false claims investigated illustrates the high priority the U.S. government places on the enforcement of healthcare fraud cases and the importance of whistleblowers bringing information to light.

The Scope of the 2024 National Health Care Fraud Enforcement Action

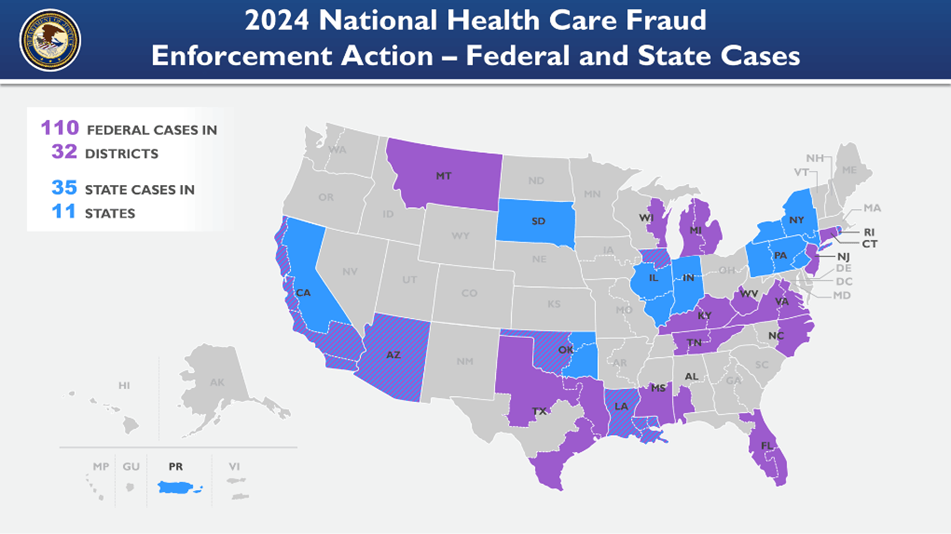

The 2024 National Health Care Fraud Enforcement Action involved multiple agencies in over 32 federal districts across the United States. 32 U.S. Attorneys’ Offices and 11 State Attorney Generals’ Offices were involved. The prosecution of the claims was led by the Health Care Fraud Strike Force teams and coordinated by the Health Care Fraud Unit of the Criminal Division’s Fraud Section. Other core partners included the Department of Health and Human Services (DHHS), the Office of Inspector General (OIG), the FBI, and the DEA.

The large number of agencies involved, and the coordinated enforcement demonstrates the level of importance the U.S. government places on stopping health care fraud. Given the large financial implications these cases have and the potential to put a large number of Americans in physical risk, the U.S. government relies strongly on the tips of whistleblowers to escalate further action against these fraudulent claims. A healthcare fraud attorney is essential to effectively bring a case under the False Claims Act.

The False Claims Act in Health Care Fraud

The False Claims Act was enacted in 1863 under President Lincoln. The law allows whistleblowers, also known as relators, to file lawsuits on behalf of the U.S. Government against bad actors committing fraud against the government. In health care fraud actions, the False Claims Act is typically implicated when individuals or organizations submit fraudulent claims for Medicare, Medicaid, or TRICARE payments. Typical examples include billing for services not provided, overbilling, billing for services that are not medically necessary, etc.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Whistleblowers in health care fraud claims are often employees, contractors, or insiders who are privy to information for false billing or kickback schemes. A claim under the False Claims Act is known as a “qui tam” lawsuit. Once filed, the government decides whether to “intervene” on behalf of the relator. The government may choose to intervene and take over the case, or it may allow the whistleblower to proceed independently. If the case is successful, a whistleblower will receive a portion of the judgment, typically ranging from 15% to 30%, depending on whether the government intervenes. A qualified healthcare fraud lawyer can assist in bringing the strongest possible case for a qui tam lawsuit under the False Claims Act.

Check out this article on the dangers of healthcare fraud for patients and the healthcare system.