Deleting that Email? Think Again. Why the SEC is Fining Companies Hundreds of Millions while Giving SEC Whistleblowers Millions

Table of Contents

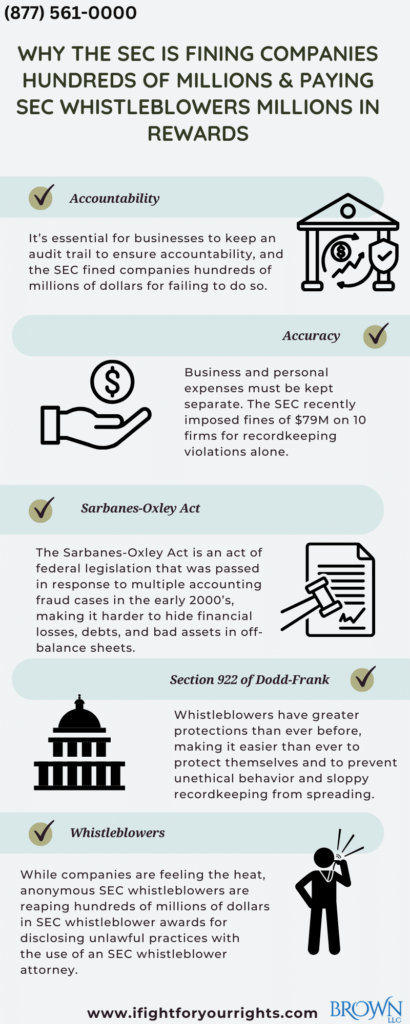

Accountability requires an audit trail, and the SEC is fining companies hundreds of millions of dollars who fail to preserve that audit trail when companies either deliberately destroy information or when they notice that their employees are communicating with clients via back channels and not taking steps to preserve those communications. While companies are feeling the sting, anonymous SEC whistleblowers are reaping tens of millions of dollars in SEC whistleblower awards for disclosing these unlawful practices.

For example, it’s well established that it’s common practice to wine and dine clients in the financial industry. Who wouldn’t want to ingratiate themselves with those they do business with? Humans are social creatures after all. You might not even think twice about texting clients about transactions on your own cell phone thereby interspersing work and pleasure together.

Companies need to think twice if they foster an atmosphere that allows back-channel communications such as personal texts or in the case of foreign clients in China, for example, with WeChat or other platforms in which the company is not preserving the communications. The SEC sees things in strictly black and white terms. THIS IS NOT A GREY AREA. They are clear that using personal apps or communications for transactions is a way of avoiding appropriate record keeping. They’ll look at whether the company knows of a widespread failure to keep records of documents, and if they are, they will fine the company and potentially reward the whistleblower.

Accuracy in keeping records- not a trivial matter

Expenses for business, and expenses for personal use must be kept strictly separate. If you’re putting personal purchases on your company credit card, think again.

The SEC recently imposed fines of $79M on 10 firms for recordkeeping violations alone. The recipients of the fines included:

- Interactive Brokers Corp. and affiliate Interactive Brokers LLC (together, Interactive Brokers) agreed to pay a $35 million penalty;

- Robert W. Baird & Co. Inc. agreed to pay a $15 million penalty;

- William Blair & Company LLC and affiliate William Blair Investment Management LLC (WBIM) agreed to pay a $10 million penalty;

- Nuveen Securities LLC agreed to pay an $8.5 million penalty;

- Fifth Third Securities Inc. agreed to pay an $8 million penalty; and

- Perella Weinberg Partners LP (Perella Weinberg), together with Tudor, Pickering, Holt & Co. Securities LLC (TPH) and Perella Weinberg Partners Capital Management LP (Perella Weinberg Capital), which self-reported, agreed to pay a $2.5 million penalty.

At the same time, the SEC is awarding whistleblowers up to 30% of the recovered amount as an SEC whistleblower reward and better yet, with the use of an SEC whistleblower attorney, the individual has the potential to stay anonymous from start to finish.

The authority for the SEC to act on the inaction of companies to maintain proper audit trails and to reward and protect SEC whistleblowers emanates from its regulatory powers and a couple statutes: Sarbanes-Oxley Act and Dodd-Frank.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Sarbanes-Oxley Act

The Sarbanes-Oxley Act is an act of federal legislation that was passed in response to multiple accounting fraud cases in the early 2000’s, such as Enron, WorldCom, and Tyco International that seeded distrust in US financial markets. Sarbanes-Oxley made it harder to hide financial losses, debts, and bad assets in off-balance sheet special purpose vehicles, such as transferring debt to a subsidiary so it doesn’t show in the company’s losses and defining the company’s value on gains that have not yet been realized rather than updated financial figures. It also prevents a firm from interloping in an external independent financial audit. Sarbanes-Oxley mandates precise procedures for the veracity of financial statements and designates responsibility to the CEO and CFO for proper record keeping. Section 401 requires the disclosure of off-balance sheet transactions.

In 18 U.S. Code § 1515, misleading conduct includes:

(A) knowingly making a false statement;

(B) intentionally omitting information from a statement and thereby causing a portion of such statement to be misleading, or intentionally concealing a material fact, and thereby creating a false impression by such statement;

(C) with intent to mislead, knowingly submitting or inviting reliance on a writing or recording that is false, forged, altered, or otherwise lacking in authenticity;

(D) with intent to mislead, knowingly submitting or inviting reliance on a sample, specimen, map, photograph, boundary mark, or other object that is misleading in a material respect; or

(E) knowingly using a trick, scheme, or device with intent to mislead;

Improper record keeping falls under misleading conduct, as ignorance is no defense in a court of law.

Section 922 (Whistleblower Protection) of Dodd-Frank

- Contains provisions under which a whistleblower award can be rescinded or not offered at all.

- Dodd-Frank ultimately strengthened and expanded the Whistleblower program promoted by Sarbanes-Oxley.

- Increased protections for whistleblowers make it easier than ever to take a stand for what is right and provide an internal immune response of sorts to the contagion of unethical behavior and sloppy recordkeeping within.

- Some exclusions do apply however:

- External accountants providing auditing services, persons with compliance/auditing responsibilities, attorneys representing clients who are whistleblowers, as well as upper management of a firm informed of misconduct, foreign government officials are some examples.

- The extent to which a whistleblower reports violations through internal channels initially, may affect the rewards a whistleblower receives.

- Behavior such as impeding a company’s internal compliance and participating in misconduct is highly relevant to potential qui tam rewards.

If you’re aware of the failure to preserve an audit trail in a financial industry, contact an SEC whistleblower attorney right away.

Hundreds of millions in aggregate have gone to SEC whistleblowers and if you have information regarding the destruction of audit trails, failure to preserve audit trails or other regulatory violations in which the company has failed to keep the best interest of the client above its own interest, the SEC may want to hear from you. You should contact some of the best SEC whistleblower law firms to learn your rights and understand how you can help the system by disclosing the violation and potentially keep it more secretive than the emails the company failed to preserve.