CFTC Directs Trafigura to Pay $55M for Fraud and Market Rigging

Table of Contents

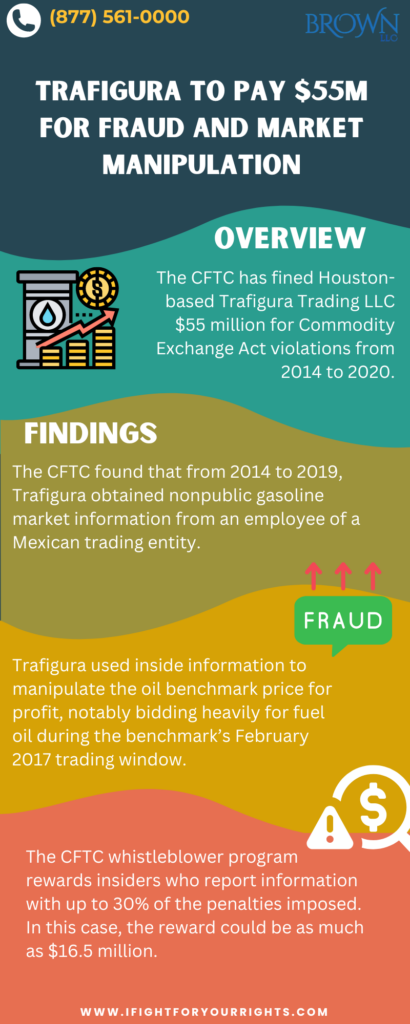

In a recent action, the Commodity Futures Trading Commission (CFTC) has ordered Houston-based global commodities merchant Trafigura Trading LLC, to pay $55 million as a monetary penalty for multiple Commodity Exchange Act violations that occurred between 2014 and 2020. Specifically, the CFTC found that Trafigura misappropriated nonpublic information for trading advantages and manipulated fuel oil benchmarks. This case is notable in that it is the first instance where the CFTC has taken action against a company for preventing whistleblowers from cooperating with the authorities. The SEC cracked down on this practice over the last decade, but companies who have language in their agreements that don’t carve out the ability for individuals to cooperate with the authorities may independently receive an SEC or CFTC warning or fine for their conduct as a stand-alone cause of action.

Trafigura Trading LLC Obtains Confidential Insider Information

Founded in 1993, Trafigura Trading LLC is a global commodity trading firm from Houston that specializes in the trading of oil, petroleum, metals, and minerals. The CFTC determined that between 2014 and 2019, Trafigura obtained nonpublic information regarding the gasoline market from a Mexican trading entity’s employee that was also in breach of the Mexican trading entity’s rules. This included early receipt of the pricing formulas the entity used to determine the price for selling gasoline as well as information on the volume, types, and destination ports for planned imports.

Trafigura Trading LLC’s Manipulative Conduct

The CFTC determined that Trafigura was able to manipulate the benchmark price of oil to profit in open arbitrage for fuel oil. In February 2017, Trafigura used its inside knowledge to bid heavily for fuel oil in the benchmark’s trading window. This heavy bidding and buying activity artificially increased the benchmark values, from which Trafigura benefited due to its long derivatives position. The remainder of the market participants seeking to rely on the benchmark were thus trading based on artificial results due to Trafigura’s manipulation.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

First CFTC Enforcement Action for Impeding Whistleblowers

The CFTC’s ruling was notable in that this is the first action by the agency against a company for preventing whistleblowers from coming forward. From 2017 to 2020, the CFTC found that Trafigura required employees to sign employment agreements with broad non-disclosure provisions. Former employees were also asked to sign separation agreements with the same provisions. These non-disclosure provisions did not have carve-out language allowing for current and former employees to communicate with law enforcement and regulators, which included the CFTC. The SEC is recent years has cracked down on language that obstructed whistleblowers from providing truthful information to the authorities as against public policy.

What is the CFTC Whistleblower Program?

The CFTC’s whistleblower program is designed to encourage individuals to report violations of the Commodity Exchange Act. The program was put in place by the Dodd-Frank Wall Street Reform and Consumer Protection Act. Passed in response to the 2008 financial crisis, the Act authorizes the CFTC to provide monetary awards to whistleblowers who voluntarily report violations of the Commodity Exchange Act. If the information leads to an action or significantly contributes to the respective action, the CFTC is authorized to provide awards provided that the sanction is over $1 million, which is known as a “Covered Action.” There is another category that may be eligible known as “Related Actions.” The awards of the CFTC are similar to the SEC whistleblower program. The CFTC pays a total award between 10 to 30% of the monetary sanctions in the Covered Action or Related Action.

The CFTC Whistleblower Programs and the Importance of a CFTC Whistleblower Lawyer

The role of a CFTC whistleblower lawyer is important to guide a potential whistleblower on the complexities of the reporting process, which is to file a very articulate TCR (Tips Complaints Report). Potential CFTC whistleblowers may benefit with the use of an attorney by potentially maintaining their anonymity and having their law firm if the matter resolves try to prepare a cogent argument about why the individual should be entitled to an award and argue for the potential maximum award. Experienced lawyers in this field will help guide their clients through the legal intricacies of complying with all procedural requirements, presenting the matter in a manner the CFTC can relate to, and shepherding it through the process.

The CFTC whistleblower program encourages insiders with information like contained herein to report it and in turn potentially be eligible for a CFTC whistleblower award up to 30% of the amount levied, which in the instant case could be as high as a $16.5 million CFTC whistleblower reward. Additionally, the program encourages the use of a CFTC whistleblower law firm since you may be able to stay anonymous from start to finish with a lawyer. Also, there’s tricky parts of the CFTC program just like the SEC whistleblower program. Both have a large volume of tips, so in order to succeed the tip should be written in a manner that’s easily digestible by the CFTC citing regulations, facts, and comparable actions. These whistleblower programs are so secretive sometimes that the whistleblower is not necessarily notified of the action taken against the company! Further, the individual has to continue to monitor the Notice of Covered Actions and then if they see their complaint in a NOCA, they need to elocute why they are the one who is eligible for the award. Seasoned whistleblower law firms add value from start to finish with the CFTC TCR process.

While the anonymity offered with the program inherently bestows a level of protection, CFTC whistleblower lawyers know how to utilize laws concerning retaliation against whistleblowers if the individual has also reported the misconduct internally and is facing repercussions. Potential remedies include helping whistleblowers seek reinstatement, back pay, and compensation for any damages suffered due to retaliation. However, instead of facing retaliation its best to speak with an accomplished whistleblower law firm, preferably a firm with people who used to work at the Department of Justice to share with you the government perspective on things and also coach you early before you even report the matter internally about how to report things the right way.