Another $100 Million in SEC Whistleblowers Awards, Reaching $2 Billion Milestone

Table of Contents

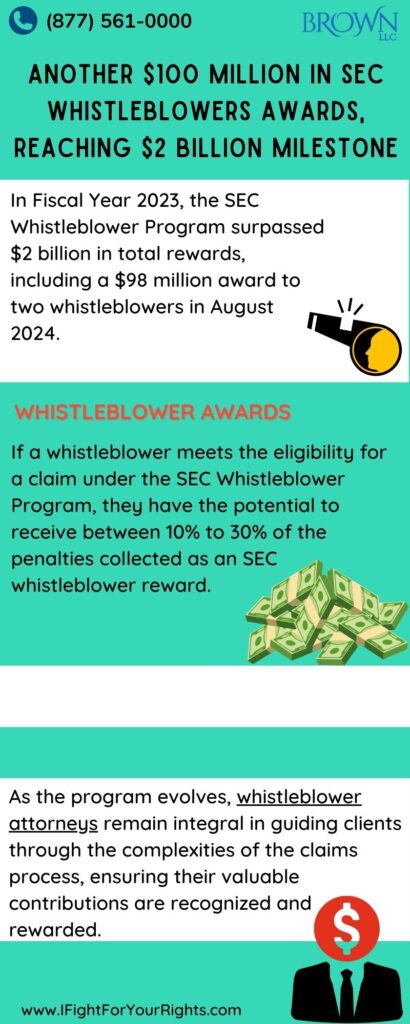

The SEC Whistleblower Program reached a milestone in Fiscal Year 2023 by surpassing the lifetime $2 Billion mark for aggregate SEC whistleblower rewards. The $2 Billion amount includes a recent SEC award in August 2024 of more than $98 million to two whistleblowers. Since the inception of the SEC Whistleblower Program in 2010, the program has rewarded individuals for providing critical information on federal securities laws violations. These recent milestones highlight the success of the SEC Whistleblower Program and its importance in incentivizing whistleblowers to come forward with credible insider information. The marker also highlights the importance of SEC whistleblower lawyers successfully advising their clients throughout the legal process.

The History of the SEC Whistleblower Program

The SEC Whistleblower Program was established in 2010 by the Dodd-Frank Act. Due to the 2008 financial crisis, several high-profile financial scandals were revealed, such as the Madoff Ponzi scheme and the bankruptcy of large financial institutions due to a concentration risk for subprime mortgages. In response, the government established the SEC Whistleblower Program to incentivize insiders with information to come forward and report securities laws violations and in turn receive a whistleblower award of up to 30% of what the government recovers. In the early years, the program focused on establishing processes for whistleblowers to come forward and granted its first award at a modest sum of $50,000 in 2012. The program has continued to grow, including notably the largest-ever award at the time in 2014 of $30 million. In recent years, the program has surged due to an increased focus on financial crimes and the SEC streamlining the award process.

Notable SEC Whistleblower Awards

Over 400 whistleblowers have received awards since the inception of the program, including the highest whistleblower award ever offered consisting of $114 million. Here are some claims of note:

- Merrill Lynch (2016 – $83 Million award): The SEC awarded a group of whistleblowers one of the largest awards ever for exposing alleged misconduct at Merrill Lynch. Merrill Lynch was accused of misusing customer funds and failing to safeguard customer assets by generating false profits to primarily benefit the firm.

- Monsanto (2016 – $22 Million award): A whistleblower was awarded for exposing former biotech company Monsanto for alleged accounting violations related to its flagship product. The whistleblower was a former financial executive who revealed information that allowed the SEC to charge the company for failing to properly report earnings over three years.

- Deutsche Bank (2015 – $16.5 Million award): In one of the first significant awards ever under the SEC Whistleblower Program, Deutsche Bank was charged for misstating the value of one of its derivatives portfolios. The action led to investors being misled about the true financial condition of the bank. The whistleblower was a former risk officer at the bank.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

SEC Whistleblower Claim Eligibility

Under the SEC Whistleblower Program, whistleblowers who meet the criteria of an eligible claim may receive a portion of the penalties that the agency collects. To be eligible, the claim must meet the following criteria:

- Original: To be considered “original information” by the SEC, the information must be “independent knowledge or analysis.” This means the information cannot be sourced from public information or third-party reports and should not already be known to the SEC. 17 C.F.R. § 240.21F-4

- Timely: The information must have been provided to the SEC for the first time after July 21, 2010, following the enactment of the Dodd-Frank Act. Additionally, the information must have been provided within a time frame for the SEC to act upon it. https://www.sec.gov/news/press/2011/2011-116.htm

- Credible: The information must be reliable and specific enough to be actionable. For information to be deemed credible, it must present clear, detailed, and verifiable facts that support the claims of a violation of securities laws. The SEC assesses credibility based on the quality of the evidence provided, such as documentation, the specificity of the allegations, and whether the information aligns with other known facts or leads to further investigation. https://www.sec.gov/enforcement-litigation/whistleblower-program

- Sanctions exceed $1 million: The information provided by the whistleblower must lead to a successful enforcement action where the SEC imposes monetary sanctions that exceed $1 million. The $1 million threshold includes the total of all penalties, disgorgements, and interest collected in the action. Multiple enforcement actions arising from the same core information can be aggregated to meet this threshold. https://www.sec.gov/files/rules/final/2011/34-64545.pdf

Whistleblower Award Eligibility

If a whistleblower meets the eligibility for a claim under the SEC Whistleblower Program, they have the potential to receive between 10% to 30% of the penalties collected as an SEC whistleblower reward. The award is presumed to be 30% if the award is $5 million or less and there are no negative factors, such as the whistleblower being part of the illegal action, withholding reporting, or interfering with the investigation. Rule 21F-6(c). If the award is over $5 million, the SEC considers the following factors:

- Factors increasing the award percentage:

- The significance of the information provided

- The extent of the assistance provided in its investigation and any successful proceeding

- Law enforcement interest in deterring violations of the securities laws by making awards to whistleblowers who provide information that leads to the successful enforcement of these laws

- Whether, and the extent to which, the whistleblower participated in the company’s internal compliance systems, such as, for example, reporting the possible securities violations through internal whistleblower, legal or compliance procedures before, or at the same time, reporting them to SEC

- To reduce the award only (i.e., not the percentage):

- If the whistleblower was a participant in, or culpable for the securities law violation(s) they reported

- If they unreasonably delayed reporting the violation(s) to SEC

- If they interfered with their company’s internal compliance and reporting systems, such as making false statements to their compliance department that hindered its efforts to investigate possible wrongdoing

The SEC Whistleblower Program continues to demonstrate its pivotal role in maintaining the integrity of the financial markets. As the program evolves, whistleblower attorneys remain integral in guiding clients through the complexities of the claims process, ensuring their valuable contributions are recognized and rewarded.

What Securities Violations Can Be Reported Under the SEC Whistleblower Program?

Any potential SEC violation can be reported by whistleblowers if the conduct has an impact to investors, especially if the wrongful conduct subordinates the investors interest to the fiduciaries. The SEC provides some typical examples of the conduct its interested in addressing and holding bad actors accountable for. Here are some of the SEC violations that are addressed through the SEC whistleblower program, including, but not limited to:

- Ponzi scheme, Pyramid scheme, or a High-Yield Investment Program: Investment scams in which the principals use subsequent monies to pay earlier investors but falsify statements to make it look like everyone is earning money – until it inevitably implodes like Bernie Madoff.

- Theft or misappropriation of funds or securities: Using investor money inappropriately, such as embezzlement or for personal gain.

- Manipulation of a security’s price or volume: Commonly known as “pump and dump” schemes, these are actions that artificially inflate the market temporarily to allow for buyers to profit, such as release false press releases or mounting an underground internet team to penetrate the information boards with false intelligence.

- Insider trading: Transactions that occur based on privileged, insider information not available to the public.

- Fraudulent or unregistered securities offering: Sales that occur without valid SEC registration or false information.

- False or misleading statements about a company (including false or misleading SEC reports or financial statements): False or misleading financial reports or press releases about a company.

- Abusive naked short selling: Shorting without confirming shares can be borrowed.

- Bribery of, or improper payments to, foreign officials: Violations of the Foreign Corrupt Practices Act, such as bribing foreign officials.

- Fraudulent conduct associated with municipal securities transactions or public pension plans: False statements regarding public funds.

- Initial Coin Offerings and Cryptocurrencies: False statements and product involving digital assets such as cryptocurrencies and NFTs. The SEC may have concurrent jurisdiction with the CFTC.

Notable SEC Whistleblower Cases & Awards

According to the SEC’s official reports, the SEC awarded over $850 million to whistleblowers, including the largest ever SEC whistleblower award of $279 million in May 2023. Here is a summary of notable cases during this time frame:

- May 5, 2023: As, The SEC issued the largest ever award in the program’s history to a whistleblower who provided information that led to a successful enforcement.

- August 4, 2023: The SEC provided awards totaling more than $104 million to seven individuals for their assistance in providing documents supporting allegations that a company had engaged in securities misconduct.

- July 17, 2024: A $37 million SEC whistleblower award was provided to a whistleblower who provided information that was not known to the SEC which was significant in contributing to the enforcement action. The whistleblower’s actions included identifying potential witnesses and documents as well.

- October 10, 2024: The SEC awarded $12 million in SEC whistleblower rewards among three whistleblowers who provided key information that allowed for the enforcement of the claim.

Check out this overview of the SEC Whistleblower Program and how whistleblowers can potentially earn millions anonymously.