5 Signs You’re a Victim of Wage Theft and How to Fight Back with a Wage and Hour lawyer

Table of Contents

Wage theft is a widespread issue affecting workers in all industries. Sometimes employees don’t realize they are victims until they start looking closely at their paychecks and comparing them to what they are really owed. Employers count on the fact that if they get away with it for 10 years, Federal law only makes them pay back for three years of the violation so they feel like they’ve won – and they have since, they may not have to pay back everyone, and even the people they pay, they try to pay a fraction of what they’re owed.

It’s called “wage theft” for a reason – it is theft and it’s morally and legally wrong and, in some states it’s considered criminal! After all, if you went into your employer’s bank account and deducted money without authorization it would be considered criminal embezzlement, but if they deduct money from your paycheck you need to fight to recoup it.

Luckily there are wage and hour lawyers and employment law firms that know how to navigate the laws and help you recover your shorted wages, and sometimes double damages and other incentive awards for remedying the injustice.

Federal and state laws are designed to protect employees from unfair wage practices, but without legal help, many workers never recover their lost earnings. A lawyer can help ensure that workers receive the pay they are entitled to, including back wages, penalties, and damages.

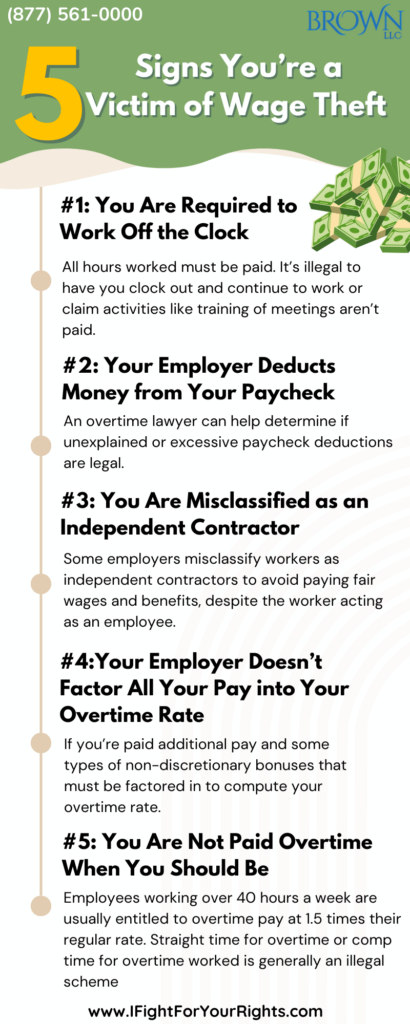

5 Common Signs of Wage Theft

You Are Not Paid Overtime When You Should Be

Most employees who work more than 40 hours in a workweek are entitled to overtime pay, which is typically one and a half times their regular hourly rate. Many employers try to avoid paying overtime by misclassifying employees as exempt from overtime, shifting hours between weeks to avoid going over 40, paying straight time for overtime or simply refusing to acknowledge extra time worked. Some employers make employees only receive pay for their scheduled shift instead of the actual work, others shave the time off and still others threaten workers who report overtime worked but encourage the work just the same.

With the popularization of remote work, workers sometimes have to spend up to 30 minutes logging into computer systems before they are paid, especially call center workers, and the employer tries to make them believe they don’t have to pay for that because its like time spent commuting. Even in person call center workers sometimes have to spend considerable time reading emails and logging into systems before logging into the timekeeping system which is a violation.

However, anything your employer makes you do for work is compensable, so don’t believe the lies!

Some employers try to claim salaried employees are not entitled to overtime, but that is not always true. Only employees who meet specific exemption requirements under the Fair Labor Standards Act (FLSA) can be denied overtime pay. If your employer has classified you as exempt from overtime because of a salary without a clear explanation or proof that you meet legal requirements, you may be owed unpaid overtime.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

The exemptions from paying overtime are well defined and the more ordinary your job is the more likely that you’re entitled to overtime pay. Even sophisticated jobs that properly salary an employee may still have to pay overtime if the employee doesn’t’ receive the benefit of the salary – that is, if the employee is paid the same weekly pay regardless of how many hours over 40, they work, in weeks they work under 40 if the employer deducts pay, it may be a violation.

A wage and hour lawyer can review your job classification and work history and paystubs to determine if your employer is violating wage laws. Have no fear if you don’t easily have your paystubs handy – from your information alone they can still potentially commence an unpaid wages lawsuit. If you are entitled to overtime pay that has not been provided, an unpaid overtime attorney can pursue legal action to recover what you are owed and try to have the employer pay back double the damages, plus attorneys’ fees and costs.

You Are Required to Work Off the Clock

Employers sometimes pressure workers to complete tasks before or after their scheduled shifts without compensation. This might include setting up before a shift, staying late to finish work, or responding to emails and calls outside of work hours. Even short periods of unpaid work add up over time and can result in significant lost wages.

Some employers implement policies requiring employees to clock out before finishing their work or claim that work-related activities such as training sessions or mandatory meetings do not count as paid time. Under wage and hour laws, all work performed for the benefit of an employer must be compensated.

If you are regularly working without pay, an attorney can help you gather evidence the right way, such as work logs and communications, to demonstrate that your employer is violating wage laws. An attorney can also help ensure you are compensated for past unpaid work and that your employer stops illegal labor practices moving forward.

Your Employer Deducts Money from Your Paycheck for Unlawful Reasons

Wage deductions can sometimes be legal, such as deductions for taxes or employee benefits, but some employers take advantage of workers by making deductions that violate wage laws. Common examples include deducting money for cash register shortages, damaged equipment, or work-related supplies. Other times it’s a mystery deduction just called MISC or something like that.

In many cases, these deductions bring an employee’s hourly wage below the legal minimum, which is prohibited under federal and state laws. Even if an employee agrees to the deductions, an employer may still be violating labor laws by failing to pay the required minimum wage. And an individual may not be able to give their consent for an illegal deduction despite the employer claiming otherwise.

If your paycheck includes unexplained or excessive deductions, a lawyer can help determine whether they are legal. If they are not, an attorney can demand repayment of the wages withheld and take legal action if necessary.

You Are Misclassified as an Independent Contractor

Independent contractors are not entitled to the same legal protections as employees, including overtime pay, minimum wage guarantees, and benefits. Some employers misclassify workers as independent contractors to avoid paying fair wages and benefits, even though the worker functions as an employee. Also, independent contractor schemes commonly are tax fraud schemes too since they short payroll taxes and may trigger certain IRS whistleblower laws if pervasive and over $ 2 million in liability.

Misclassification is a significant issue in industries such as construction, trucking, and gig work, but it can happen in any field. If your employer controls your work schedule, provides the tools and materials you need to do your job, and closely supervises your tasks, you may legally be an employee rather than a contractor.

A wage and hour attorney can assess your job conditions and determine if you have been misclassified. If so, an attorney can help you recover the wages and benefits you should have received as a legally recognized employee.

Your Employer Does Not Provide Legally Required Breaks or Meal Periods

Many states require employers to provide rest breaks and meal periods to employees. Some employers violate these laws by requiring workers to stay on duty during breaks, discouraging them from taking breaks, or failing to pay employees for required break times.

Employees who are required to work through their breaks must be compensated for that time. For example, if a worker is required to stay at their desk and answer calls during lunch, that time should be paid. In some cases, if a worker is denied proper meal and rest breaks, they may also be entitled to additional pay as a penalty. Some workers have an automatic meal break deduction of time regardless of whether they work the meal or not.

A wage and hour lawyer can help determine if your employer is violating break laws and whether you are entitled to additional compensation. An attorney can also take legal action to ensure that your employer changes their policies to comply with labor laws.

How a Wage and Hour Lawyer Can Help

Employers who engage in wage theft often assume that employees will not challenge them. Many workers fear retaliation, believe they don’t have enough evidence, or simply don’t know where to start. A wage and hour attorney can guide you through the process, protect your rights, and ensure you receive the compensation you deserve.

An attorney can help by:

- Reviewing your pay records and identifying violations of wage laws

- Gathering evidence to support your claim, including time records and witness statements

- Negotiating with your employer pre-suit via a demand letter to recover unpaid wages

- Filing a legal claim under the Fair Labor Standards Act (FLSA) and/or state wage and hour laws if your employer refuses to pay

- Protecting you from retaliation and ensuring your rights are upheld

In many cases, attorneys handle wage and hour claims on a contingency basis, meaning you don’t pay anything upfront, and the attorney only collects a fee if they recover money for you.

Take Action Before It’s Too Late

Wage theft claims are subject to strict time limits, so it’s important to act quickly if you believe your employer is underpaying you. The longer you wait, the harder it may be to recover lost wages.

If you suspect that your employer is not paying you what you are owed, consulting a wage and hour lawyer can help you understand your rights and take the necessary steps to recover your earnings. Seeking legal help can make a significant difference in ensuring that employers are held accountable and that you receive the compensation you have rightfully earned.

It’s your money – you worked hard for it, don’t let the employer win – if they shorted your pay, you have rights! You can collect double damages under Federal Law, and sometimes triple damages under State law. New Jersey wage and hour violations have a triple damage component! Massachusetts overtime rights dictate at least three times damages! And the attorneys’ fees and costs may have to be paid on top of your damages.

Learn your rights, fight back and have a free consultation with one of the best wage and hour law firms. Your actions may help yourself as well as assist others and quality employment law firms like Brown, LLC offer free consultations and typically are only paid if they win your case – so let us educate you and fight for your rights.