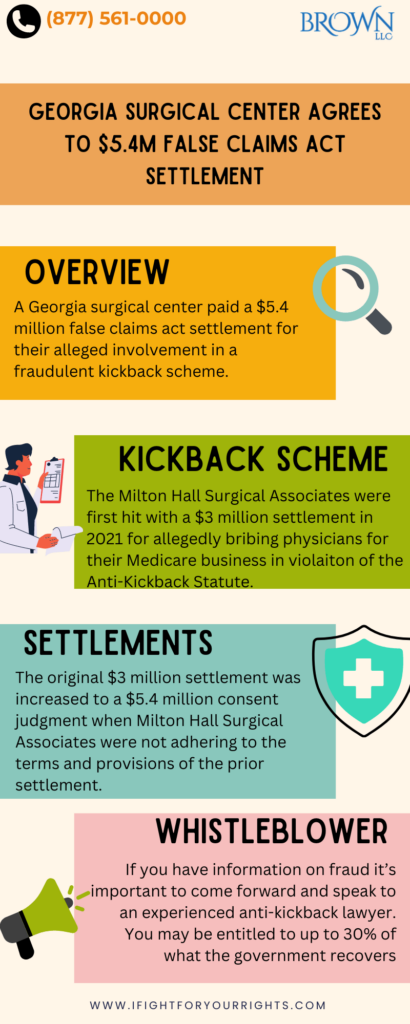

Georgia Surgical Center Agrees to $5.4M False Claims Settlement

Table of Contents

Healthcare fraud is a critical problem because it affects the credibility of the healthcare system, inflates costs for ordinary taxpayers and can directly harm patients. Recently, a Georgia surgical center and its former head were penalized $5.4 million for their involvement in a fraudulent kickback scheme.

Background of the Case

The Milton Hall Surgical Associates, along with another doctor, were first hit with a $3 million settlement in 2021 for allegedly bribing physicians. The whistleblower, a doctor and employee of Milton Hall, filed a complaint under the False Claims Act with a whistleblower law firm alleging that his employer received millions of dollars in kickbacks from medical service providers after they conducted unjustified procedures on patients to generate illicit profits (1). These fraudulent activities were allegedly related to the indictment of a former insurance commissioner of Georgia.

Elements of the Scheme

Among the companies involved in the scheme were Next Health LLC and Entellus Medical Inc., which provided unnecessary medical services to Milton Hall’s patients. These companies conducted nasal procedures that were medically unnecessary, and they did so only to receive insurance monies, some of which implicated Medicare fraud and Medicaid fraud (2). The Anti-Kickback Statute prohibits paying incentives to bill Medicare or Medicaid precisely to prevent acts like this which interfere with medical judgment, elevate healthcare costs, and put competition at an unfair disadvantage.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Penalty Enhancement and False Claims Act Litigation

The original $3 million settlement was increased to a $5.4 million consent judgment when Milton Hall Surgical Associates were not adhering to the terms and provisions of the prior settlement. A U.S. District Judge approved this higher settlement amount to signal a mechanism to enforce settlement obligations under the False Claims Act. This legal action demonstrates the penalties one must potentially pay for violating the False Claims Act settlement terms.

Impact of Whistleblowers on Healthcare Fraud

On the flip side the whistleblower in this case is entitled to up to 30% of what the government recovers, so it could be a $1.5 million whistleblower award for disclosing the fraud. Whistleblowers such as the relator (another name for whistleblower) in this case are essential to unveiling and addressing healthcare fraud. Under the False Claims Act, whistleblowers receive certain protections and potential monetary rewards for coming forward with credible and novel information of fraud against government contracts and programs. In most cases, whistleblowers are insiders who have detailed knowledge of fraud, which is critical to a successful case, however, outsiders and others are still eligible to blow the whistle (3).

Whistleblowers are well protected under the False Claims Act from retaliation by their employer, including prohibitions against being fired, demoted, or harassed for reporting fraud. This protection is vital because it encourages insiders to feel safe and incentivizes them to report the wrongdoing without worrying about reprisals (4).

Broader Context of Healthcare Fraud Enforcement

The case against Milton Hall Surgical Associates is part of a broader effort by the U.S. Department of Justice to combat healthcare fraud. In the past few years, many healthcare providers have paid significant settlements for violations under the False Claims Act and the Anti-Kickback Statute. For example, the Department of Justice settled with several anesthesia providers and outpatient surgery centers for over $28 million for a kickback scheme in 2021(5).

Additionally, a report from the DOJ stated that for fiscal year 2023, settlements and judgments under the False Claims Act amounted to over $2.68 billion, indicating that the government is strongly committed to combatting healthcare fraud (6).

The enhanced penalty imposed on the Georgia-based surgical center speaks volumes about the consequences of perpetrating healthcare fraud. Several truths are self-evident. Whistleblowers are central to uncovering fraud. Further, safeguarding tax dollars and ensuring the healthcare system works as intended are important byproducts of whistleblowers wielding the False Claims Act properly.

If you have information on fraud but do not know what to do, it is important to come forward and speak to an anti-kickback lawyer. When you report healthcare fraud, you may be eligible for legal protections and whistleblower rewards under the False Claims Act. Experienced anti-kickback attorneys offer essential advice on whistleblower protections and will guide you through the process from start to finish, ensuring that your rights are protected when you come forward to report healthcare fraud.

Law360 Article on Georgia Surgery Business Penalty

DOJ Report on False Claims Act Lawsuit

National Law Review on the False Claims Act

DOJ Press Release on Anesthesia Providers and Outpatient Surgery Centers