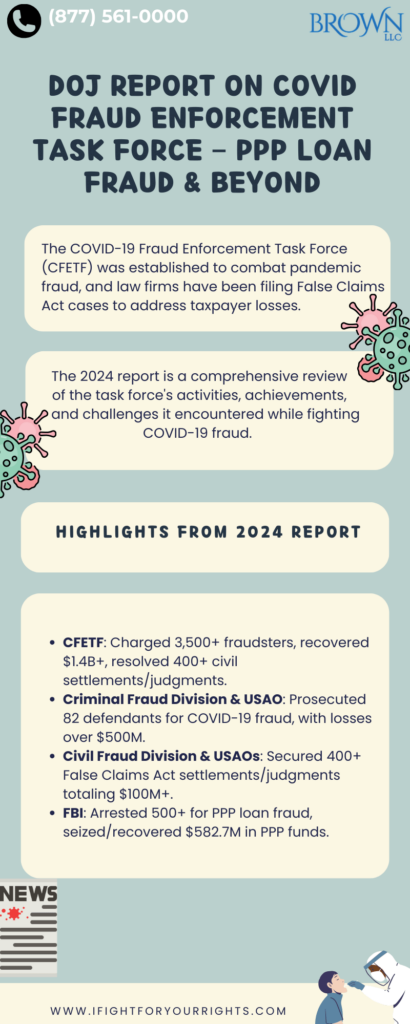

DOJ Report on COVID Fraud Enforcement Task Force – PPP Loan Fraud & Beyond

The COVID-19 pandemic shook the world in an unprecedented way, and forced countless governments, industries, and communities to reshape their traditional practices and adapt to a new paradigm. As the government scrambled to enact measures to contain the virus it was shutting down businesses but providing hundreds of billions of dollars to keep industries afloat, as well as desperately purchasing equipment and tests from companies with dubious track records. Fraudsters saw the COVID chaos as a perfect opportunity for personal economic gain at the expense of the taxpayers and worse at the expense of the health of the people.

The COVID-19 Fraud Enforcement Task Force (CFETF) is a federal group from the government that has been established to combat pandemic fraud, and False Claims Act law firms like Brown, LLC have been filing cases to remedy all the different ways taxpayers were ripped off. On April 9, 2024, the CFETF released its 2024 report, detailing its efforts in curtailing COVID-19 fraud.

What is the COVID-19 Fraud Enforcement Task Force?

The CFETF is a multi-agency group established in May 2021. Led by the United States Deputy Attorney General, it includes various federal agencies including the Department of Justice (DOJ), the Federal Bureau of Investigation (FBI), and the Department of Health and Human Services (HHS). These groups represent a united force with a mission to identify, investigate, and prosecute and hold civilly accountable instances of fraud related to COVID-19 relief programs, healthcare services, and other pandemic-related schemes.[1]

Highlights of the CFETF 2024 Report

The 2024 report is a comprehensive review of the task force’s activities, achievements, and challenges it has encountered in the past year while fighting COVID-19 fraud. Aside from a summary of its achievements, the DOJ also called for Congress to extend the statute of limitations for COVID-19 fraud-related offenses, expand the Pandemic Response Accountability Committee’s (PRAC) authority, and continue supplying resources to the agencies and ongoing investigations.[2] Here are some of the major highlights from the report:

- The CFETF has charged more than 3,500 fraudsters, recovered over $1.4 billion, and resolved over 400 civil settlements and judgments.[1]

- The DOJ has put together three COVID-19 Fraud Enforcement Strike Forces in the District of Maryland, Southern District of Florida, Eastern and Central Districts of California, District of New Jersey, and the District of Colorado. To date, these strike forces have charged over 250 defendants with associated losses of over $339 million.

- The Eastern District of California prosecuted a gang member for fraudulently claiming $25 million in unemployment benefits

- The Central District of California convicted a ring of fraudsters who fraudulently obtained $20 million in SBA loans

- The District of Maryland sentenced a defendant to seven years in prison for PPP, EIDL, and UI fraud totaling up to $1 million in losses.

- The Southern District of Florida charged 17 employees of the Broward County Sheriff’s Office with PPP loan fraud.

- The District of Colorado has seized over $1B in fraudulently obtained EIDL funds, which included houses, vehicles, cryptocurrency, and bank accounts.

- The Criminal Fraud Division and USAO partners have criminally prosecuted 82 defendants for COVID-19 fraud with associated losses over $500M

- The Civil Fraud Division and USAOs have obtained more than 400 False Claims Act settlements and judgments totaling over $100M

- The Tax Division and District of New Jersey charged a tax preparer with filing thousands of tax returns claiming fraudulent COVID tax credits

- The Antitrust Division reached a settlement with seven companies, who collectively agreed to pay over $681M in criminal penalties for illegally raising the price of COVID-19 drugs

- The National Unemployment Insurance Fraud Task Force (NUIFTF), a first-of-its-kind task force generating actionable leads against foreign actors and crime syndicates committing cyber-enabled fraud, has disseminated over 100 leads and intelligence associated with over $3B in suspected pandemic fraud

- The PRAC’s efforts have led to 127 investigations, with over 60 defendants charged, 44 years in collective prison time, and $11M in restitution

- The Department of Labor, Office of Inspector General’s (DOL-OIG) oversight of the UI program has resulted in 1,128 criminal convictions with defendants sentenced to a collective 24,850 months in prison

- The Small Business Administration, Office of Inspector General’s (SBA-OIG) oversight of the PPP and EIDL programs has resulted in 1,255 indictments and 683 convictions

- The Federal Bureau of Investigation (FBI) has arrested over 500 defendants for PPP fraud and seized, recovered, forfeited, or prevented the loss of approximately $582.7M in PPP funds

- The U.S. Secret Service (USSS) has seized over $1.4B, forfeited over $900M, and remitted over $400M in pandemic funds

- The IRS Criminal Investigation (IRS-CI) has initiated ERC fraud investigations involving $2.9B

- The United States Postal Inspection Service (USPIS) worked to bring charges against 160 people for over $279M in pandemic fraud

- The Department of Health and Human Services Office of Inspector General’s (HHS-OIG) investigations resulted in 290 indictments, 135 criminal convictions, and $477M in monetary recoveries

- The Department of the Treasury Special Inspector General for Pandemic Recovery’s (SIGPR) investigations led to 21 arrests, $11M+ in restitution orders, and nearly $10M in forfeitures

- Since August 2022, Homeland Security Investigations (HSI) has supported 127 convictions and seized approximately $7.5M related to COVID-19 fraud

- Department of Homeland Security, Office of Inspector General (DHS-OIG) investigations have resulted in 87 criminal convictions and over $20M in recoveries

- PPP Loan Fraud remains extensive – the Paycheck Protection Program was pilfered by outright thieves, to complicit financial entities like Kabbage, to ineligible businesses

These highlights entail a small portion of the cross-agency efforts to catch and prosecute COVID-19 fraud. These agencies have been massively successful in recovering huge amounts of money for the federal government, as well as rewarding the whistleblowers who bring it to the government’s attention. That said, the report concludes by acknowledging the challenges posed by increasingly complex fraud schemes and cites the need for federal agencies to remain vigilant and innovative in their efforts to catch fraud. The successes the CFETF has had can only be a sign that more permanent cross-agency measures can bolster stronger defenses against fraudulent actors–both domestic and foreign.

[1] https://www.justice.gov/opa/pr/fact-sheet-covid-19-fraud-enforcement-task-force-2024-report

[2] https://www.justice.gov/coronavirus/media/1347161/dl?inline