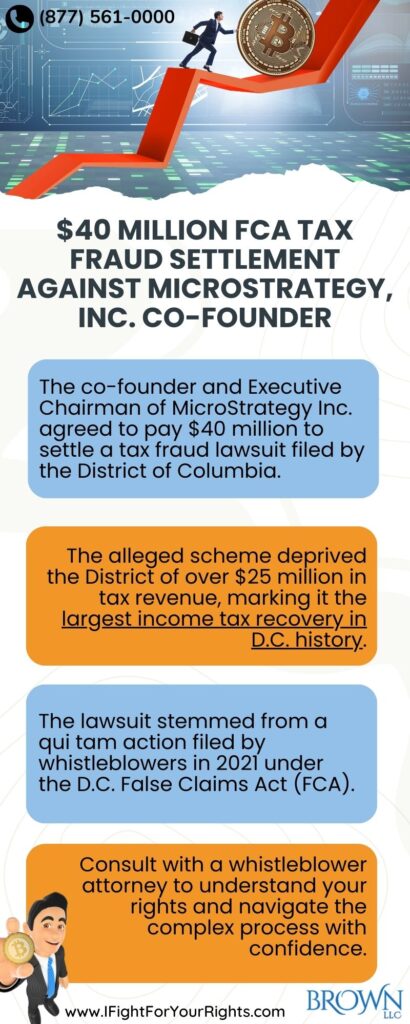

$40 Million FCA Tax Fraud Settlement Against MicroStrategy, Inc. Co-Founder

Table of Contents

The co-founder and Executive Chairman of MicroStrategy Inc., a notorious billionaire who has pumped the price of bitcoin, has agreed to pay $40 million to settle a tax fraud lawsuit brought by the District of Columbia. This settlement, announced in June 2024, marked the largest income tax recovery in D.C. history. (1)

The District’s lawsuit, filed under the D.C. False Claims Act (FCA), alleged that the co-founder had fraudulently claimed to be a resident of alternatively either Florida or Virginia to avoid paying D.C. income taxes from 2005 to 2020. This scheme allegedly deprived the District of over $25 million in tax revenue. (2) Most states don’t allow tax fraud recoveries through their False Claims Act with a few notable exceptions such as New York and Illinois. After viewing the success of the NY and IL False Claims Act recoveries DC amended its False Claims Act statute to permit recoveries for, “The District taxable income, District sales, or District revenue of the person against whom the action is being brought equals or exceeds $1 million for any taxable year subject to any action brought pursuant to this subchapter, and the damages pleaded in the action total $350,000 or more…”

Whistleblowers Play a Key Role

The lawsuit originated from a qui tam action filed by whistleblowers in 2021 under the D.C. FCA. The whistleblowers alleged that the co-founder had not only allegedly underpaid taxes but also bragged about doing so and encouraged others to do the same.(2)

The D.C. Attorney General’s office, after conducting its own investigation, intervened in the lawsuit and filed its complaint against MicroStrategy and its co-founder. This case was the first of its kind brought under amendments to the D.C. False Claims Act that expanded the Attorney General’s authority to prosecute tax fraud cases. (3)

These amendments allow private citizens to file lawsuits on behalf of the District against high earners who are underpaying or evading taxes.

Details of the Allegations

The co-founder had lived in D.C. since at least 2005, residing in a luxurious Georgetown penthouse and keeping yachts docked at Washington Harbor. Despite this, he filed tax returns as a resident of Virginia until 2012 and subsequently as a Florida resident, taking advantage of lower tax rates in those jurisdictions. (4)

The District alleged that the co-founder went to great lengths to maintain the appearance of residency outside D.C., obtaining a Florida driver’s license and registering to vote in Florida. However, the District argued that he never intended to abandon D.C. as his primary residence. (4) This feigning of Virginia and Florida residency was allegedly done due to both states’ favorable personal income tax rates compared to D.C., which allegedly led to the co-founder being able to avoid over $25 million in D.C. taxes. (5)

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

MicroStrategy’s Involvement

The lawsuit also implicated MicroStrategy, alleging that the company aided its co-founder in his tax avoidance scheme. (5) The complaint alleged that MicroStrategy employees falsely reported the co-founder’s address information on his W-2 forms and omitted accurate information from withholding filings submitted to the District. The District argued that MicroStrategy was aware of its co-founder’s true residency due to his open discussions about it and the company’s detailed records of his whereabouts. (4)

The Importance of the DC False Claims Act Settlement and Future Implications

While MicroStrategy and its co-founder denied any wrongdoing, the $40 million settlement highlights the effectiveness of whistleblower actions and government intervention in tax fraud cases. The substantial recovery serves as a deterrent to potential tax evaders and highlights the risks associated with such schemes.

This case also demonstrates the growing trend of states leveraging False Claims Acts to pursue tax fraud, as seen in similar laws in New York and other jurisdictions. (3) The success of these laws in generating substantial revenue for state governments is likely to encourage further enforcement efforts in the future. (4)

The IRS Whistleblower Program encourages individuals with knowledge of tax fraud to come forward. Whistleblowers can receive a monetary award of up to 30% of the taxes, penalties, and interest collected by the IRS at the conclusion of an investigation initiated by the information they provided. To qualify for a whistleblower award, the whistleblower must provide specific and credible information about a taxpayer’s tax liability.

FCA Whistleblower Compliance: Importance of Reporting

The IRS Whistleblower Program provides a valuable avenue for individuals to report tax fraud and potentially receive substantial financial rewards. If you have information about potential tax fraud, consulting with an IRS tax whistleblower attorney is highly recommended to understand your rights and navigate the complex process effectively.

It is highly recommended to seek legal counsel from an experienced IRS whistleblower law firm when considering filing a whistleblower claim. A seasoned attorney can evaluate the strength of your claim and advise you on the best strategy on how to navigate through the intricacies of the statute and maximize your chance for success.

Also, don’t forget to check the top 5 biggest whistleblower settlements of 2024.

WUSA 9 – Michael Saylor’s Tax Fraud Settlement Marks Largest in DC History

District of Columbia AG’s Office – $40 Million Settlement Article

Morgan Lewis – $40 Million Tax-Related Settlement Article

Hodgson Russ – FCA Residency Case Settles for $40 Million

PietraGallo – New DC FCA Ushered in by $40 Million Settlement