What Is Healthcare Fraud

Health care fraud occurs when someone intentionally submits, or causes another person to submit, false or misleading information for the purpose of determining the amount of health care benefits payable. It is a significant problem in the United States, with tens, if not, hundreds of billions of dollars lost every year due to fraudulent practices. Fraud can take many forms, including false billing, kickbacks, and misrepresenting services provided. The size, growth, and diversity of government healthcare programs make them especially vulnerable to fraud, leaving even Federal programs such as Medicaid and Medicare susceptible.

What Is the Reward of a Whistleblower in Healthcare Fraud?

Luckily, just like in healthcare itself when there’s an antidote the patient benefits, there’s an antidote to fraud against the government with the False Claims Act (FCA), a statute that incentives whistleblowers to come forth and receive up to 30% of what the government recovers. Add to that certain states like California and Illinois have a mechanism to recover for private insurance fraud and the whistleblower can receive up to 50% of what is recovered. It’s no wonder individuals have received hundreds of millions of dollars of whistleblower rewards each year, for properly reporting healthcare fraud with the use of a healthcare fraud attorney.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

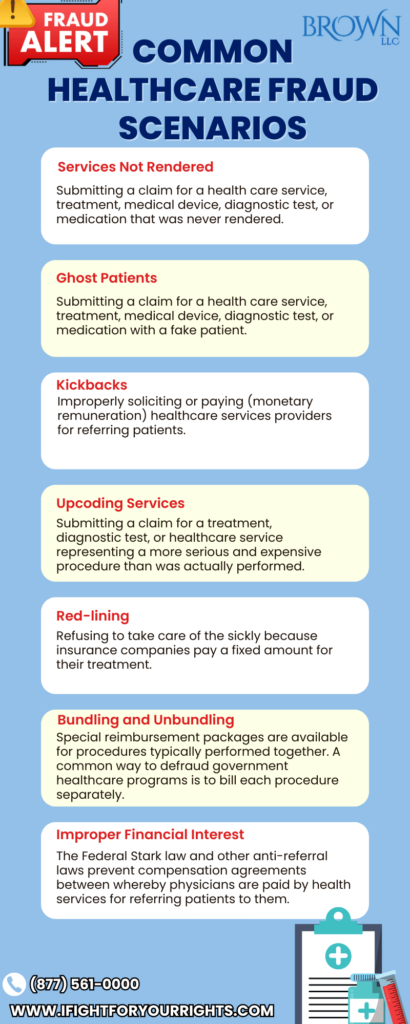

What Are Some Common Healthcare Fraud Scenarios?

Businesses and individuals defraud state and federal government healthcare programs in many different ways. Common examples of fraudulent conduct include:

- Services Not Rendered – Submitting a claim for a health care service, treatment, medical device, diagnostic test, or medication that was never rendered.

- Cost Inflation – Inflating cost reports or falsifying information on them with the intention to maximize reimbursement is another common type of fraud.

- Ghost Patients – Submitting a claim for a health care service, treatment, medical device, diagnostic test, or medication that was never rendered.

- Research Grant Fraud – Falsifying research data and results in order to secure a grant. Over-billing and spending grant money for unrelated research is also considered under research grant fraud.

- Kickbacks – Improperly soliciting (monetary remuneration) healthcare services providers for referring patients or healthcare services payable by a state-funded healthcare program.

- Upcoding Services – Submitting a claim for a treatment, diagnostic test, or healthcare service representing a more serious and expensive procedure than was actually performed.

- Red-lining – Refusing to take care of the sickly because insurance companies pay a fixed amount, that is not commensurable with real costs, for their treatment.

- Bundling and Unbundling – Special reimbursement packages are available for procedures typically performed together. A common way to defraud government healthcare programs is to overlook the package and bill each procedure separately.

- False Certifications – In order to qualify for payment from the state, physicians, hospitals, and other healthcare providers have to submit a number of documents with bills. Falsifying those documents is fraud.

- Improper Financial Interest – The Federal Stark law and other anti-referral laws prevent compensation agreements between whereby physicians are paid by health services for referring patients to them.

- Medically Unnecessary Treatments – To qualify for payment by government health programs, treatments, pharmaceuticals, and healthcare services should be medically necessary. It’s considered fraud to submit claims for medically needless healthcare services.

Healthcare Fraud Whistleblower Lawyers

At our law firm, we understand the importance of combatting healthcare fraud, and we assist whistleblowers in successfully prosecuting businesses and individuals who engage in fraudulent practices at the expense of the taxpayer and the insurance companies. Our healthcare fraud lawyers are experienced in representing whistleblowers and helping them navigate the complex legal system. We work closely with our clients to ensure that they understand their rights and responsibilities under the law and that they are protected from retaliation.

When the healthcare fraud implicates programs like Medicare, Medicaid or Tricare then the False Claims Act kicks in and the qui tam lawsuit must be filed confidentially under seal with the use of a False Claims Act law firm – you can not file the lawsuit pro se. Prosecuting health care fraud is an important priority of the Department of Justice (DOJ) and FCA complaints are initially investigated by the DOJ and/or the Department of Defense, if Tricare is implicated. That’s why it’s important to select a health care fraud law firm that has experience interfacing with the DOJ and DOD, and even has experience working as a former DOJ attorney or agent.

State-Specific Healthcare Fraud Whistleblower Protections and Awards

In addition to the False Claims Act, whistleblowers can also play a vital role in combating healthcare fraud under state insurance programs, such as The California Insurance Frauds Prevention Act (CIFPA) and the Illinois Insurance Claims Fraud Prevention Act (ICFPA).

Under the IFPA, individuals who report healthcare fraud are protected from retaliation by their employers and can sue for damages if retaliation occurs. Additionally, whistleblowers can file a lawsuit on behalf of the state, which can result in the recovery of up to three times the amount of damages caused by the fraud. The ICFPA provides similar protections to whistleblowers in Illinois, allowing them to file lawsuits on behalf of the state and recover damages. Both programs also allow the relator, or plaintiff who brings the action on behalf of the state to obtain up to 50% of the recovery as a whistleblower award.

By working together with whistleblowers and state and federal agencies, we can help combat healthcare fraud and protect the integrity of our healthcare system. If you suspect that healthcare fraud is taking place, contact our health care fraud whistleblower law firm today for a free, confidential consultation to learn more about how we can assist you in reporting it and potentially receive a whistleblower award.

The size, growth, and diversity of government healthcare programs present multiple oversight challenges; leaving large Federal programs such as Medicaid and Medicare susceptible to fraud. The U.S. Government Accountability Office (GAO) designates both programs “high-risk.” The False Claims Act and a number of other laws have been passed to encourage whistleblowers because for every dollar the government spends on fighting fraud in health, it receives $7.

Here are some of the most Frequently Asked Questions Regarding Healthcare Fraud. If you don’t see your question on the list, please call or email and we’ll try to provide a free, confidential answer to your healthcare fraud question. Healthcare Fraud hurts us all. Help someone today by putting an end to it.

What Are Some of the Red Flags for Healthcare Fraud?

A key principle to consider is if the health care entity is governed by doing what’s best for the patients versus what’s best for their own profits. Healthcare fraud causes insurance companies and the taxpayers to pay tens of billions of dollars each year for products and services that are superfluous or just outright false and can take the form of billing fraud, kickbacks, overutilization, and falsifying records. Some red flags for healthcare fraud include unusual billing patterns, unnecessary services, kickbacks or bribes, high utilization rates, unexplained adjustments or write-offs, giving items of value to induce patient referrals and suspicious documentation. Additionally, healthcare providers who engage in upcoding, unbundling, or billing for services not provided are also committing fraud. Some healthcare fraud you know it when you see it, but another key is if you see something, say something – avail yourself of a free, confidential consultation with an healthcare fraud law firm to obtain a deeper understanding about whether the conduct you’re observing is indeed fraud.

Who Should You Contact in Case of Health Fraud?

If you suspect healthcare fraud, and are interested in potentially receiving a whistleblower award you should contact a False Claims Act law firm to educate you about your options. A whistleblower law firm can help you understand your rights and protect you from retaliation. You can also report healthcare fraud to the Department of Justice, Office of Inspector General, or the Centers for Medicare & Medicaid Services. Many companies have compliance officers and other reporting mechanisms, but be warned – reporting through those channels often results in the company retaliating against the individual doing the reporting.

Which Is the Most Common Form of Health Care Fraud and Abuse?

According to a 2020 report, the most common form of healthcare fraud and abuse is billing fraud which accounts for about 30% of the health care fraud. Billing fraud occurs when healthcare providers bill for services that were not provided, bill for services that were unnecessary, or overcharge for services rendered. This type of fraud can be difficult to detect, but it can have a significant impact on healthcare costs. Since billing fraud is such a broad term, theoretically any submission of a false invoice for payment to the government or an insurance company can constitute health care fraud and its broadest sense of course it would encompass much greater than 30% of health care fraud. The most common frauds aren’t always the most sophisticated and any event that puts the economics of the biller ahead of the needs of the patient or the fairness to the system could constitute fraud. Kickbacks are common in which providers and pharmaceutical companies provide items of value to induce referrals or use of a product.

What Is the Biggest Healthcare Fraud in The US?

The biggest healthcare fraud in the US involved the pharmaceutical company GlaxoSmithKline, which paid $3 billion in fines and settlements for various forms of fraud, including off-label marketing, kickbacks, and failure to report safety data. This case highlights the importance of whistleblowers in exposing healthcare fraud and holding companies accountable.

How to Become a Healthcare Fraud Investigator?

There are a few routes to pursue for individuals who wish to become a health care investigator. Some individuals will work in the private sector, directly working for companies to help detect and eliminate fraud and abuse to avoid potential liability. The bigger swath of investigators work for the state and federal government in positions like the FBI, DOD- OIG, HHA, attorney general’s office and may have a law and/or law enforcement background. To become a healthcare fraud investigator, you typically need a bachelor’s degree in a related field, such as criminal justice, accounting, or healthcare administration. Some employers may also require a master’s degree or professional certification. Additionally, experience in law enforcement or healthcare can be beneficial. Healthcare fraud investigators must have strong analytical and investigative skills, integrity and be able to work independently.

How to Detect Fraud and Abuse in Healthcare?

The systems relies on insiders to blow the whistle on systemic fraud, because from the outside sometimes the conduct looks lawful, especially with sophisticated schemes that are deployed to evade detection. Detecting fraud and abuse in healthcare requires a combination of data analysis, investigative skills, and knowledge of healthcare regulations. Healthcare providers can monitor billing patterns and utilization rates to identify unusual activity. Additionally, they can implement internal controls and audits to detect and prevent fraud. However, by far, whistleblowers play the most critical role in identifying healthcare fraud and abuse, because without them, the government is often too busy to figure out what’s going on.

How to Prevent Healthcare Fraud?

Preventing healthcare fraud requires a proactive approach that includes employee training, internal controls, and monitoring. Healthcare providers should ensure that all employees are trained on healthcare regulations and fraud prevention. They should also implement internal controls, such as audits and reviews, to detect and prevent fraud. Additionally, providers can work with law enforcement and government agencies to identify and prosecute healthcare fraud. Individuals with knowledge of fraud should come forth and report it through the proper mechanisms to hold unscrupulous companies accountable for their conduct. Awareness of what is misconduct is a challenge, since sometimes individuals like sales representatives for pharmaceutical companies may not even ben cognizant that providing items for value to induce referrals or prescriptions is unlawful.