PPP Loan Fraud Whistleblowers FAQs

What is the Paycheck Protection Program (PPP)?

The Paycheck Protection Program (PPP) was an emergent loan program established by Congress to help businesses affected by the COVID-19 pandemic. The program was launched in March 2020 as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and it has since been extended and modified by subsequent legislation. The program was a rare instance in which there was broad bi-partisan support and hasty distribution of billions upon billions of dollars. Unfortunately, where there’s money, there’s all sorts of fraudsters and it’s estimated that billions of dollars went to outright scammers, ineligible businesses and excess monies went to companies that double counted or inflated their payrolls.

Small businesses with fewer than 500 employees (or up to 500 employees per physical location for certain industries) were able to receive loans to cover payroll costs, rent, mortgage interest, and utilities under the PPP. The cardinal purpose of providing funding for employees was also thwarted when some businesses took the money and ran, that is took the loan and still laid off the workforce. The government launched an investigation into alleged PPP loan fraud after receiving a concerning PPP loan fraud report from multiple sources. This misuse of funds not only undermined the intended goal of preserving jobs but also raised ethical and legal concerns regarding the misallocation of taxpayer money. If you wish to report PPP loan fraud, you should consult with a whistleblower law firm to ensure proper legal guidance and protection. Whistleblower law firms experienced in handling such cases, offering support and assistance throughout the reporting and legal process, safeguarding whistleblowers against retaliation and ensuring accountability for fraudulent activities. It’s crucial to act responsibly and ethically to uphold the integrity of government programs and protect the interests of employees and taxpayers alike.

What is Considered PPP Loan Fraud?

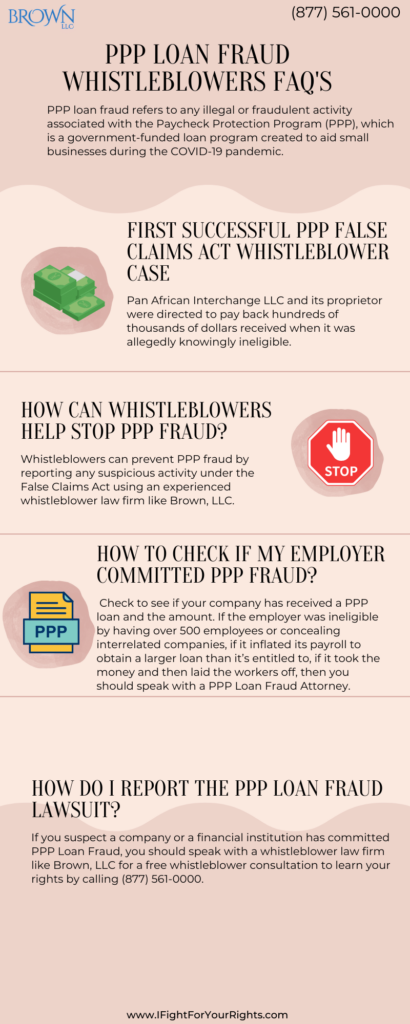

Any illegal or fraudulent activity relating to the Paycheck Protection Program (PPP), a government-funded loan program designed to assist small businesses during the COVID-19 pandemic, is referred to as PPP loan fraud. PPP loan fraud examples include:

- Falsifying or providing false information on a PPP loan application

- Falsifying the number of employees or payroll expenses in order to qualify for a larger loan

- Hiding interrelated companies to falsely show less than 500 employees

- Inflating Payroll Costs to qualify for a higher loan

- Laying off the staff, but falsely claiming they were still working to have loan forgiveness

- Falsifying the nature of the business to receive a loan even though certain NAICS coded businesses are ineligible

PPP whistleblower programs can help bring justice and receive a PPP whistleblower reward which could be in millions. It’s important to consult with a PPP loan fraud whistleblower lawyer on how to report PPP loan fraud.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

First Successful PPP False Claims Act Whistleblower Case

The first ever PPP whistleblower case was against Pan African Interchange LLC and its owner, who were ordered to pay $208,332.00 to satisfy the second Pan African Interchange PPP Loan along with $21,583.31 to settle False Claims Act allegations that they falsely certified that the company would not receive more than one Paycheck Protection Program (PPP) loan before December 31, 2020, when in fact they received more than one loan. This landmark case sheds light on the importance of accountability and integrity in government assistance programs, particularly during times of crisis.

The PPP whistleblower program serves as a critical mechanism for ensuring transparency and accountability in the distribution of funds meant to aid small businesses affected by the COVID-19 pandemic. Businesses seeking assistance through the PPP were required to certify that they would not receive more than one PPP loan before the specified date. However, Pan African Interchange allegedly received two PPP loans and failed to comply with demands to return the second loan. The settlement reached in this case underscores the significant role whistleblowers play in exposing fraud and wrongdoing, ultimately protecting the integrity of government initiatives aimed at supporting struggling businesses. It serves as a reminder of the legal and ethical obligations businesses have when participating in federally funded programs and the consequences of fraudulent activities.

How Can Whistleblowers Help Stop and Report PPP Loan Fraud?

Whistleblowers can assist in the prevention of PPP fraud by reporting any fraudulent activity that they witness or suspect utilizing the whistleblower provisions of The False Claims Act. They can provide valuable information to whistleblower law firms such as Brown, LLC, a whistleblower law firm with experienced PPP loan fraud whistleblower attorneys who file cases nationwide.

PPP Whistleblowers who report fraud may be eligible for a PPP whistleblower reward. The monetary compensation under the False Claims Act can be up to 30% of what the government recovers, but more likely these are cases that the government will intervene and settle which places the ceiling at 25%. Filing a PPP loan whistleblower case under the FCA if you are aware of fraud has the potential to be critical in holding businesses and individuals accountable for their fraudulent activities and ensuring that PPP funds are used to support the intended recipients – the employees of small businesses affected by the COVID-19 pandemic.

A PPP fraud lawyer must represent a whistleblower in order to file a qui tam lawsuit under the False Claims Act. The government may ask for treble or triple damages from a Defendant.

How Can I Tell if My Employer Committed Paycheck Protection Program Fraud?

Determine whether your company has received a PPP loan. There are numerous public databases you can consult regarding the size of the loan the business received and the amount of employees claimed. If that information is inconsistent with what you know, there may be fraud. Further, if you’re aware that the company concealed interrelated companies to make it below the 500 employee cap, then you might have the precise information needed to become a viable PPP loan whistleblower and to be eligible for a PPP whistleblower reward. It’s imperative to scrutinize the details meticulously to ensure compliance and integrity within the PPP framework. Whistleblowers play a crucial role in safeguarding against abuse and ensuring that relief funds reach their intended recipients. If you suspect any irregularities or fraudulent activities, reporting them could not only protect the integrity of the program but also potentially result in financial rewards for you as a whistleblower.

Can My Employer Retaliate Against Me if I Report PPP Loan Fraud?

Whistleblowers who face retaliation from their employers can seek redress under the False Claims Act.

Among these remedies are:

- Back pay includes wages and benefits lost as a result of an illegal termination.

- Re-employment in their previous position

- Front pay, which includes wages and benefits to cover the time spent looking for a new job.

- Out-of-pocket expenses, including the cost of finding work

- Compensation for pain and suffering

- Punitive damages

- Court costs and attorney fees

When you hire a whistleblower lawyer to file your claim, the firm can help explain you on how to report PPP fraud, likely outcomes and work with you to avoid potential retaliation or provide the timetable for you so you know if you want to leave the company. The case is initially filed confidentially, under seal, so your identity is not disclosed to the defendant and it may stay under seal for many years as the government investigates.

How to Report PPP Loan Fraud?

If you suspect a company or a financial institution has committed PPP Loan Fraud, you should speak with a PPP whistleblower law firm like Brown, LLC for a free whistleblower consultation to learn your rights by calling (877) 561-0000. The first to file rule is important to understand, and if you’re not the first to file, you may have ceded your rights to a recovery. There are many courageous whistleblowers who have received whistleblower awards in the millions for doing the right thing. With billions in suspected PPP Loan Fraud, you should consult with a qui tam law firm to learn your rights on how to report PPP loan fraud. It’s crucial to report PPP loan fraud promptly to ensure accountability and protect the integrity of financial assistance programs.