What is a Qui Tam? Filing a Qui Tam Lawsuit

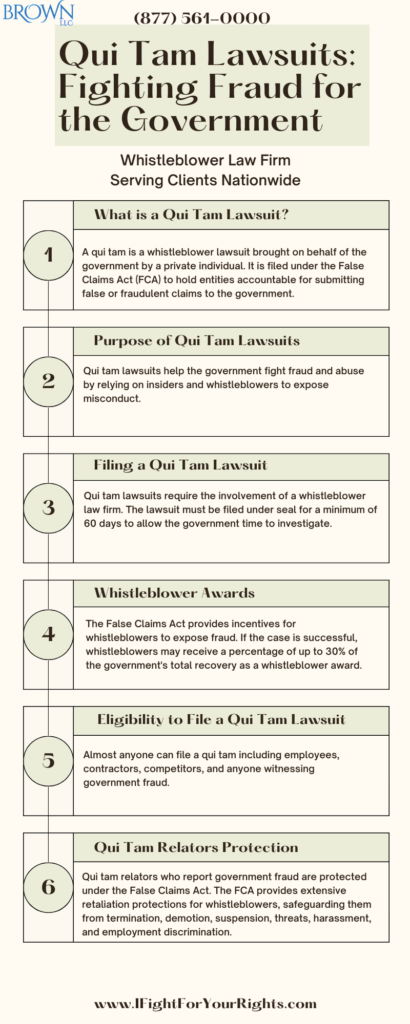

What Is a Qui Tam Lawsuit?

A qui tam lawsuit is a type of whistleblower lawsuit brought on behalf of the government through a private individual typically filed under the False Claims Act (FCA). The False Claims Act, imposes liability on individuals or entities that submit false or fraudulent claims for payment to the federal government and through the plaintiff, also known as the relator since he relates the government’s claim through his own complaint, the individual is entitled to a percentage of the recovery as a whistleblower award if succesful. The term “qui tam” is derived from the Latin phrase “qui tam pro domino rege quam pro se ipso in hac parte sequitur,” which translates as “he who sues for the king as well as for himself.”

The False Claims Act was enacted in 1863 (known as the Lincoln Law at the time) to combat fraud against the government during the Civil War. The government is poorly equipped to police itself most of the time and relies on insiders from companies to blow the whistle on misconduct or else the government programs tend to be widely exploited. For example, the wonderful PPP Loan program was enacted in haste to help businesses during the uncertainty of the pandemic, but unscrupulous entities defrauded it of billions upon billions of dollars and combatting the PPP Loan Fraud depends on people in the new blowing the whistle on businesses who do things like double counting their employees, or those that laid them off and kept the money and ran. Since 1863, the law has been amended several times with bipartisan support, most recently in 1986. The FCA is one of the most potent tools in the government’s arsenal for combating fraud against it. Every year the government recovers billions of dollars’ worth of fraud and abuse through the FCA and thanks to individuals who have the courage to come forth with information that the government wouldn’t have known had it known been for the whistleblowers.

In order to bring forth a qui tam lawsuit, the FCA requires the use a whistleblower law firm, so a whistleblower cannot proceed pro se, that is without an attorney. The thought process is similar to that most courts will not allow a corporation to represent itself in court, and since the United States is the true party in interest it requires a qui tam law firm to handle the whistleblower lawsuit. Further, bad lawyers make bad laws, and non-lawyers trying to bumble around the law themselves have the chance to create bad law, and the government does not want to risk that, nor have to assign an Assistant United States Attorney to essentially babysit a pro se litigant. The law also contemplates the dynamics of a public-private partnership and with the use of qui tam counsel, the government’s resources are extended rather than diminished.

Some criteria for initiating a qui tam is that the relator must have knowledge of specific credible information that gives rise to a reasonable belief that a person or entity has submitted a false claim to the government. The lawsuit must be filed under seal for a minimum of 60 days to give the government time to investigate the case before it is made public, but in reality, it often stays sealed for several years as the government investigates which also gives times for the relator to plan an exit strategy if desired.

Whistleblower Awards

The False Claims Act provides incentives for whistleblowers to come forward, recognizing the professional and personal risks they frequently take to expose and stop government fraud and the government’s desire to properly incentivize individuals to step forward and blow the whistle. Although the False Claims Act combats economic fraud against the government, the consequences of the fraud can consequentially affect lives. Fraud can endanger the lives of patients with substandard care or unnecessary services in Medicare Fraud, the health of individuals with bad drugs when pharmaceutical; fraud has been committed, and the safety and welfare of our servicemembers when substandard or defective equipment is fraudulently sold and the health care practitioners themselves if faulty equipment is provided, such as non-compliant PPE.

If the government intervenes and the case is successful through a settlement or a trial, the whistleblower, or relator, is entitled to receive between 15% to 25% of the government’s total recovery as a whistleblower award. If the whistleblower proceeds and succeeds without the government’s intervention, the whistleblower reward ranges from 15% to 30% of the government’s total recovery as a whistleblower reward. However, even though the percentage may be greater with non-intervention, cases on average tend to settle more with government intervention, so a smaller percentage of a bigger recovery is often better than a bigger percentage of a smaller recovery.

An example of a qui tam that involved alleged pharmaceutical fraud, in 2012, global pharmaceutical company, GlaxoSmithKline LLC (GSK), agreed to pay $3 billion to resolve False Claims Act allegations that it unlawfully promoted prescription drugs inconsistent with its approval ( also known as off label promotion or off label marketing), failed to report safety data, engaged in false price reporting, and paid kickbacks to providers to encourage the use of certain drugs. The whistleblowers in this case were entitled to whistleblower rewards of up to $600 million.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Who Can File a Qui Tam Lawsuit?

Here are some examples of people who may file a qui tam lawsuit:

- An employee who witnesses their company submitting false claims to the government, such as upcoding Medicare, unbundling, or engaging in kickbacks

- A contractor who discovers the submission of false claims to the government for payment.

- A competitor who witnesses their competitor submitting false claims to the government.

- Anyone who witnesses the government being defrauded by a person or entity.

How Long Does a Qui Tam Lawsuit Take?

The length of a qui tam lawsuit can vary greatly depending on a number of factors, including the complexity of the case, the defendant’s cooperation, and the government’s resources. Although a qui tam lawsuit can take anywhere from the minimum of one year to as long as a decade, qui tam cases tend to last around 3-5 years give or take.

Some of the factors that can influence the length of a qui tam case are as follows:

- Complexity: Qui tam cases can be extremely complex, involving numerous legal and factual issues. The more complex it is, the longer it will take to resolve.

Defendant cooperation: If the defendant cooperates with the government’s investigation, the case may be resolved faster. If the defendant does not cooperate, however, the case may take longer to resolve.

- Government resources: The government has limited resources for investigating and prosecuting qui tam cases. Cases with higher value damages or imminent public harm are given priority. Therefore, If the government is busy with other cases, the case may take longer to resolve.

Qui Tam Relators Protection

Qui tam relators who report government fraud are protected under the False Claims Act. According to the FCA, any employee who is discharged, demoted, suspended, threatened, harassed, or otherwise discriminated against in the terms and conditions of employment because of lawful acts performed by the employee to disclose or prevent fraud on the government may file a claim against the employer.

The FCA’s retaliation protections are extensive. They are applicable to any employee, regardless of position or title. They also apply to any form of retaliation, including termination, demotion, suspension, threats, harassment, and employment discrimination.