The Evolution of Whistleblower Laws and How They Protect Employees

Whistleblower laws, and more specifically, whistleblower protection laws, have been an integral part of the legal landscape for decades. These laws provide crucial protections for employees who report workplace misconduct, including fraudulent conduct, workplace safety hazards, money laundering, and other types of illegal and unethical behavior. As a leading whistleblower law firm, Brown, LLC is dedicated to helping employees understand the evolving landscape of these laws and how they can be used to protect their rights.

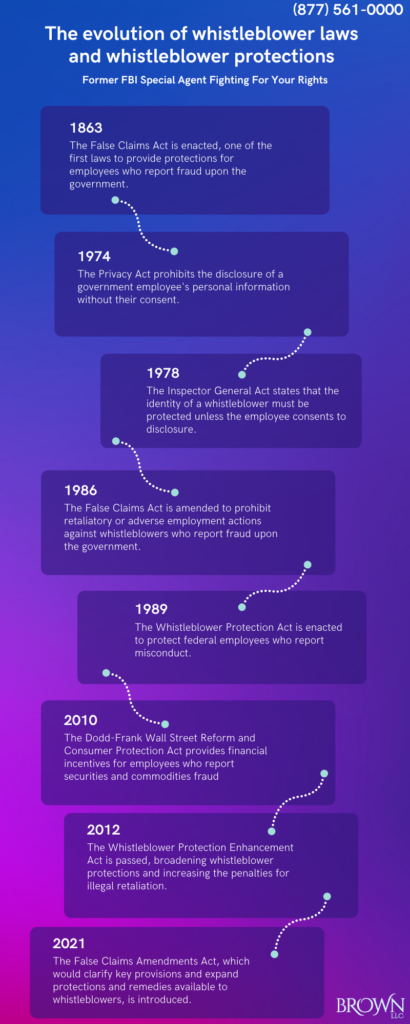

The history of whistleblower laws can be traced back to the early days of the False Claims Act (FCA), which was enacted in 1863. This law was one of the first to provide protections for employees who reported fraud in the government sector. In 1986, Congress also amended the False Claims Act to add a prohibition against retaliatory or other adverse employment actions by an employer against a whistleblower who tries to report fraud against the government. Over the years, the scope of whistleblower laws has expanded to include the private sector, with the introduction of the Occupational Safety and Health Act (OSHA) and the Employee Retirement Income Security Act (ERISA), which both contain protections for whistleblowers who report violations.

The 1980s and 1990s saw several key amendments to whistleblower laws, including the Whistleblower Protection Act (WPA) of 1989, which was enacted to protect federal employees who reported misconduct. More recently in 2012, the Whistleblower Protection Enhancement Act (WPEA) was passed, which, among other things, broadened the qualifications for protected disclosures while also increasing the penalties for violations of whistleblower protections, and further allowed federal employees to collect reasonable and foreseeable compensatory damages for retaliation and unlawful reprisals. The WPEA also established the position of Whistleblower Protection Ombudsman to educate agency employees about whistleblower retaliation prohibitions and whistleblower rights.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

According to the WPEA, whistleblowers do not lose their protections if they make a disclosure to a supervisor while off duty, while on the job, or if the wrongdoing has previously been reported. Whistleblowers would also not lose their protected status because of the length of time since the misconduct occurred, or based on the employee’s motivations for reporting the violation.

In recent years, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, commonly referred to as “Dodd-Frank,” has emerged as one of the most important pieces of legislation for whistleblowers. This act provides financial incentives for employees who report securities fraud to an SEC whistleblower attorney, commodities fraud, and other violations of the law. Under the act, whistleblowers are eligible for rewards of up to 30% of the monetary sanctions recovered in an enforcement action brought as a result of the whistleblower’s information. Similar to the other whistleblower statutes, Dodd-Frank also prohibits retaliation and other discriminatory or adverse action taken against a whistleblower who provides information to the SEC or makes proper disclosures required under the securities laws.

There are also numerous provisions for anonymity for federal whistleblowers. Both the WPA and the Inspector General Act of 1978 state that the identity of a whistleblower must be protected unless the employee making the disclosure consents to their identity being disclosed. According to the Inspector General Act:

(h) The identity of any individual who makes a disclosure described in subsection (a) may not be disclosed by the Special Counsel without such individual’s consent unless the Special Counsel determines that the disclosure of the individual’s identity is necessary because of an imminent danger to public health or safety or imminent violation of any criminal law.

Anonymity protection provisions are not only detailed in whistleblower laws. There are other federal laws that govern whistleblower disclosures and protections, such as the Privacy Act of 1974. The Privacy Act prohibits the disclosure of a government employee’s personal information without their consent. This provision would make it illegal for any government or agency official, including the President, to reveal the identity of an employee, including whistleblowers. If the law is broken, those who reveal the identities of government employees could face civil and criminal penalties.

Today, whistleblower laws offer a wide range of protections for employees who report a wide range of violations, including but not limited to government fraud, workplace misconduct, and securities laws violations. These laws protect employees from retaliation by their employers, including termination, demotion, and harassment. Whistleblowers may also be entitled to compensatory damages, including lost wages and benefits, and to reimbursement for legal fees and other expenses incurred as a result of their reporting. For example, under the False Claims Act, a whistleblower who suffers termination or demotion is entitled to twice the amount of lost wages and backpay.

There are other exciting new developments to whistleblower protection laws on the horizon. In the 2021-2022 legislative session, Senator Grassley introduced the False Claims Amendments Act (Senate Bill 2428), which clarifies key provisions and terms in the existing statute, and further expands protections and remedies available to whistleblowers who face retaliation. While the bill has not yet been passed, the rampant fraud seen during the COVID-19 pandemic has highlighted the important role that whistleblowers play in rooting out fraud, and it is likely that legislators will pass additional whistleblower protection laws in the coming years. Numerous state legislatures are also proposing state law analogues to the False Claims Act and similar laws. For example, the Pennsylvania State Senate just recently introduced the Commonwealth Fraud Prevention Act (CFPA) which is modeled on the federal False Claims Act and will provide protections to whistleblowers from retaliation.

As a leading whistleblower law firm, Brown, LLC is committed to helping employees understand the evolving landscape of whistleblower laws and how they can be used to protect their rights. Our attorneys keep up-to-date with the latest changes and developments in this complex and rapidly changing area. With years of experience in this field, our team is equipped to guide you through the legal process and help you secure the protections you deserve.

If you need to consult an attorney about protections for whistleblowers, call Brown, LLC at (877) 561-0000 for a free, confidential consultation.