7 Medicare Scams : How to Detect and Avoid

Medicare is an important program that provides healthcare coverage to millions of Americans over the age of 65, as well as some younger people with disabilities. Unfortunately, Medicare fraud is a serious issue that can harm both individuals and the healthcare system as a whole. Scammers and fraudsters frequently prey on Medicare beneficiaries through various schemes ranging from phone scams to identity theft. In this blog, we will go over seven common Medicare scams and explain how to spot and avoid them. Additionally, we’ll explore the role of Medicare fraud whistleblowers in combating these fraudulent activities.

How Do Medicare Scam Calls Work?

Medicare phone scams are a type of scam in which fraudsters pose as representatives of Medicare or another related organization in order to obtain personal information from people. They may claim that there is an issue with the individual’s Medicare coverage or that a special deal, such as free medical equipment or services, is available. If the individual does not provide their personal information, the caller may threaten them with legal action or the loss of Medicare benefits.

Speak with the Lawyers at Brown, LLC Today!

Over 100 million in judgments and settlements trials in state and federal courts. We fight for maximum damage and results.

Scammers may use a technique known as caller ID spoofing to make the call appear to be from a legitimate Medicare representative or another trusted organization, such as the Social Security Administration (SSA) or a private insurance company. Caller ID spoofing is the practice of falsifying caller ID information in order to make the call appear to come from a different number or location. This tactic is frequently used to gain the individual’s trust and make the scam appear more legitimate.

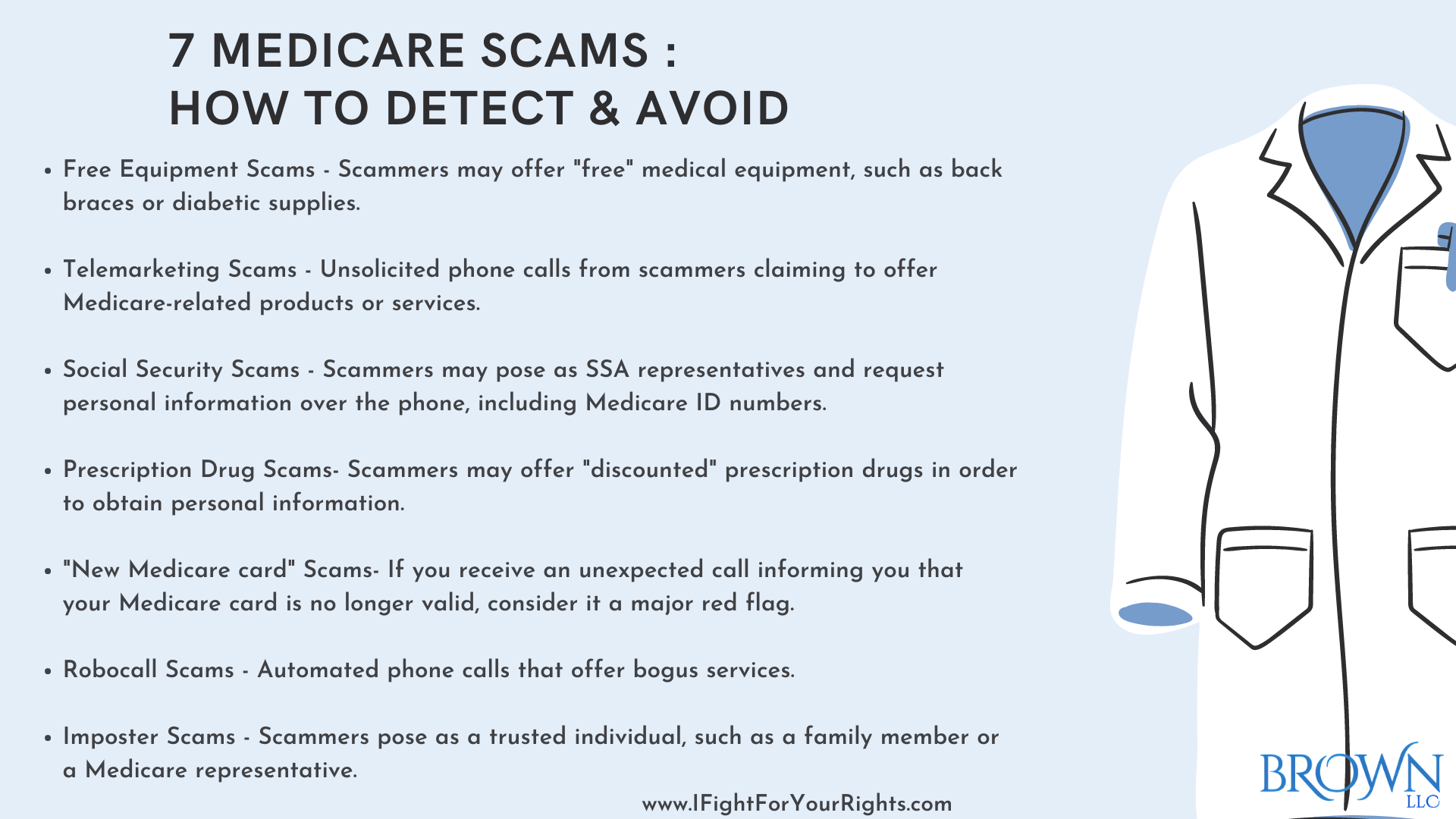

7 Latest Medicare Scam Calls to Avoid

- Free Equipment Scams – To obtain Medicare beneficiary information, scammers may offer “free” medical equipment, such as back braces or diabetic supplies.

- Telemarketing Scams – Unsolicited phone calls from scammers claiming to offer Medicare-related products or services constitute telemarketing scams.

- Social Security Scams – Scammers may pose as SSA representatives and request personal information over the phone, including Medicare ID numbers.

- Prescription Drug Scams- Scammers may offer “discounted” prescription drugs in order to obtain personal information or sell counterfeit drugs.

- “New Medicare card” scam- If you receive an unexpected call informing you that your Medicare card is no longer valid, consider it a major red flag. Medicare never initiates unsolicited calls, so be wary if someone contacts you out of the blue.

- Robocall Scams – Robocall scams involve automated phone calls that offer bogus services or threaten the person with legal action.

- Imposter Scams – In order to obtain personal information, scammers pose as a trusted individual, such as a family member or a Medicare representative.

What To Do If You Receive a Medicare Scam Call

It is critical to be cautious if you receive a call from someone claiming to be a Medicare representative, it is a Medicare phone scam. Legitimate Medicare representatives will never request personal information from you over the phone or via email. If you receive a Medicare scam call, follow these steps:

- Do not give the caller any personal information, such as your Medicare ID number, Social Security number, or bank account information.

- Contact the Federal Trade Commission (FTC) or the Medicare fraud hotline at 1-800-MEDICARE. (1-800-633-4227).

If you are unsure whether a call is legitimate, hang up and contact Medicare directly to verify the call.

What to Do If You Gave Personal Information to a Scammer?

If you provide personal Medicare information to a scammer, you must act quickly to limit the potential damage. Here are some things you should do:

- Notify Medicare and the Social Security Administration – Contact the Medicare fraud hotline and the Social Security Administration’s fraud hotline as soon as possible. You can help prevent the scammer from defrauding others by reporting the scam.

- Review Your Medicare Statements – Review your Medicare statements on a regular basis to ensure that no unauthorized charges or services have been added. If you notice any irregularities, notify Medicare.

- Keep a close eye on your credit report to see if there have been any unauthorized inquiries or new accounts opened in your name.

- Put a Fraud Alert on Your Credit Report – Consider putting a fraud alert on your credit report to prevent anyone from opening new accounts in your name without your knowledge. A fraud alert informs potential creditors that they must confirm your identity before granting credit.

- Change Your Medicare Card – If you suspect that your Medicare card has been compromised, contact Medicare and request a new one. Change any other passwords or account information associated with your Medicare account as well.

- Be Wary – Be wary of unsolicited calls or emails purporting to be from Medicare. Scare tactics are frequently used by scammers to obtain personal information, so always verify the source of any communication before providing any information.

By taking these steps, you can help protect yourself from the potential fallout of a Medicare scam. Remember, prevention is key, so always be vigilant and cautious when dealing with unsolicited calls or emails related to your Medicare benefits.